COIN Breakout & Special SPX Study

Is COIN Buyable? Fundamental + Technical Analysis with Price Targets || Second Installment of 20% Bounces from Lows in the SPX

Over the past few weeks, I've published a series of fundamental and technical analyses in occasional free publications. Six companies, presenting interesting trading ideas, have been featured; the publications are open for everyone [free], get access:

From the six companies analyzed, four have rallied, including a healthy pullback before resuming the rally in the case of LLY. For UNH the price continues squeezing, brewing an explosive move, and NOW that after a month has been consolidating.

In addition to the fundamental and technical analysis for COIN, this publication brings you a second installment of a special study of 20%+ bounces in the S&P500 after significant corrections; and as usual a market snapshot updating support and resistance levels for the SPX, NDX, IWM, Mag 7, PLTR, NFLX, BRK.B, LLY, UNH, COST, IBIT, AVGO, AMD and 30+ securities.

Let’s begin.

COIN is a leader in crypto financial infrastructure, now safeguarding over $310 billion in assets on its platform. Serving more than 110 million users and thousands of institutions across 100+ countries, the company has evolved its business model. Its recent financial performance, including $1.6 billion in Q1 2025 revenue, highlights a strategic shift toward stable, recurring income from institutional custody and staking services, providing a complement to its core trading business.

Coinbase Establishes Market Leadership in Institutional Custody While Scaling Recurring Revenue Streams

Coinbase's initiative to reduce dependence on volatile retail transaction fees has demonstrated measurable success, transforming its revenue composition through mid-2025. The 2024 launch of spot Bitcoin ETFs served as a key catalyst, establishing Coinbase Custody's market leadership position as the preferred custodial provider for major institutional issuers, including BlackRock and Franklin Templeton. This development has generated substantial and predictable custody fee revenue streams. Concurrently, expanded staking services, particularly for Ethereum, have strengthened the company's subscription and services revenue base. While interest income from USDC stablecoin operations remains a significant contributor, it now functions as one component within a broader, more resilient diversified portfolio of recurring revenue products that effectively mitigate trading volume volatility.

Operational Innovation and Market Positioning

Coinbase has established itself as the first U.S. exchange to implement continuous 24/7 trading capabilities for Bitcoin and Ethereum futures contracts. This operational advancement creates competitive differentiation against established market incumbents such as CME Group, which operates on a 23/5 trading schedule. While this initiative is projected to drive increased trading volume, particularly among retail market participants, it requires substantial capital investment in redundant matching engine infrastructure to maintain operational continuity and system reliability.

Financial Performance Analysis and Revenue Composition

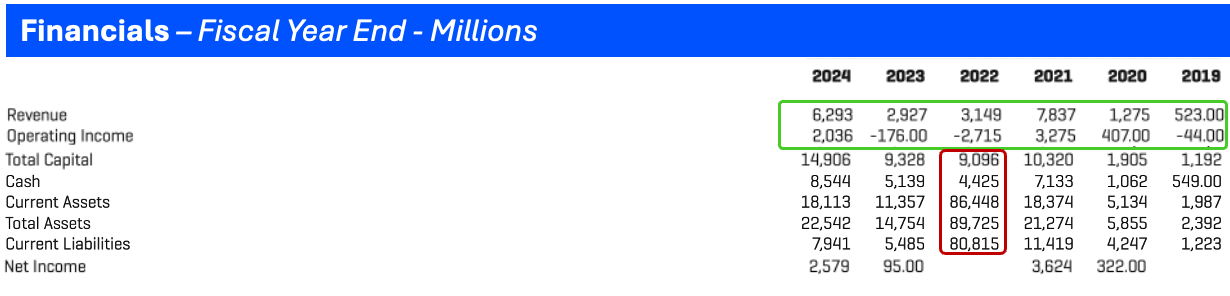

The financial performance continues to demonstrate strong correlation with cryptocurrency market dynamics. COIN achieved robust revenue growth of 111% to $6.6 billion in 2024, representing significant recovery while remaining below the 2021 peak of $7.4 billion. This expansion was primarily driven by increased trading volume and cryptocurrency asset appreciation during the second half of the year. Monthly Transacting Users (MTUs) exhibited consistent growth of 14%, reaching 8.4 million users in 2024.

Transaction fees retained their position as the primary revenue driver, accounting for 61% of total revenue in 2024, compared to 49% in the preceding year. Retail users contributed 86% of transaction fee revenue, underscoring the company's ongoing dependence on this customer segment. Despite subscription and services revenue achieving 64% growth to $2.3 billion, the organization's revenue structure remains predominantly weighted toward transaction-based income streams subject to market volatility.

The fourth quarter 2024 results demonstrated great performance momentum with 138% year-over-year revenue growth to $2.27 billion. Operating income expanded substantially by 790% during this period, supported by disciplined cost management evidenced by a measured 29% increase in general and administrative expenses. The company has established a stabilized expense base ranging from $3 billion to $3.5 billion annually, indicating significant operating leverage potential as revenues approach the $6 billion threshold. Coinbase concluded 2024 with a strong liquidity position of $9.3 billion.

Strategic Positioning and Competitive Environment

The cryptocurrency exchange landscape includes over 300 active platforms, with Coinbase maintaining approximately 10% market share of total trading volume as of late 2024. The platform facilitated $1.2 trillion in trading volume within a global market estimated at over $10.6 trillion. Primary competitors include Binance (focused on non-U.S. markets), Kraken, Gemini, and Robinhood.

Coinbase maintains strategic advantages within the U.S. market through comprehensive regulatory compliance, including strict adherence to Anti-Money Laundering (AML) and Know-Your-Customer (KYC) requirements. This regulatory positioning creates meaningful differentiation from international exchanges that cannot serve U.S. customers. However, domestic competition continues to intensify from specialized cryptocurrency platforms and established fintech organizations such as Square and PayPal, which have integrated cryptocurrency purchasing capabilities into their service offerings. The potential market entry of traditional financial institutions into the cryptocurrency sector, contingent upon regulatory framework clarification, represents a significant long-term competitive consideration.

The company's ability to maintain its custodial market leadership position while expanding staking services and other institutional offerings will be critical determinants of long-term revenue stability and growth trajectory. As the cryptocurrency market continues to mature and institutional adoption accelerates, Coinbase's early positioning in these higher-margin, recurring revenue segments positions it favorably for sustained competitive advantage.

The analysis continues with a technical breakdown for COIN with price targets and a special study on pullbacks following 20% bounces from major bottoms. This study aims to assess any potential pullback and provide you with documented references for what to expect in this bull market, which I've been calling since April 2025.

This is the second installment of a study focusing on price action after 20%+ bounces from bear markets (Following a -20% decline or deeper). Unlock all the insights in this publication, along with our library containing previous analyses and educational content on technical indicators. For the library, click here; for the previous installment, use the following access:

Let’s continue with COIN:

Technical Analysis and Price Target