Health, AI, and the Future of Commerce

The Trillion-Dollar Chases: LLY - AMD - SHOP || Market Update: Make or Break

The Trillion-Dollar Chases: Health, AI, and the Future of Commerce

Today’s deep fundamental analysis examines three companies at critical inflection points, each pursuing distinct pathways toward trillion-dollar market opportunities. Eli Lilly (LLY) is transforming obesity treatment with its incretin franchise, AMD is challenging for AI computing dominance against NVIDIA, and Shopify (SHOP) is redefining global commerce infrastructure. While operating in vastly different sectors, these companies share a defining characteristic: they are deploying billions of dollars in capital today to capture exponential growth tomorrow. In an era of elevated interest rates and tightening monetary conditions, the market has become increasingly discriminating about corporate investment strategies. Investors now demand clarity on capital efficiency, return timelines, and the financial logic underlying massive R&D and infrastructure commitments.

These three companies are executing investment cycles that will define their competitive positions for the next decade.

Eli Lilly (LLY +21% in November while the market is falling) is constructing a $9 billion manufacturing complex to address supply constraints in obesity and diabetes treatments, the largest capital commitment in pharmaceutical history.

AMD (consolidating after a +58% move in October) is channeling billions into R&D and the $4.9 billion ZT Systems acquisition to challenge NVIDIA’s AI accelerator dominance, betting that rack-scale solutions can capture meaningful share of the projected $1 trillion AI silicon market by 2030.

Shopify (SHOP reaching oversold conditions with a -16% pullback in November) is expanding its logistics network and AI capabilities while maintaining an asset-light model, attempting to prove that a technology platform can compete with Amazon’s physical infrastructure without sacrificing operating leverage. Each strategy represents a bold vision, but bold visions require financial validation.

The market is reacting instantly to these focal points, but the true signal lies in the fundamental execution beneath their press releases. To understand which of these capital-intensive bets are poised to deliver durable shareholder value versus those simply riding momentum, read the full analysis that presents the business context for each company, their financial evolution during the last seven years, their competitive landscape, and their technical charts.

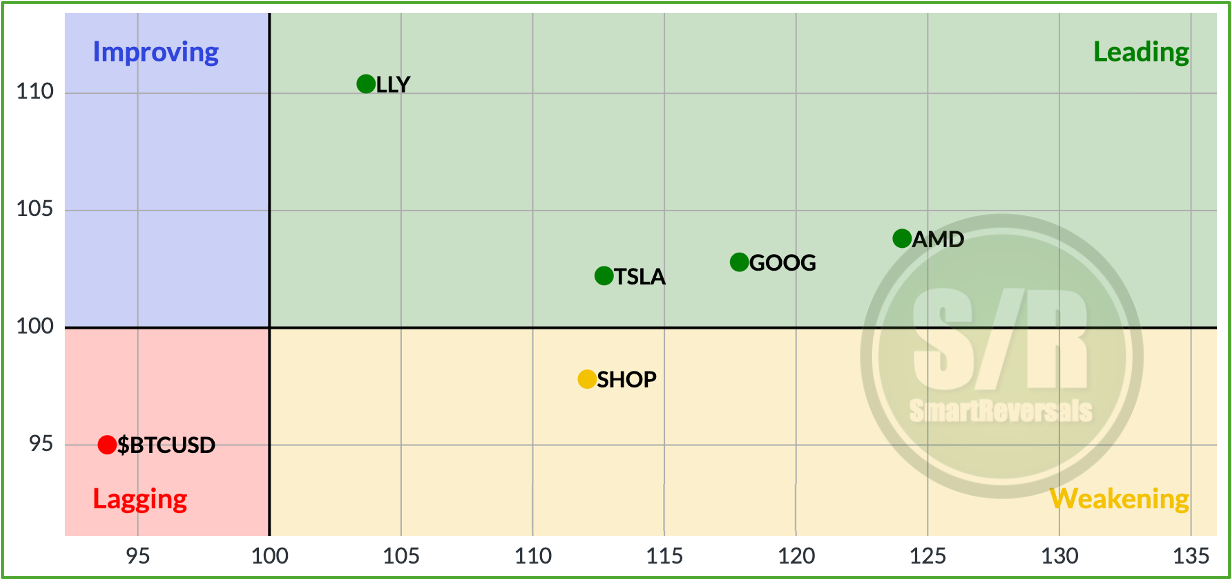

At the end of this publication, read the stock market and crypto space update with the momentum map including all the securities tracked (not only the six charted above in the Momentum Map). It’s worth noting the oversold conditions in indices, Bitcoin, and the so far bullish reaction to NVDA earnings. We will talk about it.

Upgrade the subscription and gain immediate access to the Fundamental Library, featuring updated analyses for AMZN, TSLA, NFLX, PLTR, AAPL, GOOG, META, MSFT, and INTC as of today, plus today’s publication with AMD, LLY, and SHOP. Your subscription also unlocks the complete Market Intelligence Library and the essential Stock Market Update included with the Weekly Compass. Use the links:

2026 is coming with a significant top and volatility, the approach today is not necessarily bullish for all these companies considering essential levels that could break, let’s begin to warm up being open minded to profit on pullbacks when key supports are breached.

Let’s begin.

Advanced Micro Devices (AMD) is a premier global semiconductor company operating on a “fabless” business model, meaning it designs high-performance processors while outsourcing manufacturing to foundry partners like TSMC. The company competes fiercely across two primary battlegrounds: the CPU market, where its Ryzen (PC) and EPYC (Data Center) processors have successfully eroded Intel’s long-standing dominance; and the GPU market, where its Radeon graphics cards and Instinct accelerators challenge Nvidia. Currently, AMD’s strategy is heavily focused on capturing the booming demand for artificial intelligence infrastructure, positioning its MI300 series accelerators as the primary alternative for enterprise AI workloads while maintaining its stronghold in the gaming console market through partnerships with Sony and Microsoft.

AMD Charts a Course for AI’s $100 Billion Club

Advanced Micro Devices (AMD) has sharply revised its long-term outlook, projecting the total addressable market (TAM) for AI silicon to exceed $1 trillion by 2030. At its 2025 Financial Analyst Day, the company unveiled a strategic roadmap targeting double-digit market share in this expanding sector, implying potential annual data center revenue surpassing $100 billion. This represents a transformative leap from the current run rate of approximately $16 billion. The ambitious forecast is underpinned by a robust product pipeline, including the forthcoming MI400 and MI500 series accelerators, and a strategic move toward rack-scale solutions designed to compete directly with NVIDIA’s integrated ecosystem.

Profitability and Cash Generation