Strong Growth Anchors the ‘Santa Rally’

GDP Above Expectations Fueled the Bullish Setup - Bullish and Bearish Aspects Ahead of 2026.

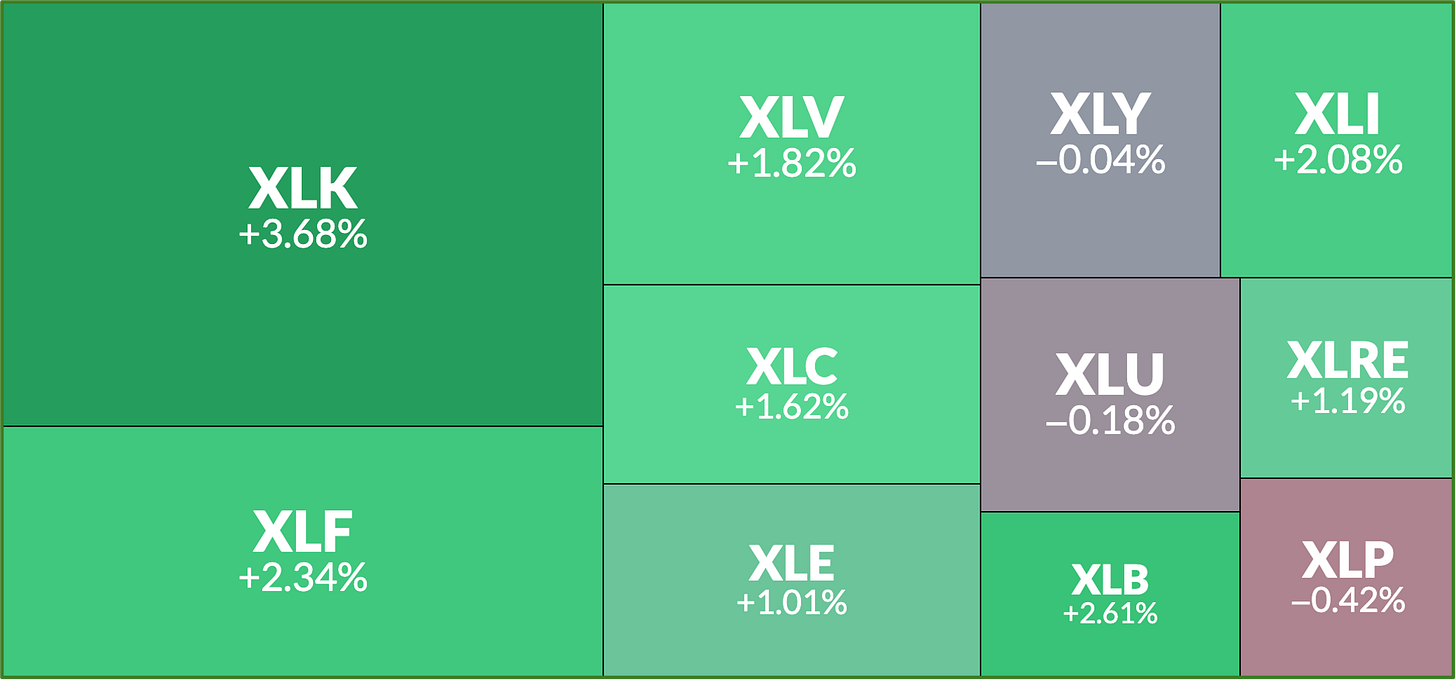

The week ended in positive territory for major U.S. indices as considered a week ago based on their price structure. Our high-probability setups correctly favored bullish moves for NDX/QQQ, NVDA, and SMH. Tech indeed led the move illustrated by the sector heatmap below for the week with XLK jumping +3.7% and Financials (XLF) following with +2.3%.

5 Days Move per Sector:

A sharp divergence emerged between digital and tangible assets this week. Bitcoin remained range-bound with bulls defending support at $86,600 against critical resistance at $90,000. Meanwhile, traditional commodities staged a powerful breakout. Gold and silver futures rallied to new all time highs, driving the materials sector (XLB) to a market leading 2.6% weekly gain. This rotation suggests investors are currently favoring precious metals over cryptocurrencies as hedges against geopolitical tensions and dollar weakness. We will study Bitcoin and Metals in the premium section below as we do every weekend.

Strong Growth Anchors the ‘Santa Rally’

Wall Street has officially entered the seasonal “Santa Claus rally” window, covering the final five trading sessions of 2025 and the first two of 2026. The market’s advance is supported by a robust economic backdrop. Third quarter GDP expanded at a 4.3% annualized rate, significantly exceeding the 3.0% consensus forecast. While this economic heat has pushed the probability of a January Federal Reserve rate cut below 15%, investors remain undeterred. The major indices appear positioned to protect year to date gains approaching 18% as strong growth data outweighs immediate monetary policy concerns heading into the new year.

High Probability Setups: Short and Long Term

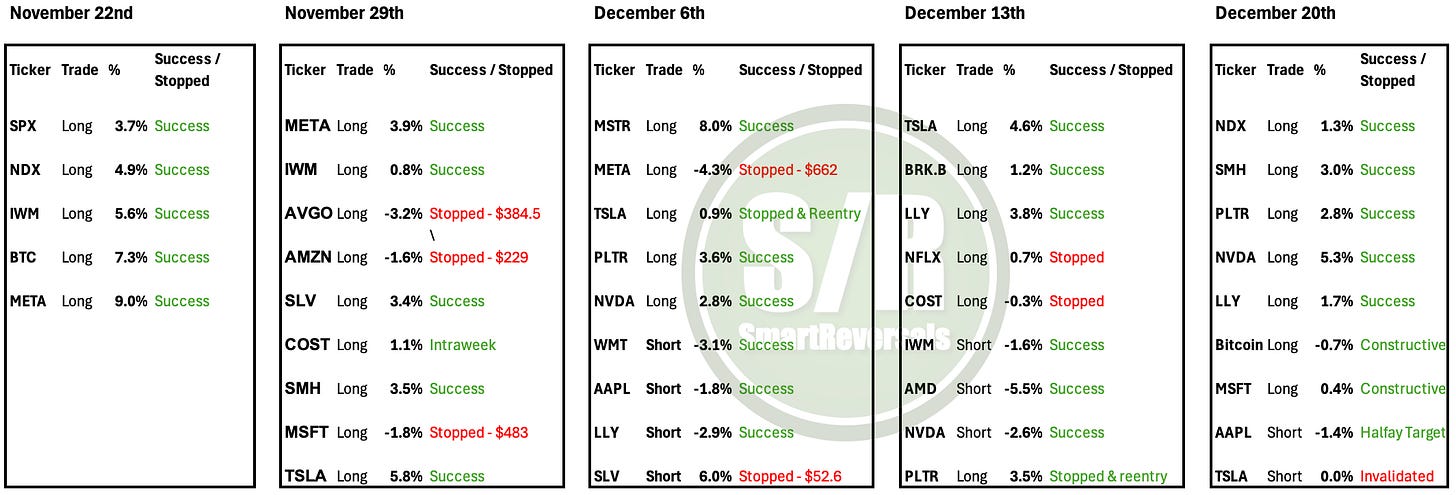

During the last five weeks, the following setups have been exclusively shared with premium subscribers. Each setup includes the price target and the crucial price level that serves as a stop-loss reference for managing risk. These setups have included both long (bullish) and short (bearish) positions as follows:

With a cumulative accuracy ratio of 75%, this is your invitation to subscribe to the Premium Plan. Unlock next week’s setups and gain access to deeper analysis across equities and the crypto space.

As this is the final Weekly Compass of 2025, it is important to note that long-term setups are a staple of this publication. For instance, I issued bullish calls for AAPL in July, when it was lagging behind the rest of the Magnificent Seven. I set a target of $284, a level consistently present in every subsequent chart since, and the resulting 30% rally provided excellent returns for investors. Similarly, in August 2025, I highlighted a breakout formation brewing in TSLA, which materialized in September and delivered a robust 33% gain.

Regarding the indices, my April 26th Weekly Compass flagged critical bullish signals for the SPX and NDX. Since then, these indices have rallied 25% and 32%, respectively. Throughout this run, I published continuous market intelligence studies to help you navigate the bull market, even when mainstream financial outlets were preaching bearishness.

The beauty of Substack is that every analysis remains on the record. For new subscribers, here are four key publications that defied the consensus:

June 12th: With the SPX up 25% from its April low, I correctly anticipated further bullish continuation.

July 3rd: I outlined specific targets for a pullback later in the year, followed by a resumption of the uptrend.

September 15th: I projected a 5% pullback for the SPX; while it arrived later than expected, it played out symmetrically as analyzed.

November 27th: I posted new bullish targets for the SPX and NDX, noting that a significant correction may not occur until 2026. This methodology is consistent. It is the same approach I used in Q3 2024 to predict a major top at $6,107—a forecast validated when the market reversed from $6,147 in February 2025.

Links to the publications are here:

This publication maintains a market-neutral stance, providing also bearish signals whether the objective is to execute a short position or simply avoid buying at a top. This approach proved critical for Bitcoin in October 2025, when Bitcoin precisely hit our major resistance level of $122.7K, a target we had identified as far back as May, during a period of significant doubt regarding the stock market and crypto space recovery. Exhaustion levels have been anticipated for NFLX, MSFT, PLTR, and NVDA when they have been extremely overbought. Is GOOG the next to consolidate?.

My focus is always on price action. News, opinions, and market sentiment are considered sometimes as contrarian indicators. Unlock the premium content before the new year!

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions. Maintaining a consistent watchlist is key to improving performance; it allows you to refine the timing of your entries and effectively rotate capital as new opportunities emerge.

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Our Agenda Today:

Momentum Map

High Probability Setups

Major Indices, Volatility, Breadth, and Bitcoin

Individual Stocks and ETFs

Momentum Map and SPX

During the last months we have seen the awakening of several names from the Lagging quadrant, names with strong fundamentals (don’t assume financially weak company will jump, or one with good financials but revenue decreasing), and of course bullish reversal setups. That has been the case for NVDA, TSLA, AAPL, WMT, BRK.B, and LLY, a glorious move by a non-tech company. Building on those FACTS, last week we observed constructive moves on: