Three Breakout Setups to Watch

Why These Setups Offer the Best Risk/Reward: Targets and Fundamental Rationale

In bull markets, breakout strategies stand out as a powerful approach for capturing significant price movements, particularly in large-cap and mega-cap companies. These strategies focus on identifying securities poised to break through established trading ranges or resistance levels, often signaling the start of a new, sustained uptrend. For investors looking to capitalize on momentum in market leaders across diverse sectors like finance, consumer travel, and technology, this methodology offers clear entry points while helping to manage risk. The key is a disciplined fusion of technical indicators mentioned below, confirmed by rising volume, and protected by well-defined stop-loss measures (based on support and resistance levels).

Today we will cover two topics:

Stock Market & Crypto Update: Essential Long-Term Charts

Three Breakout Companies

The fundamental analysis published over the last few months has successfully identified several companies—including APP, AVGO, TSM, HOOD, and more—that have since broken out. Today, the names of the new companies, along with their full analysis, are detailed below in the premium section, following the market updates for the S&P 500 (SPX), Nasdaq 100 (NDX), and Bitcoin.

There are two publications that are a must read since they provide context for today’s analysis, the first one covers the stage of the current bull market, the second one is about Bitcoin and its four year cycle:

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

If you trade some of those securities, the premium subscription is for you.

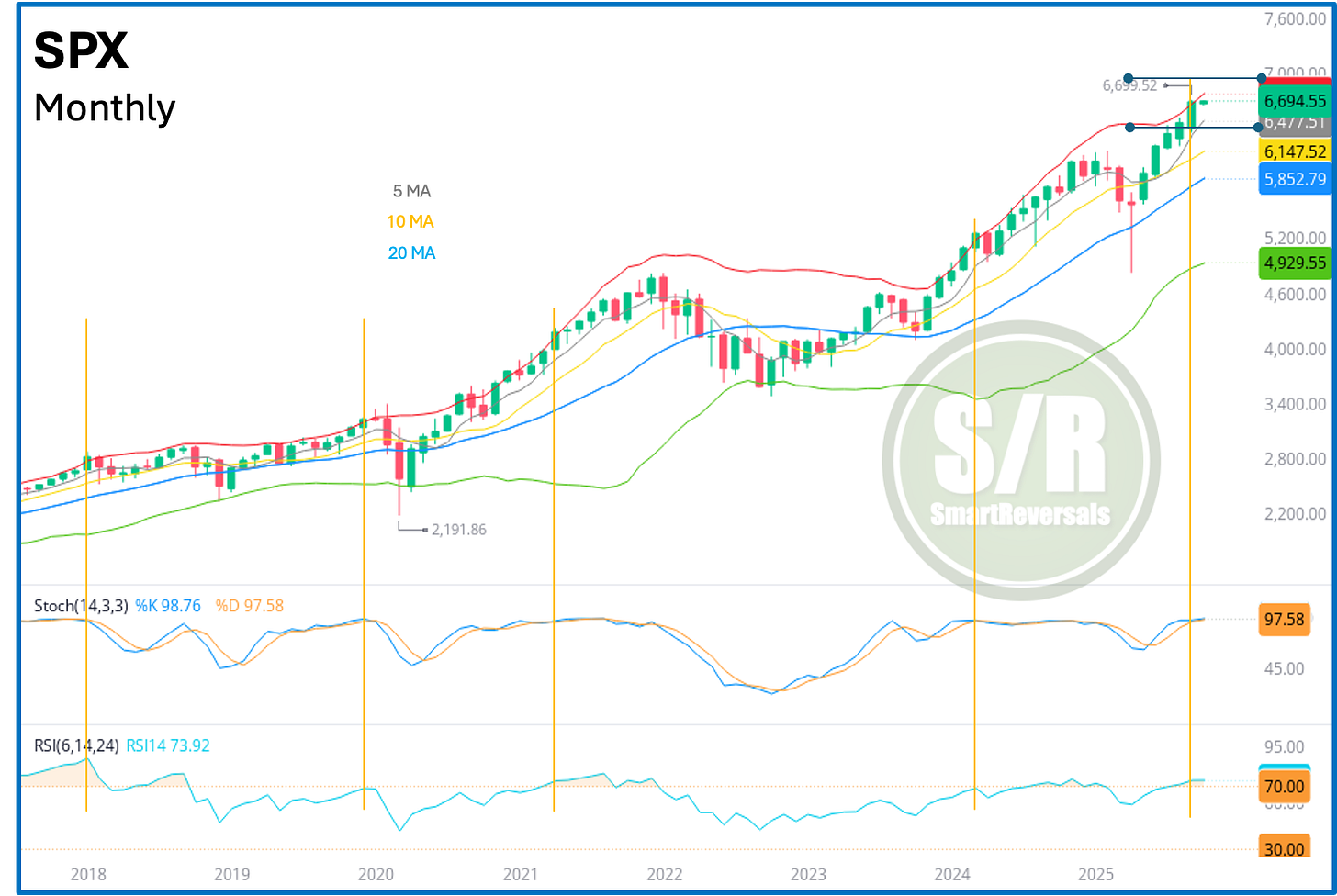

Let’s begin with essential elements to watch for the SPX this month:

SPX - Chart Analysis and Expectations:

The bull market I called in April has gained 38% since the bottom. In the special analysis linked above, we studied the exact level from which a decline began in previous overextensions and what happened afterwards. The table below summarizes that critical historical context: