The Market Rotates to Defensive Assets

As tech multiples stretch, capital rotates into the undervalued physical economy of Energy and Utilities.

The indecisive price action observed at the close of last week anticipated the recent decline in the major U.S. indices. However, as mentioned in my previous publications, the gap fill for the SPX and NDX is the best outcome that could happen for bullish continuation.

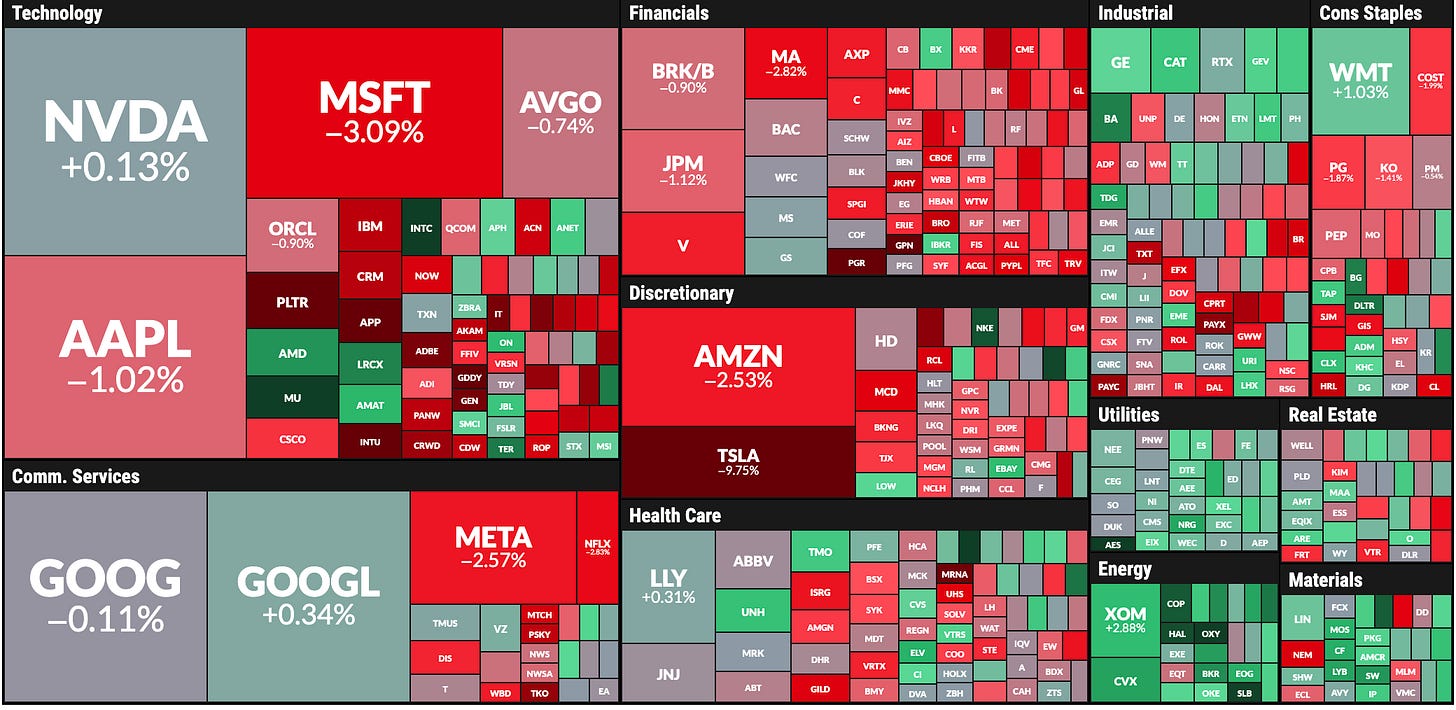

The first trading week of 2026 presented a significant rotation, since investors reduced exposure to 2025’s growth darlings; specifically Technology and Consumer Discretionary, and reallocated capital into defensive, physical assets like Energy and Utilities.

In recent weeks, I highlighted the bearish setups for both TSLA and AAPL. The former proved to be the major loser among the Magnificent Seven. The individual analysis for each of these securities (and other major ones) including technical charts and price levels is presented every weekend in this publication as detailed below, for now let’s assess sectors and the high probability setups posted last weekend:

The Winners of the Week: Physical Economy & Defense

Energy (XLE) | +2.88% The energy sector emerged as the week’s standout performer. Two key catalysts drove this rally:

Geopolitics & Supply: Heightened tensions in the Red Sea combined with OPEC+ extending production cuts into Q1 2026 provided strong support for crude prices.

The “AI Power” Trade: A compelling new narrative is getting traction based on traditional energy as a critical enabler of the AI boom. Investors are betting that renewables alone cannot meet the massive power requirements of next-gen data centers, effectively repricing oil and gas majors as infrastructure plays.

Utilities (XLU) | +0.86% Utilities found a bid as investors sought defensive positioning amidst early-year uncertainty. Much like Energy, this sector is benefiting from the “AI power demand” thesis. Electricity providers are increasingly viewed as essential infrastructure required to sustain the technology sector’s expansion, transforming a traditional “boring” sector into a growth-adjacent play.

Materials (XLB) +0.61% & Industrials (XLI) +0.30% These sectors posted modest gains, underscoring the broader rotation toward “real economy” assets. As capital fled purely digital growth stocks, it found a home in the tangible industries that underpin manufacturing and production.

The Losers: Profit-Taking & Consumer Jitters

Consumer Discretionary (XLY) | -3.46% The steepest declines were felt in Consumer Discretionary, driven by renewed anxieties over the health of the consumer.

Spending Fatigue: Reports of lackluster holiday demand weighed heavily on sentiment.

The Tesla Effect: Sector heavyweights dragged the index lower, most notably Tesla, which slid after reporting a decline in annual sales for the second consecutive year.

Locking in Gains: After a stellar run in 2025, investors used the new tax year as an opportunity to book profits.

Technology (XLK) | -1.37% The leader of 2025 faced a wave of profit-taking to start the year. While the long-term thesis remains bullish for A.I., the short-term focus shifted to risk management.

Financials (XLF) -1.44% Financials lagged as general market caution and falling yields, which typically compress bank margins.

High Probability Setups

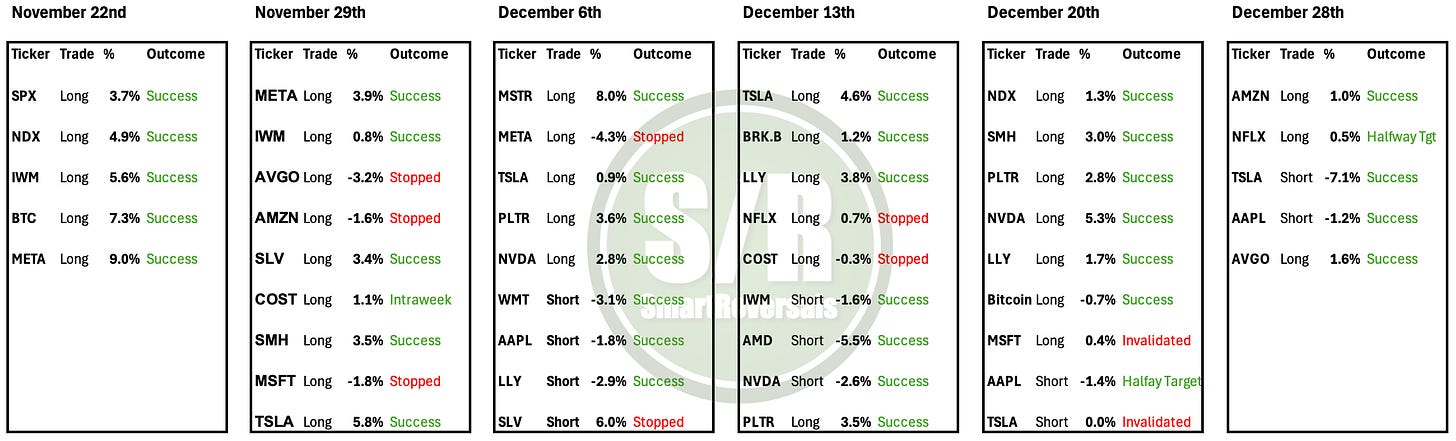

Fundamental and macroeconomic factors have recently aligned with the overbought conditions seen in many of the assets we track. For this reason, over the last two weeks, I have included bearish opportunities in my list of high-probability setups. These can be monetized via short selling or, for those managing options, by purchasing puts.

The high-probability setups posted for paid subscribers over the last six weeks have achieved a 76% success rate.

Fundamental and macroeconomic factors have recently aligned with the overbought conditions seen in many of the assets we track. For this reason, over the last two weeks, I have included bearish opportunities in my list of high-probability setups. These can be monetized via short selling or, for those managing options, by purchasing puts.

Methodology: Each setup includes a price target for the week ahead and an invalidation level derived from modeled support and resistance levels for each security, a system thousands of subscribers have relied on for over 20 months. These levels help define momentum-based targets, while the Central Weekly Level (CWL) acts as a critical line in the sand for invalidation and stop-loss placement. This structure ensures you receive not just a trade idea, but the full technical context, target, and risk parameters.

While these setups are designed for the week ahead, some have multi-week potential. For example, the bullish thesis for LLY has appeared in our high-probability list for three consecutive weeks, just as the short thesis for TSLA has featured for two.

Occasionally, a setup may not gain traction immediately. This occurred recently with Bitcoin and MSFT; however, Bitcoin validated its bullish thesis this week, while MSFT broke lower. Both outcomes have been updated in the December 20th ideas log.

The most impulsive and profitable setup from last week was TSLA. It plunged to the third layer of support we anticipated, delivering a -7.1% move. A short position here was a major win, and put options would have yielded even significant returns.

Subscribe to the Paid / Premium plan now to unlock weekly high-probability setups. One single trade can cover the monthly subscription cost. My analysis focuses on clear price action and actionable insights, combining market studies and fundamental analysis to give you a true edge in your investing.

In addition to the high probability setups, this publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions. Maintaining a consistent watchlist is key to improving performance; it allows you to refine the timing of your entries in case of having a preference for one or some securities, and effectively rotate capital when new opportunities emerge.

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Today’s Agenda:

Momentum Map and SPX

High Probability Setups

Major Indices Volatility, Breadth, and Bitcoin

Individual Stocks and ETFs