Technicals Beat Sentiment - Validating the Bounce

Breakdown of last week’s winning calls + the Top 9 High-Probability Trades to navigate the week ahead

Last week, the Weekly Compass correctly anticipated a market bounce by looking past the noise. While sentiment was excessively bearish, the data told a different story: oversold breadth, price action, and volatility metrics all aligned with key support lines often visited during this type of bull markets. As discussed in Wednesday’s market intelligence report, while price history never repeats exactly, professional analysis reveals that technical patterns often do, and this time it was no different.

Premium subscribers were equipped with these high probability signals and the Central Weekly Level (CWL) a simple yet powerful tool where momentum is defined as “bullish above, bearish below”, validating the bullish reversal setup.

The market validated this thesis emphatically:

SPX & QQQ: The indices jumped 3.7% and 4.9%, respectively.

IWM: Highlighted as a high-conviction bullish pick last Saturday, it rallied +5.6%.

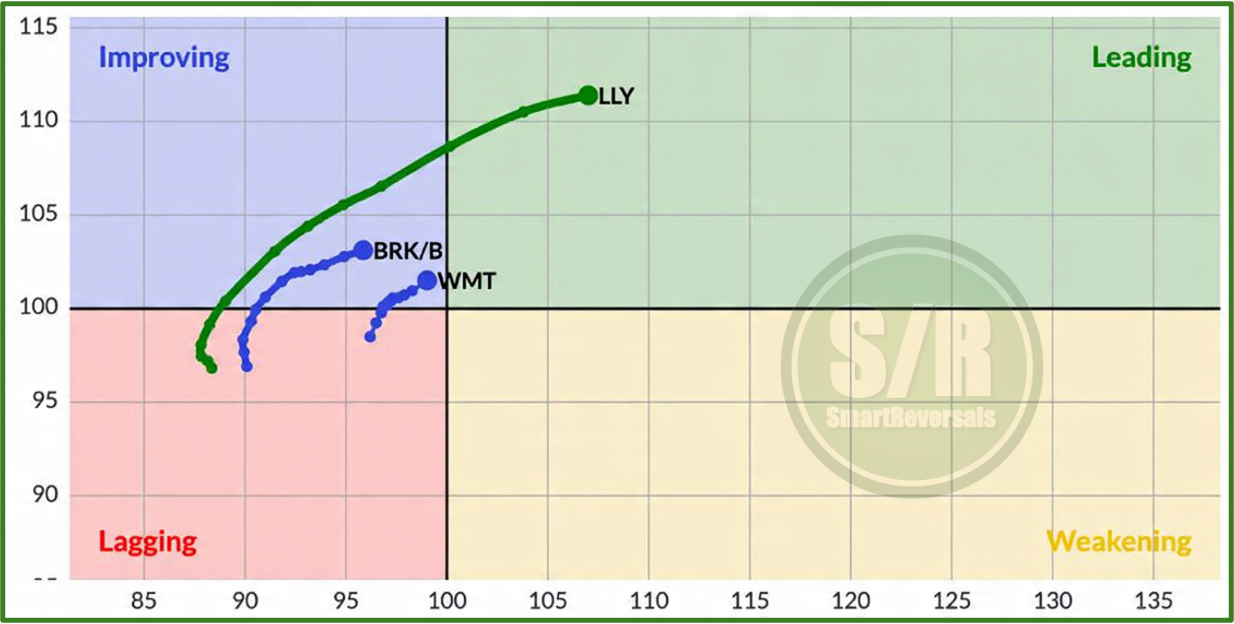

The Momentum Map correctly validated growth potential in WMT +4.9% for the week, BRK.B (+2%).

My publication had META under serious watch and successfully captured the recent +9% surge. The stock is finally executing the breakout move that other tech giants, like AAPL and TSLA, presented months ago.

The rotation move for LLY has been glorious, resulting in a rally of more than 30% over the last two months. While the momentum is clear, is it time for a breather? Be cautious about chasing the price here. I provide the crucial ‘bullish above / bearish below’ level for next week. Remember, while some stocks are showing signs of potential weakness, there are always more rallies brewing elsewhere.

Unlock the Momentum Map featuring over 30 securities and a curated list of the highest probability setups for the week ahead, all based on proven technical indicators. My approach combines technical analysis, momentum, and key price levels to validate every setup. This publication now presents a clear hierarchy of high probability trades designed to help you navigate the market efficiently.

Get the actionable intelligence you need. This publication serves as a powerful resource for technical traders seeking in depth setup analysis, and as a clear guide for people who need actionable insights to manage their market capital efficiently while working their 9 to 5. Subscribe now!

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

The purpose of a watchlist is rotation; bulls and bears alike can monetize opportunities in any environment. The Momentum Map used in this publication helps fine-tune these reversals and to assess continuation in a move using high rated companies or assets with high volume and institutional interest. There are more premium securities brewing a bounce like META’s.

The Support and Resistance levels for all of those securities were posted yesterday, they can be reached here with market commentary:

Today we go straight to the charts and setups.

Let’s begin with the complete Momentum Map, the 9 highest probability setups, the S&P 500, and the key technical charts: