Positioning for Santa Season

9 High Probability Setups and Momentum Indicators Tracking Price Action

The technology sector lead Friday’s recovery, surging 2.0% to help major indices reclaim key technical levels studied here and restore market momentum heading into the end of the year. This strength lifted investor sentiment from defensive positioning.

The rally was driven by renewed strength in semiconductors, where Nvidia climbed nearly 4% on reports of potential resumed chip sales to China under revised export guidelines. Meanwhile, Micron Technology surged 7% following a robust earnings outlook that lifted the broader memory and storage subsector. This sector rotation back into technology reversed the previous week’s valuation concerns, suggesting investors view recent pullbacks as buying opportunities rather than fundamental deterioration; nothing different to our technical expectation for volatility during the next two weeks after the rate cut.

Conversely, the consumer sector faced material headwinds. Nike plunged over 10% after reporting disappointing China sales that raise questions about its competitive positioning in a critical growth market. Geopolitical developments influenced defense stocks, rallying 2.7% after President Trump signaled potential military intervention scenarios regarding Venezuela. This created renewed focus on defense spending and geopolitical risk hedges like metals entering 2026.

Today’s High Probability Setups feature 7 bullish and 2 bearish opportunities ready to be monetized.

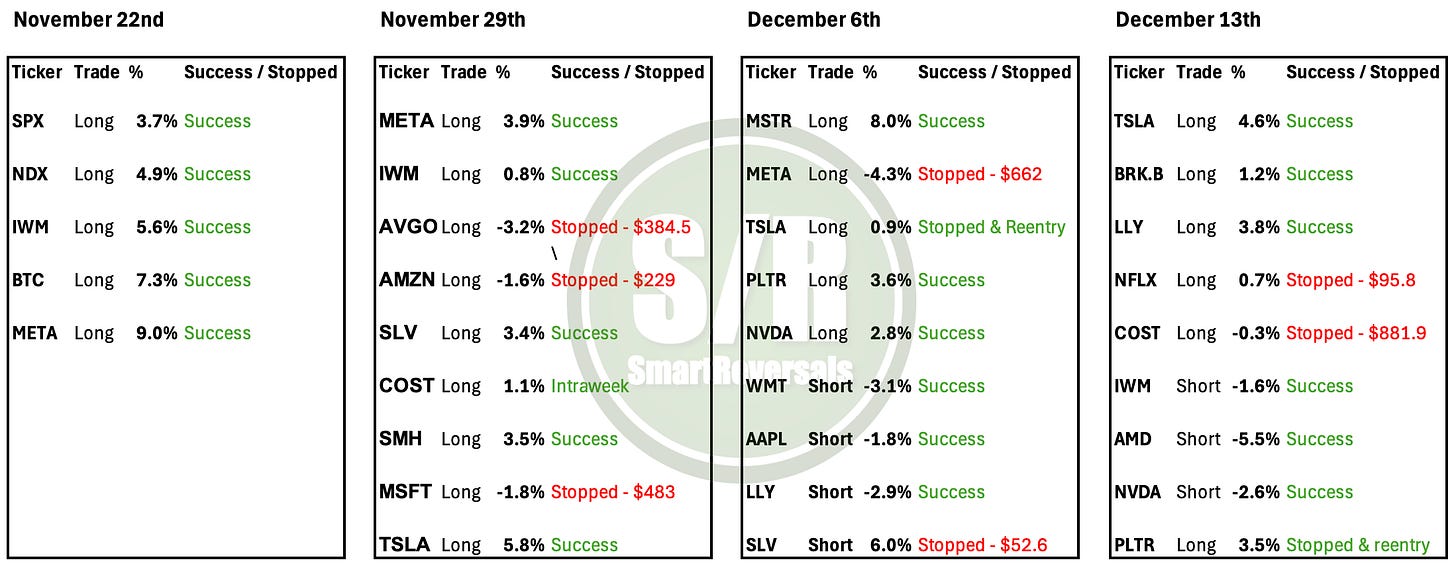

During the last four weeks, the following setups have been exclusively shared with premium subscribers. Each setup includes a crucial price level that serves as a stop-loss reference for managing risk. These setups have included both long (bullish) and short (bearish) positions as follows:

The performance has been remarkable and is an invitation for you to subscribe to the premium plan, so you can unlock the setups for next week, along with the analysis of more securities and the stock market and crypto space in general.

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

A broad view of the market allows investors to spot rotation opportunities. If you prefer to be focused on any of these securities, this publication helps you navigate their price action since they’re here every week.

Today’s agenda

Momentum Map

9 High Probability Setups

Charts and Analysis for Main Indices, VIX, Breadth, and Bitcoin

Appendix with Charts for ETFS and Megacaps