Market Rotation: Navigating the Cycle and Seasonality

Shift to Late-Cycle Leadership - Presidential Cycle - Sectors - Stock Market Update

Understanding the rhythm of the stock market requires looking at three distinct lenses: the long-term economic cycle, intermediate momentum trends, and the historical recurring patterns of seasonality. By synthesizing these data points, we can better understand the shifting landscape of 2026.

Today’s publication features an in-depth seasonality analysis, including a breakdown of the current sector rotation, where is the stock market in the presidential cycle, and key strategic insights for 2026. I also include our mid-week update, reviewing the high-probability setups posted on Friday and Saturday. Unlock the full range of institutional-grade content by upgrading your subscription today.

Let’s begin.

The “Market Cycle” acts as a leading indicator for the broader “Economic Cycle.”

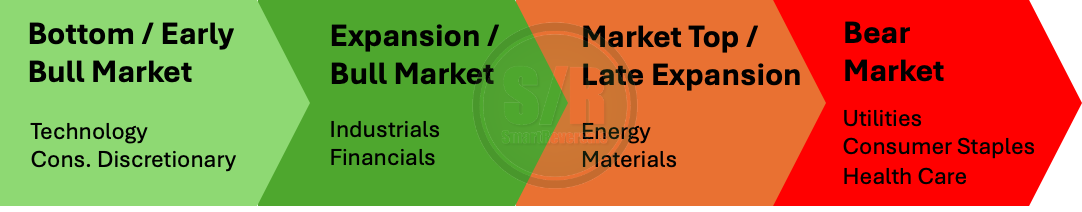

Historically, sectors rotate in a sequence as the market moves from a bottom to a top:

Market Bottom / Early Bull Market: Investors typically flock to Technology and Consumer Discretionary in anticipation of recovery.

Expansion / Bull Market: Leadership broadens to include Industrials and Financials as lending and manufacturing activity accelerate.

Market Top / Late Expansion: As the economy overheats and inflation rises, capital rotates into Energy and Basic Materials.

Bear Market / Recession: Defensive sectors like Utilities, Consumer Staples, and Health Care tend to outperform as investors seek stability.

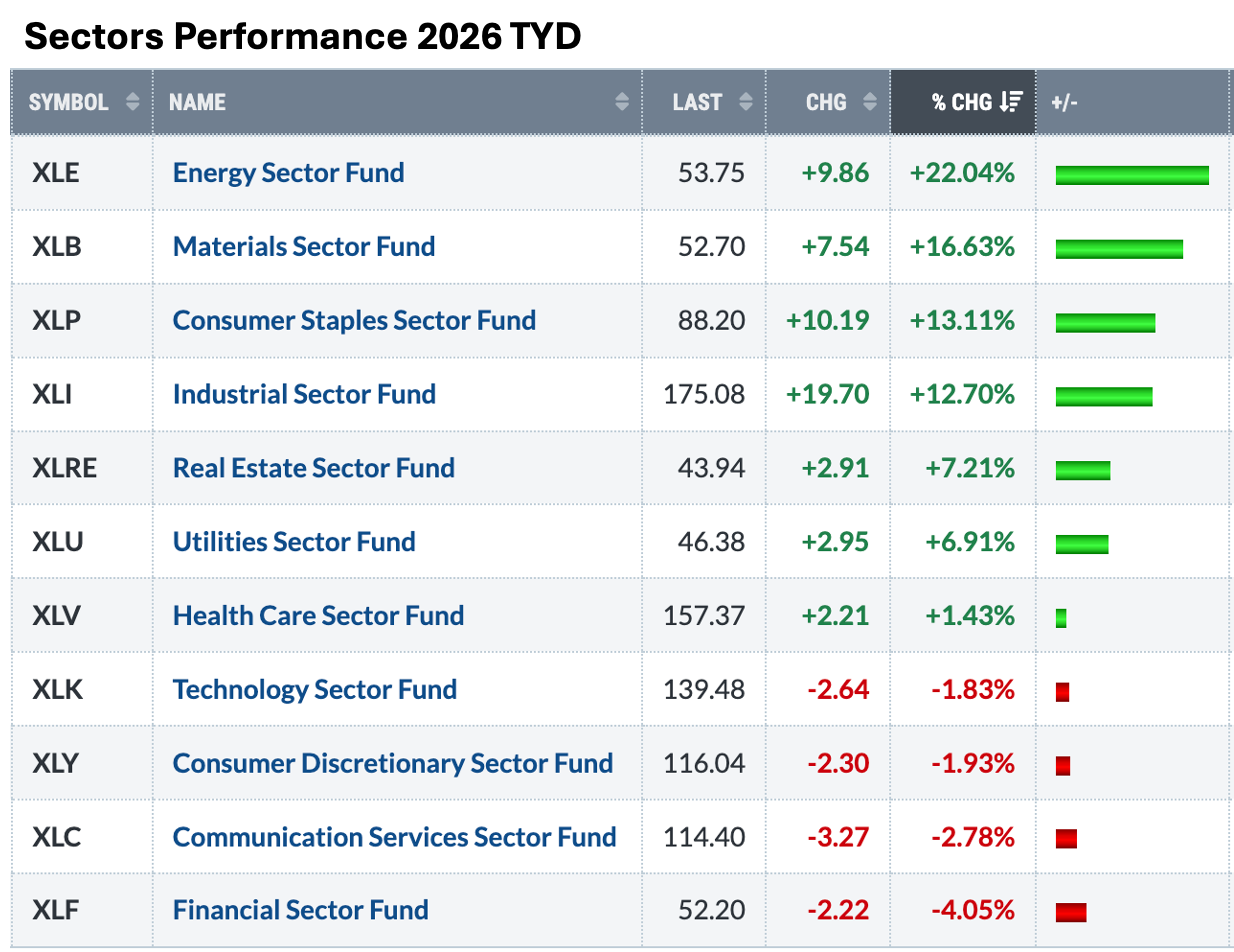

The performance data for 2026 Year-To-Date (YTD) indicates a clear rotation toward late-cycle and defensive sectors, signaling that the market may be navigating a late expansion phase.

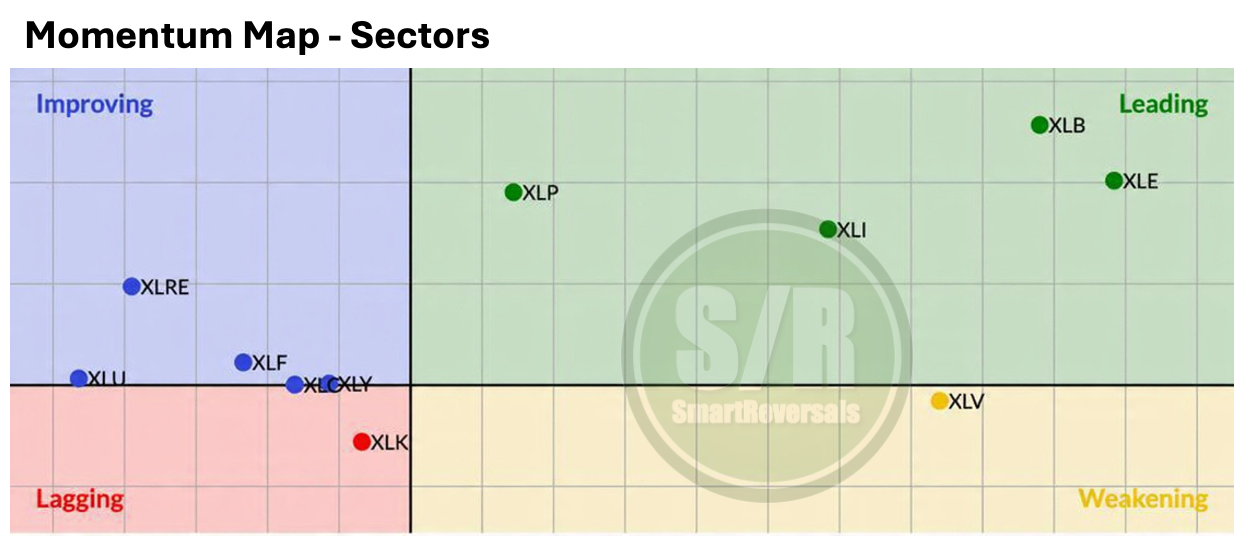

The Momentum Map confirms this transition. Energy (XLE) and Materials (XLB) are firmly in the "Leading" quadrant, exhibiting both high strength and positive momentum (potentially overbought). Meanwhile, Consumer Staples (XLP) came from Improving, moving toward leadership as a defensive hedge. Conversely, former market darlings in Technology (XLK) have drifted into the "Lagging" quadrant, suggesting a temporary exhaustion of the growth trade (potentially oversold).

Seasonality: The February Hurdle

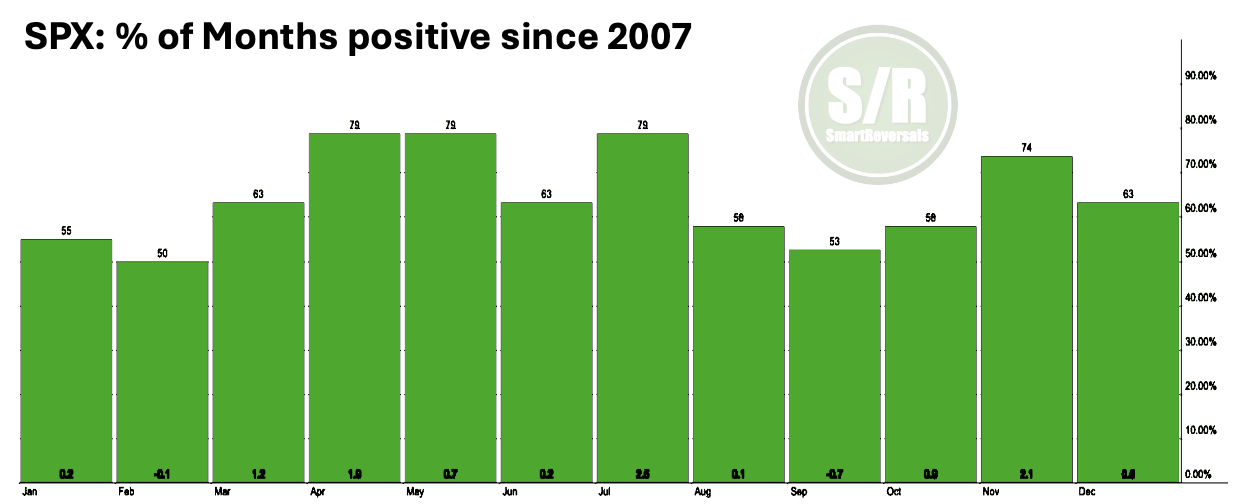

While sector rotation provides the “what,” seasonality often provides the “when.” Historical data since 2007 reveals that February has been frequently the least bullish month of the year during the last 20 years.

The February Slump: SPX data shows February often yields a low percentage of positive months (approx. 50%) and flat-to-negative average returns compared to the strong rallies seen in April (+1.54%) or November (+2.08%).

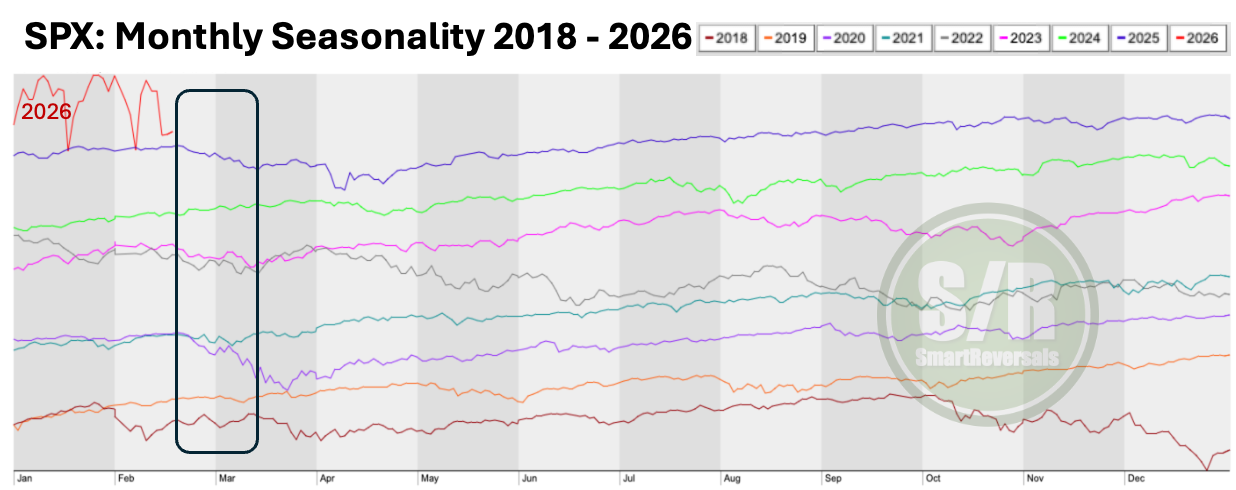

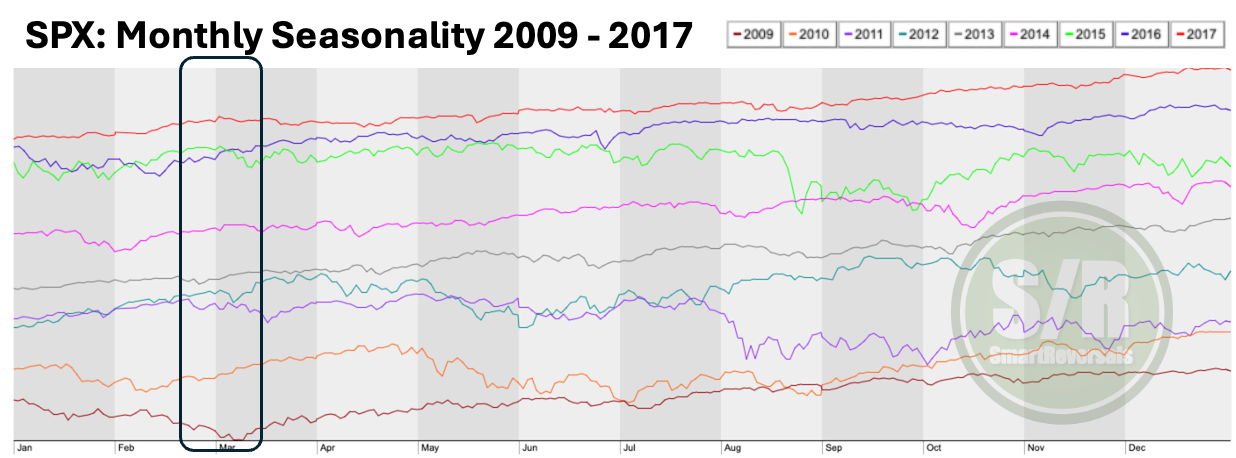

March Recovery: Seasonality charts show a historical tendency for a “dip” in late February, followed by a recovery in March as the market prepares for a typically bullish second quarter.

Choppy 2026: See the red upper line in the following chart presenting the price movements during 2026, if you feel confused as a new investor or trader, find some comfort considering that the beginning of 2026 has been specially volatile and directionless for the S&P 500 in comparison with recent years.

March often serves as a structural reversal point where the market establishes a first-quarter low before beginning a spring recovery. The data from 2009 - 2017 also reveals a recurring pattern of strength in April and July, followed by significant volatility and technical breakdowns during September, which stands out as the weakest month in the dataset.

How Does 2026 Compare to 2000 and 2008, and What Does the Presidential Cycle Suggest for the SPX?

The seasonality analysis is specially relevant for the range between 2000 and 2008 presented below considering: