Tech Awakening?

Support and Resistance Levels to Validate Momentum Next Week: Indices, Futures, ETFs, Megacaps, Crypto, Metals

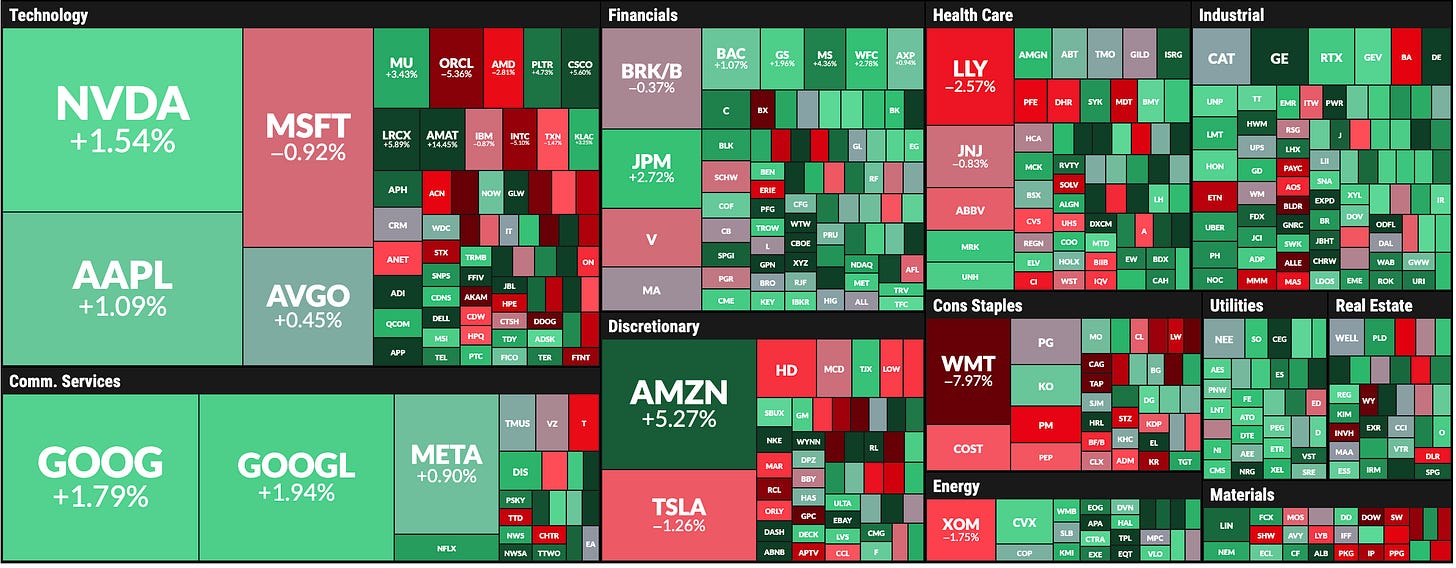

U.S. equities finished the holiday-shortened week with solid gains, snapping multi-week losing streaks. The Nasdaq Composite surged 1.5% for the week to end a five-week slide, while the S&P 500 advanced 1.1% and the Dow Jones Industrial Average secured a 0.3% weekly gain. Friday saw broad strength across the market.

Market momentum shifted dramatically on Friday following a landmark legal decision that outweighed concerning economic data. Early reports revealed that fourth-quarter economic growth slowed to 1.4%, significantly missing the 3.0% consensus forecast. Inflation metrics also ran hot, with the Personal Consumption Expenditures price index rising 2.9% year over year. Even so, stocks rallied after the Supreme Court ruled 6 to 3 that the executive branch overstepped its authority by imposing broad emergency tariffs. The President subsequently announced a new 10% global tariff plan lasting 150 days, but the removal of prior legal uncertainties provided a significant boost to investor sentiment.

Technology and consumer companies were the primary beneficiaries of the court ruling. The communication services sector jumped 2.7%, driven by a 4.01% rise in Alphabet and a 1.69% gain for Meta Platforms. Tariff-sensitive Amazon climbed 2.56%, while Nvidia and Apple added to the broad tech sector strength. On the flip side, the private credit sector faced notable selling pressure. Shares of Blue Owl Capital and Blackstone fell 4.8% and 3.57% respectively, driven by concerns over retail fund liquidity. The energy sector also lagged, falling 0.7% as crude oil futures settled at $66.49 per barrel.

Over the weekend, I anticipated that several securities were due for a reversal to recover their Central Weekly Levels (CWL). This thesis played out across our core watchlist:

Palantir (PLTR): Recovered its $134.5 CWL to close the week +2.9%.

Amazon (AMZN): Reclaimed the $203 level, triggering a bullish reversal setup and closing up +5.27%.

Semiconductor ETF (SMH): Recovered $408.3, finishing the week +1.8%.

Oversold Leaders: Nvidia (NVDA) and Netflix (NFLX) both moved above their key price levels, closing up +3.8% and +2.34% respectively.

The rotation we’ve been tracking into “Real Economy” giants like JP Morgan (JPM), Bershire (BRK.B), Exxon Mobil (XOM), Walmart (WMT), and Eli Lilly (LLY) appears overextended and in healthy pullback process.

Conversely, many tech giants are currently oversold. If these giants wake up, we could see a new leg up for the bull market, heading toward our mid-term targets for the SPX and NDX.

→ Unlock the Publication with the Targets for SPX and NDX in 2026 Click Here. ←

MAGS ETF: A Critical Junction

The weekly chart for the MAGS ETF (Magnificent Seven) suggests the worst of the bearish move may be behind us. The lower Bollinger Band was breached and oscillators reached oversold territory, conditions that mirrored the April 2025 bottom.

As noted above, several securities have recently breached their Central Weekly Level (CWL) reversing from their (bearish) setups. This essential weekly price line is modeled every Friday for 44 core securities. Paid subscribers also have the exclusive benefit of suggesting five additional tickers from their personal watchlists each weekend.

For the coming week, the MAGS ETF must hold above $61.8 to maintain its current bullish reversal setup. A successful hold targets $63.5 as an immediate move, with potential for $64.4 if momentum builds. Conversely, if $61.8 is lost, the next destination is $60.9, representing a potential -2.7% selloff.

Market risk remains elevated, but these well-modeled levels provide you with the objective tools necessary to manage risk and set accurate targets. Unlock the weekly and monthly levels for META, NVDA, AAPL, MSFT, TSLA, QQQ, SPY, IWM, SMH, and more!

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, XOM, PLTR, NFLX

Crypto & Related: Bitcoin, Ethereum, ETHA, IBIT

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Maintaining a consistent watchlist is key to improving performance navigating choppy markets like this one; it allows you to refine the timing of your entries and effectively rotate capital as new opportunities emerge.

If you trade or invest with levels, using them to set targets and to manage risk, you can unlock the ones for the week ahead upgrading your subscription.

Today’s Agenda: Actionable Levels

Using well-modeled levels is the best tool to manage risk and set objective targets. Today we cover:

Weekly Levels: Navigating the week ahead for 44 core securities.

Three high probability Setups: Securities with technicals and levels aiming at one direction with conviction.

Monthly Levels: Assessing long-term conditions and “Big Picture” trends.

Combined Analysis: Identifying confluence between weekly and monthly data.

Let’s begin.