Major Squeeze - The Importance of Setting Price Targets

S/R Levels for Feb 9 - 13 - Futures, Indices, ETFs, Stocks, Metals, Crypto

U.S. equities rallied sharply on Friday to conclude a volatile trading week, posting their strongest single-session performance since May 2025. The Dow Jones Industrial Average achieved a historic milestone by crossing and closing above the 50,000 threshold for the first time. It advanced 2.5% to settle at 50,115.67. Broader benchmarks also participated in the relief rally. The S&P 500 rose 1.9% and the NDX 2.2%. This resurgence followed a week marked by heavy losses in the technology sector and growing anxiety over the artificial intelligence trade.

This publication relies on precise targets for both bullish and bearish moves, and this week perfectly illustrated why that discipline is essential. We have used these levels to navigate reversals, this week highlighted their relevance in assessing potential bounces as well.

The current stage of the bull market is its most complex. Market conditions lack broad bullish strength, and the VIX was technically due for a bounce as we anticipated. Furthermore, Bitcoin acted as a “thermometer” for risk aversion. What we witnessed this week based on bearish crossovers studied on the weekly charts, lead to an intra-week pullback, as considered in the Weekly Compass.

Professional Navigation: Setting the Targets

Setting targets is about managing reasonable expectations and being prepared for the moment a trend might exhaust itself. Here is how our levels performed this week:

SPY: We anticipated a breach of the Central Weekly Level with a primary target of 685.2 and a likely extension to 678.54, the actual bottom print was at 675.7 before reversing.

JPM: Our extension target of 314 was reached with high conviction, allowing traders to lock in profits before a mid-week pullback and subsequent recovery.

IBIT (Bitcoin ETF): We anticipated an -8.5% decline with an extended target of 43.5. This was reached quickly at the start of the week and extended further.

BRK.B: Our bullish expectation was met and exceeded. Instead of just the 2.3% target extension at $492.3, the stock rallied 5.72%.

SMH: We expected a decline with an extended target of 382.5 (-5.3%). The ETF found support near 374.08 before bouncing.

WMT: Anticipated a 2.2% rally to 121.8. This target was exceeded, allowing traders who trail stops to capture a total rally of 4.13%.

AAPL: Our bullish setup from a week ago anticipated a move to 276.5 (+3.6%). Apple crossed this level with strength, hitting an initial extended target of 269.4 (+7.2%) earlier in the week.

QQQ: The bearish extended target was set at 607.3 (a -2.4% decline). The price extended to 596.24 and bounced precisely from that level.

IWM: The bearish target of 252 (-2.7%) was reached with extreme precision before bouncing, this one was the most choppy one of all the ones anticipated.

Risk Management: The Power of Invalidation

Accuracy is only half the battle; managing risk is what keeps you in the game. Out of the 10 high-probability setups posted last week, 9 moved in the expected direction.

The only setup that was invalidated was META. However, because we used a calculated Central Weekly Level as a reference, the invalidation at the 1.2% mark protected subscribers from a much deeper -7.68% decline.

Looking Ahead

Next month marks the second anniversary of SmartReversals. For two years, these levels have helped investors across the globe set reasonable targets and manage risk through technical discipline.

We use the Central Weekly Level (CWL) to manage momentum, we have seen the power of individual names in choppy markets, since November we have outperformed the market with bullish and bearish setups every week, today I will present in three charts how the Central Monthly Level (CML) works for longer term positions, this helps to answer questions like: What is the direction of the next big move (+/-10%)?, What is the proximity of the next correction?, or the what is the risk of not reaching our bullish target that paid subscribers know is 7,#80?.

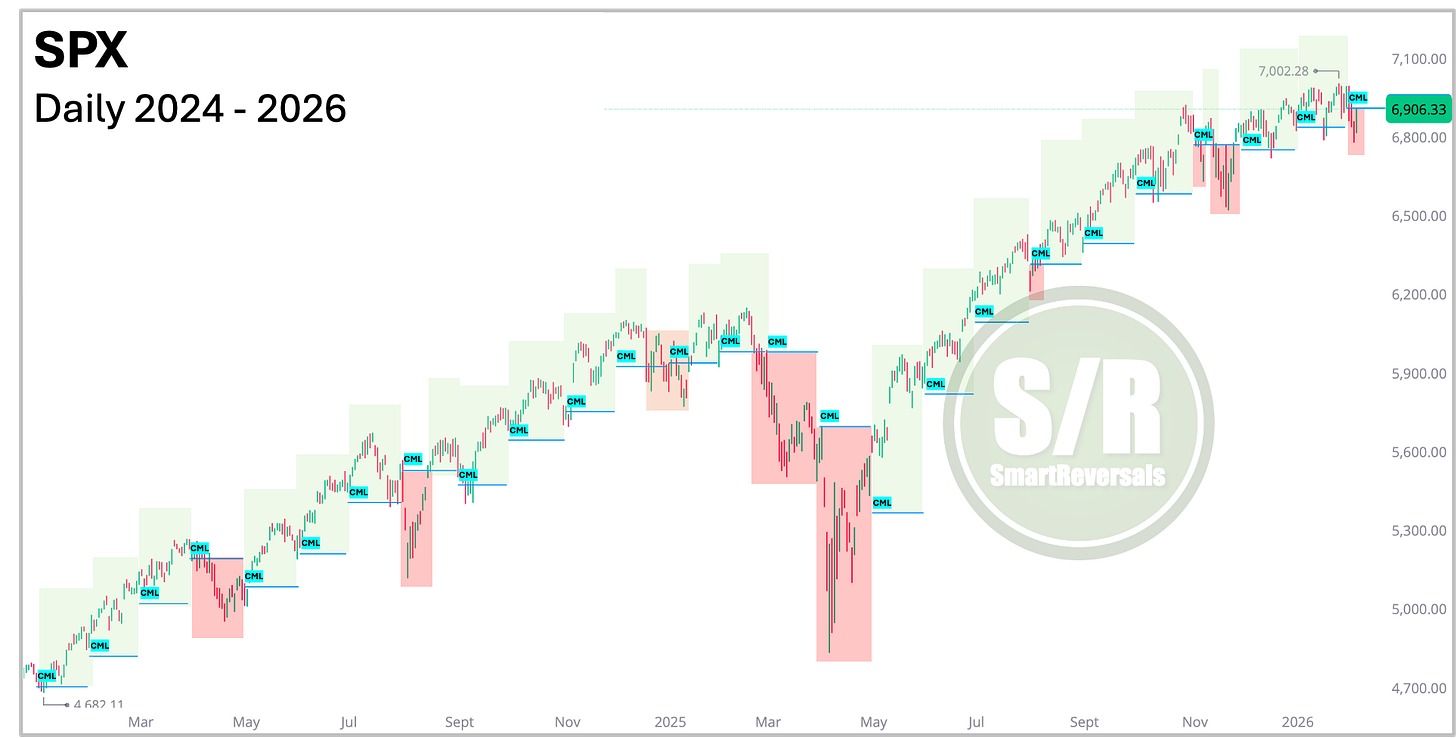

See the daily chart for SPX and the CWL posted during the last two years for every week, this monthly line is a great tool to assess bullish or bearish conditions, our role as traders is to make decisions studying price action, and the chart highlights how significant has been to lose the CML using the red areas:

Of course, there are choppy months like December 2024 when the CML was breached several times, that price action is something to consider as a condition as we use the VIX, divergences, or Bitcoin (you don’t need to trade it, just use it as a risk-on/off thermometer).

The selloff in March and April had a condition: The Price was below the CML.

We use the CWL to time momentum, the CML works better for medium or long term positions, the chart speaks by itself.

CML and Bear Markets

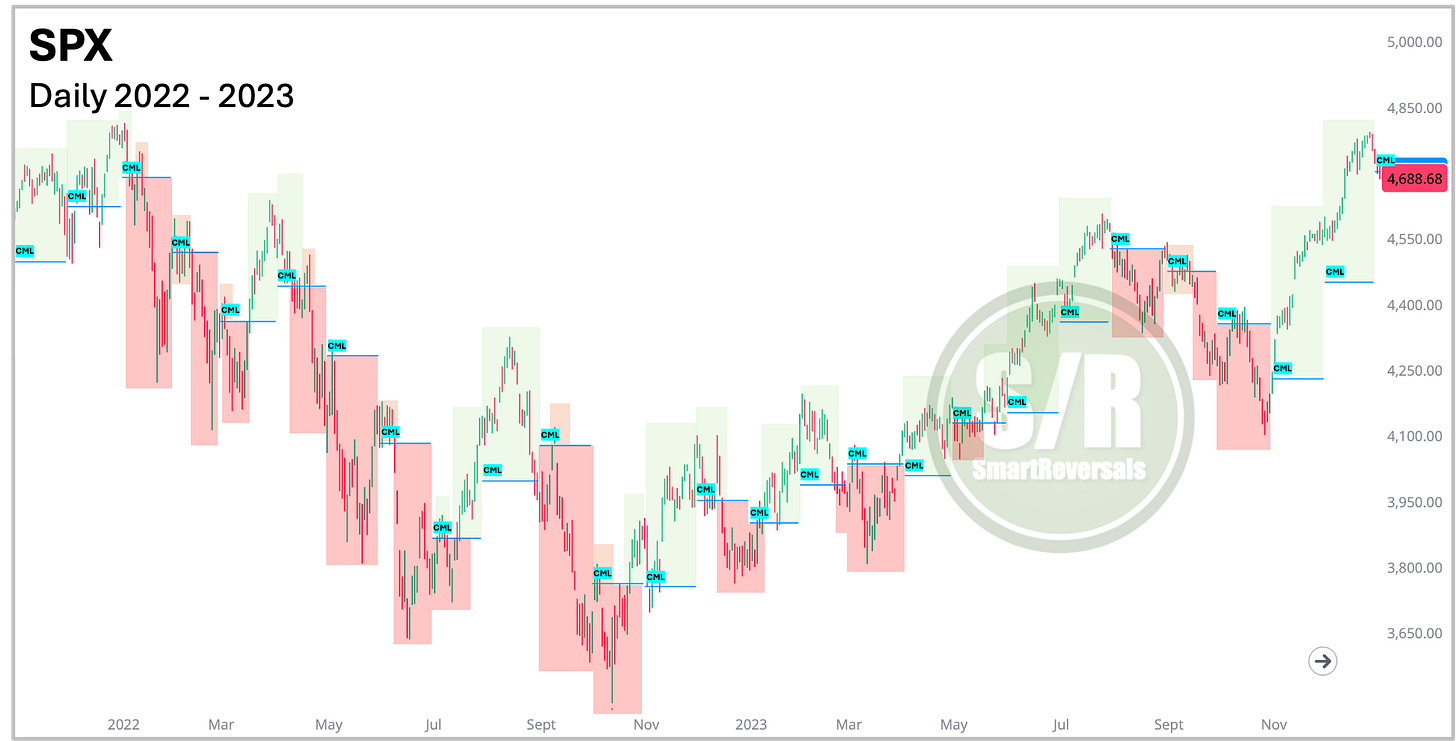

We just saw the case study for 2025, see what happened before the bear markets of 2022 and 2020:

Being positioned below the CML is a condition that increases the chances of a major breakdown. Bear in mind that bear markets have ferocious bear market rallies, if you remember March, or June-July 2022, the FOMO that they created was significant, but even the infamous Jackson Hole meeting on September 2022 that triggered the last major selloff of 2022 happened below the CML.

Another major event covered in the chart is the -10% correction of 2023, see how impressive is the constant condition of being below the CML.

This publication updates every month the CML for each of the following securities, and that CML is always every Friday combined with the weekly levels:

Our Core Watchlist:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Unlock the S/R levels for next week, and the essential monthly levels for February, it’s important to highlight that tech is below its CML.

Exclusively for premium subscribers, my latest ebook details how to master support and resistance levels (find it below), also four high-probability setups for next week.

2020 Crash - Another Clean Example of Losing the CML: