Tech Giants in Transformation: TSLA - NFLX - INTC

Fundamental Look at the Strategic Changes Defining the Future of Intel, Tesla, and Netflix

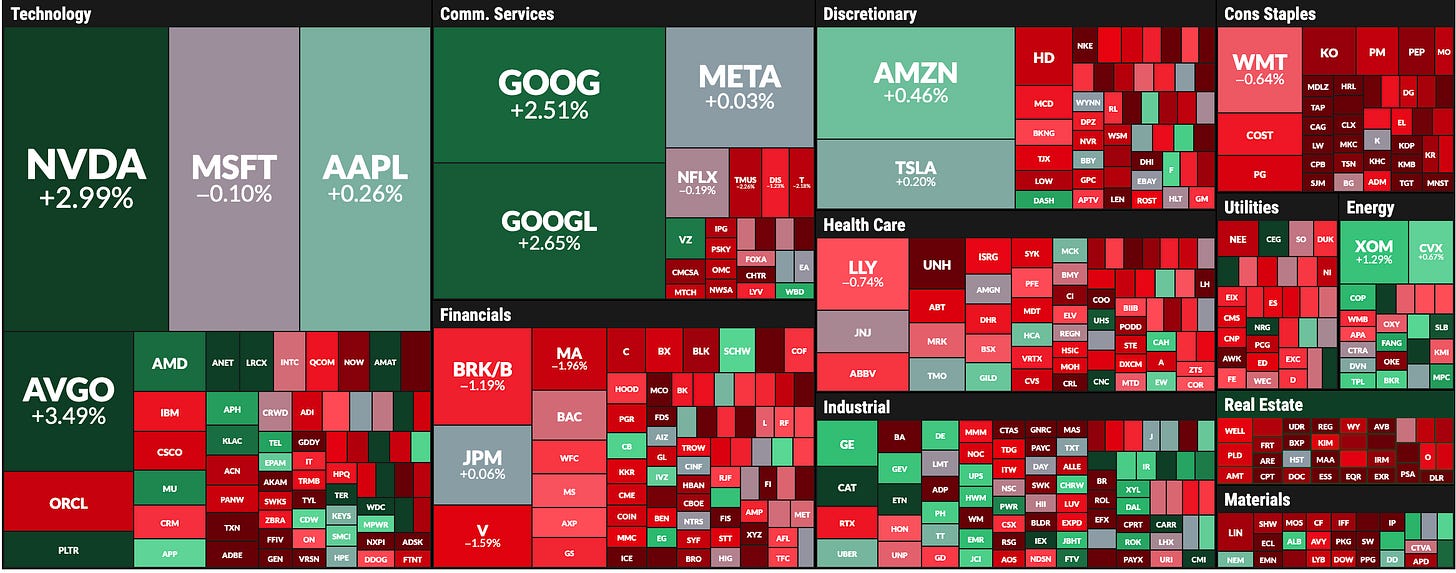

The SPX managed to stay afloat today in the neutral zone while most of the sectors and companies listed in the S&P 500 were declining. The index stayed afloat thanks to NVDA (which printed a shooting star in the daily timeframe above the upper Bollinger Band and with the RSI above 70, usually an overbought condition), GOOG (which will open tomorrow with a gap but is clearly strong), and AVGO, which rallied along with PLTR.

MSFT is recovering after its after-hours selloff, and META cratered, likely creating a bullish gap tomorrow similar to the one NFLX printed last week.

We will continue analyzing the status of the stock market and Bitcoin after a comprehensive assessment of three companies that posted results last week: TSLA, NFLX, and INTC. As promised, the fundamental library is constantly updated during this earnings season.

Premium subscribers have received the market intelligence studies that present the rationale for the current bull market and what is extremely likely to come next based on the current price structure, documented rare signals, and special statistics that have proven their worth.

Get access to unlock those studies and all the content on SmartReversals.com with the paid subscription.

That said, a selloff in a security is likely to be an opportunity. The challenge is: will you be ready to buy the opportunities when the pullback finally comes?

So far, the indices have managed to stay afloat due to internal rotation. TSLA and AAPL have been rising for weeks while GOOG and MSFT were in a consolidation process after rallying prior to the other two mentioned. More examples could be mentioned like AVGO versus AMZN, or JPM versus BRK.B. So, let’s study the three giants that recently posted earnings to assess how buyable their setups are, considering their business context.

FUNDAMENTAL DEEP DIVE & TECHNICAL ROADMAP: TESLA - NETFLIX - INTEL

The current market environment represents a significant departure from the momentum-driven expansion of recent years. Today’s investment landscape demands rigorous scrutiny of even the most established industry leaders as they confront fundamental questions regarding their competitive positioning and long-term viability. Today we will update the fundamental context for Intel, Tesla, and Netflix.—each currently executing critical strategic transformations that will determine their trajectory through the next decade.

This analysis provides a comprehensive examination of the structural challenges and growth opportunities confronting each organization. Intel’s assessment focuses on its capital-intensive effort to reestablish manufacturing leadership through its foundry initiative while defending market share in increasingly competitive server and PC processor segments. The Tesla analysis evaluates the company’s transition from automotive manufacturer to diversified technology enterprise, with particular emphasis on its substantial investments in artificial intelligence, autonomous vehicle systems, and robotics. The Netflix examination analyzes the company’s post-streaming-wars strategy, including the development of its advertising-supported tier and expansion into live programming as mechanisms for sustained revenue growth in a maturing market.

The analytical framework employed throughout this series prioritizes financial fundamentals over market sentiment or technological narratives. Each assessment examines key performance indicators including revenue composition and growth rates, operating margin trends, free cash flow generation, and balance sheet strength. This data-driven approach is designed to address a central investment question: Do these strategic initiatives represent economically viable paths to profitable growth, or do they constitute high-risk ventures with uncertain returns on invested capital?

These organizations consistently generate significant market debate, with commentary frequently driven by technological speculation or news-cycle volatility rather than operational analysis. Let’s evaluate the underlying operational realities, strategic opportunities, and material risks associated with each company’s transformation.

To learn about my Top-Down Trading Method that combines long technical setups with fundamental analysis and adds support and resistance levels to manage risk and to set long term price targets, click for access here:

Today’s fundamental analysis includes price targets for TSLA, NFLX, and INTC

Tesla, Inc. is a multifaceted technology company that operates well beyond its core identity as a leading manufacturer of electric vehicles like the Model 3, Model Y, and Cybertruck. The company’s Automotive division, its largest revenue source, is complemented by a rapidly growing Energy Generation and Storage segment that provides Powerwall and Megapack battery solutions. However, Tesla’s long-term strategy is increasingly focused on becoming a leader in Artificial Intelligence, with its valuation and future prospects heavily tied to the development of its Full Self-Driving (FSD) software, a planned autonomous Robotaxi network, and the Optimus humanoid robot.

Tesla: Short-Term Auto Sales Pressure Meets Long-Term Innovation Agenda