Navigating Volatility: How Six of Our High-Probability Setups Outperformed the Market

Support and Resistance Levels for next week - Indices, Futures, Megacaps, ETFs, Crypto, and Metals

This has been a volatile week for the market. Between seasonality, a high VIX (which, as I mentioned last weekend, it suggested a new spike, and weakness in Bitcoin (acting as a risk-off thermometer), we finally saw a bearish resolution.

My notes last week regarding the VIX and SPX were clear for paid subscribers:

“The current price action doesn’t typically reflect a final ‘top’ in volatility. The current level of 17.7 for the VIX is not the cleanest condition for a sustained bull run; a new spike in volatility remains a viable risk.” Additionally, I cited: “For the SPX, a breach of the CWL of 6,901.8 (-0.4%) points to 6,810.6 (-1.8%).”

The actual low of the week was $6,794 🎯, just 16 points away from my target. (Remember this is not gut feeling, this is based on technical analysis and modeled S/R levels every Friday for the week ahead - Like the ones updated for next week)

Technology failed to provide the necessary fuel for the market. Given its heavy weighting, the rotation observed in other sectors could not mitigate the market cracks highlighted in the Weekly Compass since January 18 🎯.

Our high-probability setups continued to pay off: MSFT, IWM and AVGO reached their bullish targets and reversed, PLTR accelerated its bearish move after breaching its CWL, and GOOG moved downward as expected. COST moved north with choppy price action but reached its bullish target of $1,024 today (the top was just 1.2 dollars shy from the target). From 8 high probability setups only BRK.B moved against its bullish setup, and META opened on Monday below its Central Weekly Level, so there was no material loss.

With six out of eight setups showing directional validation, not to mention others in my blueprint, like NVDA and TSLA, reaching their bullish targets before reversing, I want to highlight the power of individual names in choppy markets and the neutrality of my setups involving megacaps, long or shorts; and different sectors, that outperform the broader market.

This approach is valid for all types of investors. The Weekly Compass provides clear triggers, targets, and invalidation levels, alongside technical studies for moves averaging 4% while indices remain stagnant or volatile. It is an active, profitable approach.

All of this using the Support and Resistance Levels updated today for next week.

I understand that some investors have a longer-term perspective while others are concerned about a major market top. Both views are absolutely valid. For that reason, remember that I provide weekly levels every Friday, as well as monthly levels. The Central Monthly Level serves as a key tool for long-term decision-making, raising red flags for investors concerned about a potential major top if that level is lost.

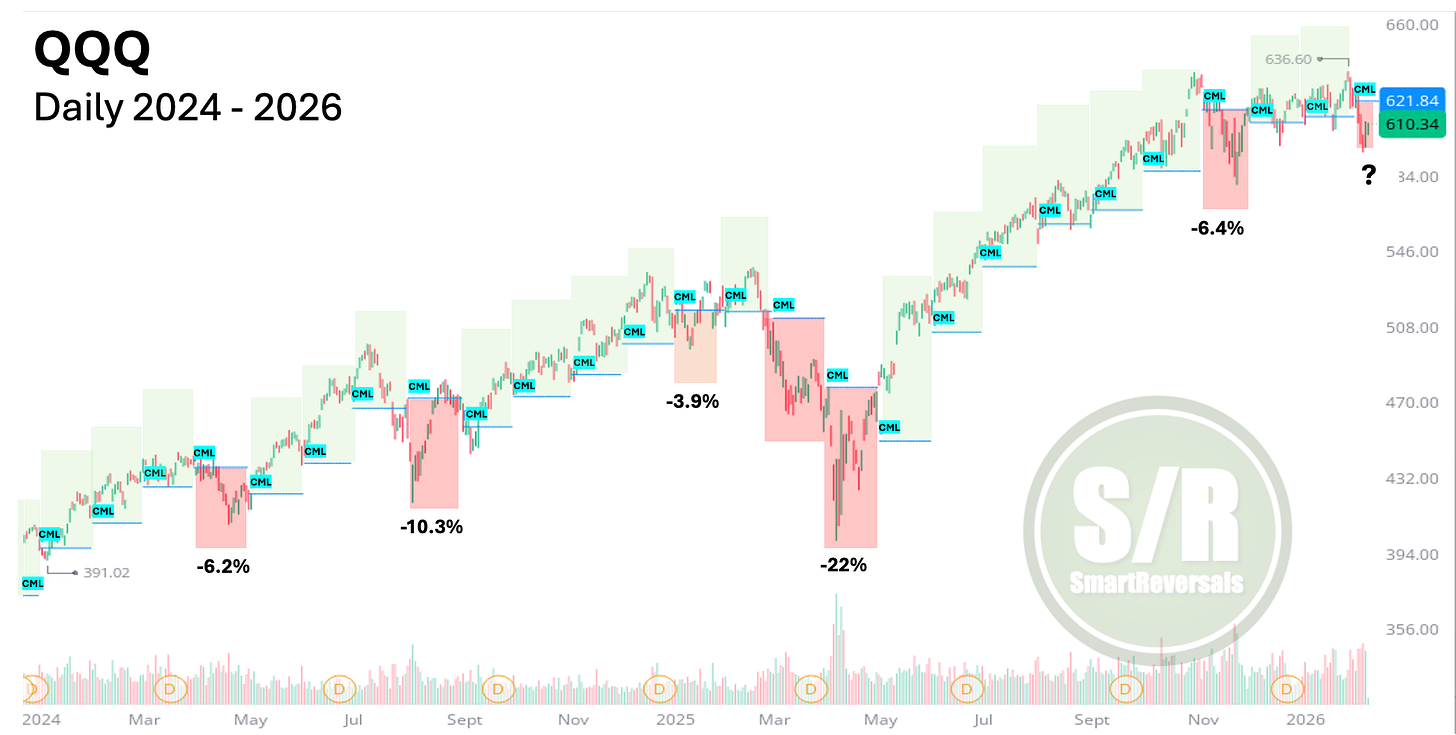

Last week we studied the performance for the SPX during the last six years using the Central Monthly Level (CML), this is the same analysis for QQQ.

Notice how significant the loss of the CML has been; the red areas highlight the drawdowns that occurred after the CML was breached.

As mentioned last week for the SPX, losing the CML is not a guarantee of a crash or bear market, but is relevant enough to be cautious, but it’s worth noting, SPX, NDX, DJI, Small Caps (IWM), and all the Magnificent Seven lost their Central Monthly Level, unlock the key price levels to watch even for long term investors. They’re posted below for premium subscribers, upgrade now your plan!

Stop Scanning. Start Anticipating. The secret to consistent performance isn’t finding a “new” stock every day, it’s mastering the ones that matter. We permanently track the market’s Megacaps and key securities with HIGH VOLUME to give you a broad market perspective. This constant focus allows you to catch the capital rotation before the crowd does and pinpoint the perfect time to enter.

We Cover every week (and month):

Indices: SPX, NDX, DJI, IWM, ES=F, NQ=F

Majors: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX, XOM

ETFs & Commodities: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Crypto: Bitcoin, Ethereum, ETHA, IBIT

Leveraged: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Ensure you have the right tools to navigate the current market. Unlock the Monthly and Weekly Levels for all of them now.

Let’s begin with the weekly levels, and then the monthly ones, with some high probability setups in advance of the weekend publication.

WEEKLY LEVELS