S/R Levels - June 10th - 14th

Weekly levels updated, Bitcoin and Ethereum added to the Monthly levels. Plan ahead your trades measuring potential reversals and consolidations. SPX QQQ IWM NVDA ES=F NQ=F CL=F, GDX, DAX, AAPL & more

SPX closed near all time highs, anyway its price action was weak during the last two days of the week, so immediate continuation is not guaranteed.

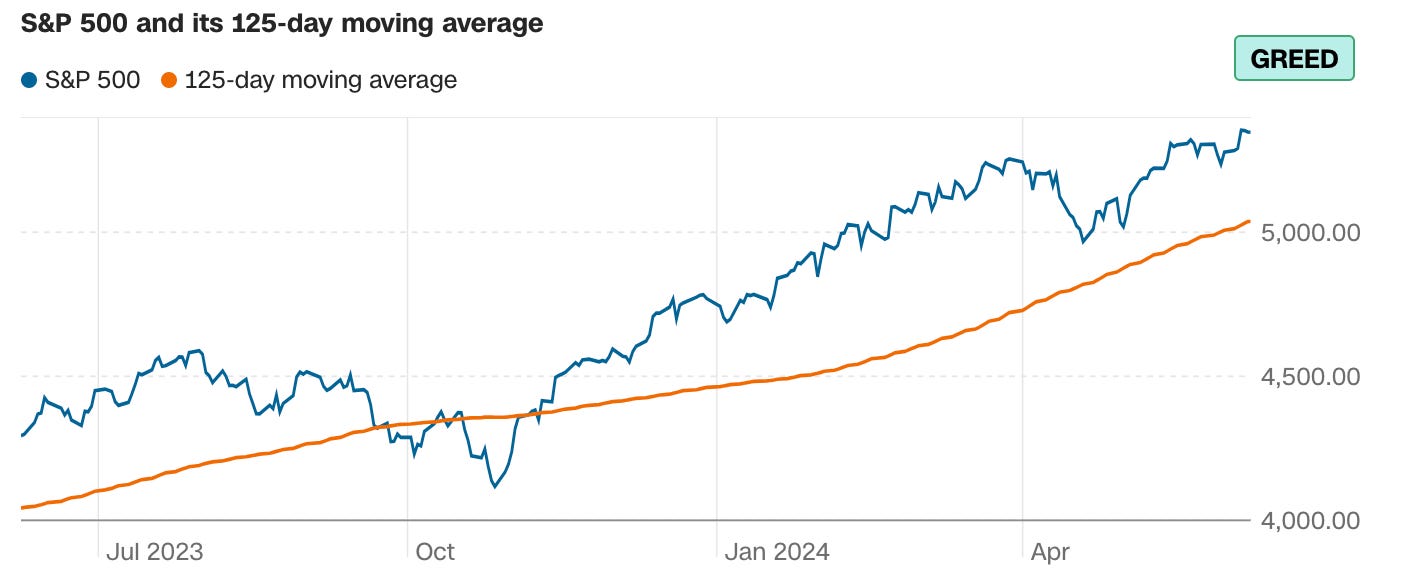

The Fear and Greed index closed in Neutral zone, but from its seven components, Market Momentum is back to greed, this indicator used the SPX price distance from its 125 DMA as presented below:

Since the NVDA split will be effective this Monday, it’s worth noting what happened with AAPL in 2020 with the stock did the same split move, back then AAPL was the market sweetheart and it looked quite solid in fundamentals, anyway it was not euphoria-proof and a 25% decline followed the split.

The levels below are useful to set protection or triggers depending on long or short positions; no matter what technicals suggest.

Weekly Levels

Bullish above the blue levels for each security: