Economic Indicators are Showing a Resilient Economy

NFP and Unemployment rate exceeded consensus expectations - Six technical and macro indicators that must stay strong the week ahead

Exhaustion is evident in the weekly charts, and multiple hanging man candles in the daily are key elements to be aware of. Good economic news injected optimism to the market. Staying open minded, managing risk and watching six easy to track indicators will give you an edge next week.

As highlighted in last week's compass, GDX declined as anticipated, while OIL rebounded following a bouncy zone. DAX retraced, aligning with Bollinger Band signals, while Bitcoin and Nikkei, despite initial bullish indications, experienced downward pressure after.

Tech continues showing indecision, and IWM is in struggling in a strong volume shelf.

The educational content last Wednesday studied Fundamentals for META, and highlighted how strong this stock is based on its financials and competitive advantages, the breakout is not surprising.

NVDA and GOOG have also been studied in the fundamental series, Google also last Wednesday, both presented bullish continuation after reversal setups that were presented last week, highlighting key levels to conquer given some lack of conviction in price action.

Most important than all, VIX jumped during the week as anticipated last week, today we will study why the Volatility Index suggests further upside in the near term.

The market is in a comparable situation like the last two weeks of June and the first two of July, when there were contradictory indicators until all of them were aligned and the pullback came up.

SPX is making progress towards my previously mentioned bullish target, but the path is not without obstacles. Caution is key as the market faces headwinds. This target was initially shared during the August sell-off and is based on a thorough analysis of breadth trusts and historical trends following rate cuts; both studies shared in previous weeks in both Wednesday’s and Saturday’s editions.

Some indicators suggest caution, and the role of a trader and even an investor at this point (50 bps jumbo rate cut), is to study and measure risk. For the near term, the following is one of the indicators that has to be considered:

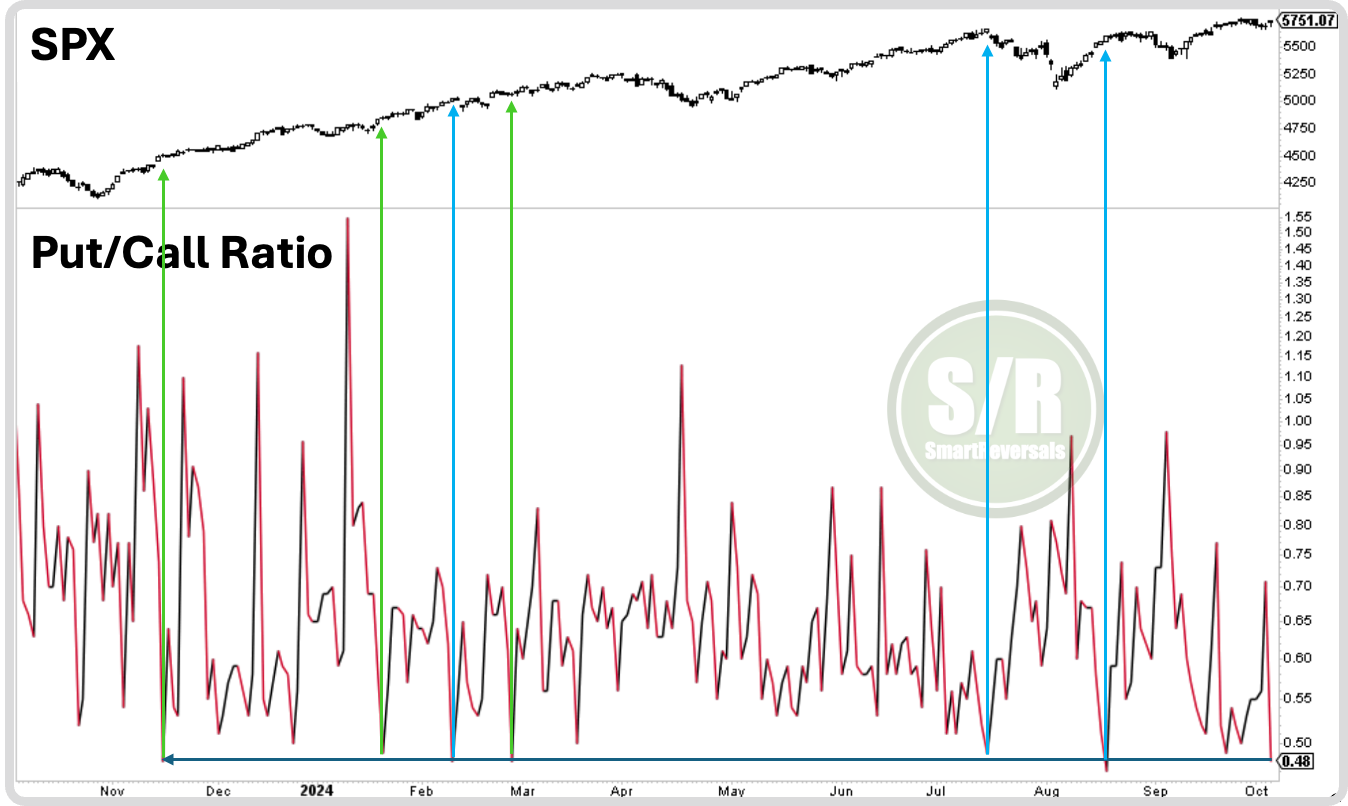

Put/Call Ratio

This indicator works as a contrarian reference, a very low read suggests extreme complacency in the market underestimating associated risks. This is part of the Fear and Greed Index that has been shared in publications to everyone during the last weeks.

Friday closed at a low level, see previous occurrences, highlighted in blue, they preceded pullbacks, the green ones were followed by bullish continuation. What was the difference? I see one: November’s Zweig breadth trust signal.

Will the market continue moving up in a straight line? the Put/Call Ratio, the Bullish Percent and some divergences in specific breadth indicators say volatility is not cleared.

Technicals are about setups and probabilities, price action presents confirmations or invalidations, that is why the S/R Levels are used and the latest edition presented how they have helped to confirm reversals without stomaching most of the bearish move, or bullish for the people who short the index.

This edition provides updates for SPX, NDX, DJI, IWM, TLT, GOOG, AAPL, TSLA, NVDA, META, MSFT, AMZN, GDX, OIL, DAX, NIKKEI, BITCOIN and other contextual charts that have proven to be a guide to assess the indexes.

SPX

The recent daily turbulence is summarized better in this chart, this edition elaborates on six indicators that must be watched: