Turbulence Ahead

The market is moving from offense to defense. - Risk aversion increased - High Probability Setups for Next Week.

The market has reached a critical inflection point. While the S&P 500 (SPX) successfully tagged our weekly target of $6,970 and briefly touched $7,000, the technicals now signal exhaustion. We are witnessing a distinct rotation: capital is flowing out of overextended sectors like Technology (NDX) and Semiconductors (SMH) and moving into the 'Real Economy', Consumer Staples, Financials, and defensive plays. With the VIX spiking as anticipated and Bitcoin (BTC)signaling risk-aversion, the 'easy mode' of a broad rally is over. Success next week will depend on identifying these specific pockets of resilience while navigating the broader bearish crossovers in the indices.

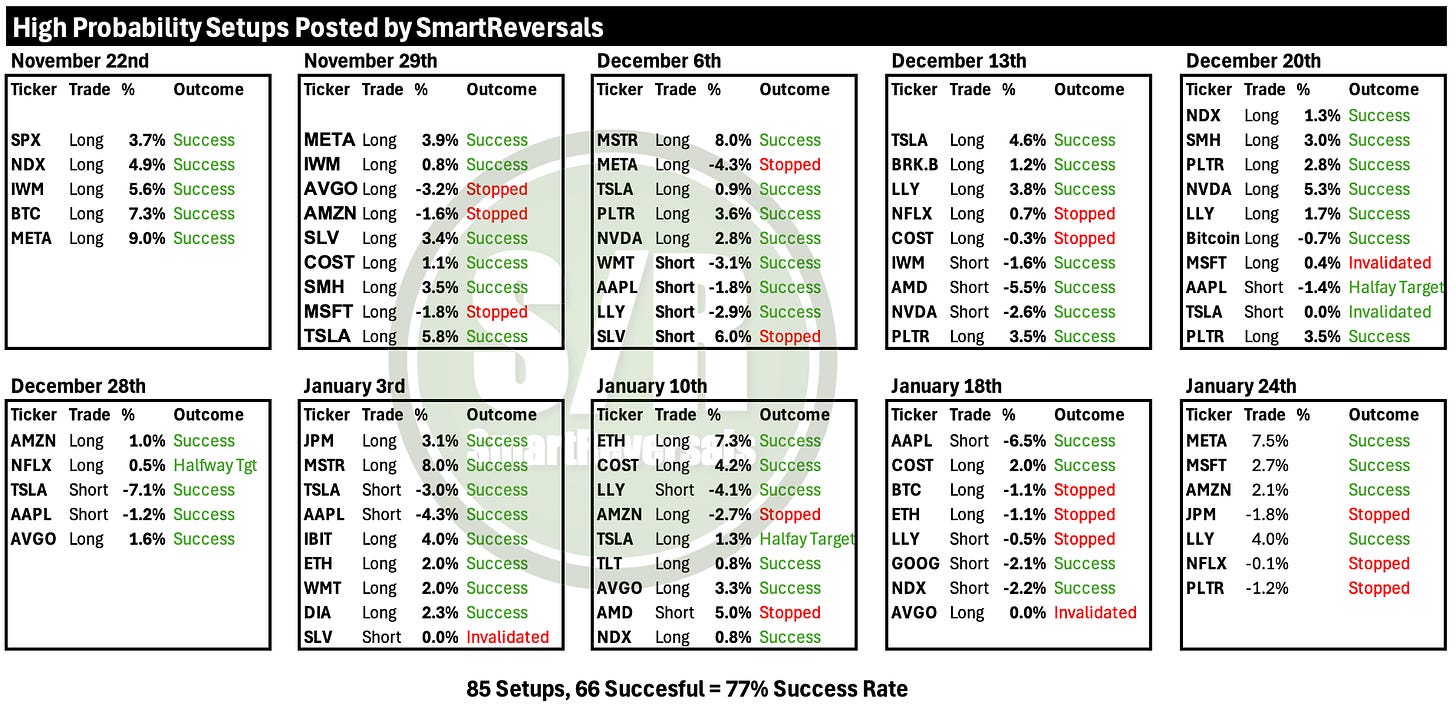

Last week, our High-Probability Setups continued to outperform, maintaining a cumulative accuracy record of 77%. We correctly identified moves in META, MSFT, AMZN, LLY, and IWM, securing an average gain of 4.1% across bullish and bearish setups. Even our invalidations (NFLX, PLTR, JPM) were cut short with a minimal -1% average loss. This edge comes from a deliberate choice: we trade a constant universe of high-volume, blue-chip securities. My focus on liquid giants ensures our orders get filled and our technical analysis remains reliable. Join the paid plan today to trade with institutional-grade precision.

Earnings season accelerates next week with PLTR (Mon), AMD (Tue), LLY/GOOG (Wed), and AMZN (Thu). We nailed the targets and risk assessments for previous reports; apply that same discipline this week by focusing on the technicals.

Sector Rotation Analysis: Flight to Safety and the Real Economy

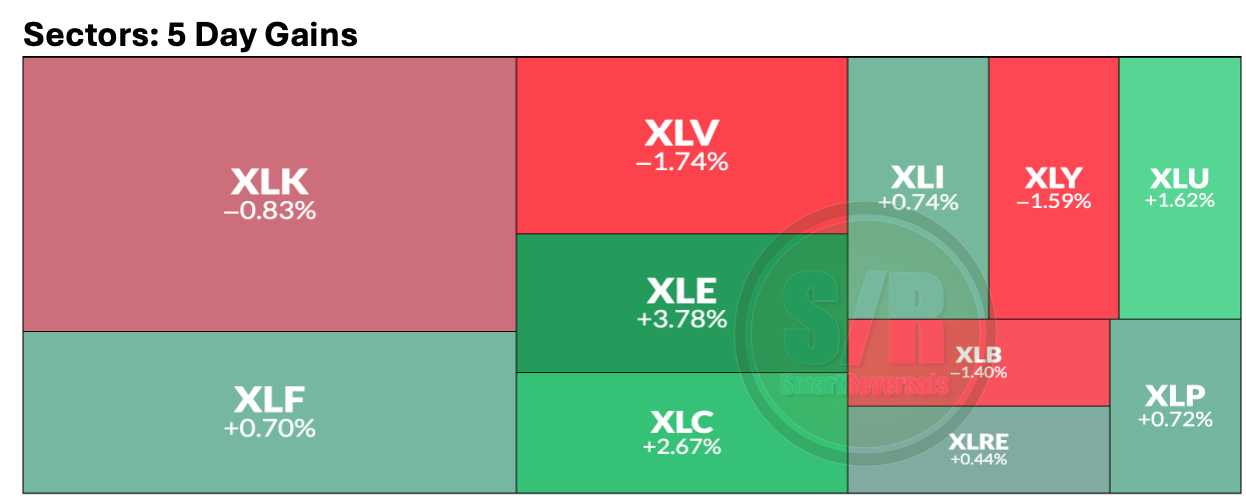

The heatmap provides visual confirmation of the defensive rotation we have analyzed. The “Growth Engines” of the market are cooling, with Technology (XLK, -0.83%) and Consumer Discretionary (XLY, -1.59%) acting as the primary sources of funds.

Capital is not leaving the market entirely; it is reallocating into the “Real Economy” and defensive havens. The outperformance of Utilities (XLU, +1.62%), Industrials (XLI, +0.74%), and Consumer Staples (XLP, +0.72%) signals that investors are prioritizing stability, dividends, and tangible assets over speculative growth. This is a classic “risk-off” configuration, where market participants seek shelter in sectors that can weather volatility. The drop in Materials (XLB, -1.40%) aligns with the sharp sell-off we observed in precious metals, confirming that the appetite for commodities and raw materials is contracting alongside the broader risk sentiment.

We track the drivers, not the noise. By mastering this constant universe of ‘Megacaps’ and Indices, you can identify capital rotation and time your entries with precision, rather than chasing random tickers.

Our Core Watchlist:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Price action is showing signs of exhaustion, make sure to have the best tools to navigate it. Subscribe now to unlock the momentum map, high probability setups, critical price levels, and technical indicators you need to navigate next week’s volatility.

Today’s Agenda

The Momentum Map: Analyzing the stage of every security in a single chart.

Setups Blueprint: High-probability trades and full universe analysis (track your favorites).

Market Context: Technical charts and price levels for U.S. Indices, Volatility, and Bitcoin.

Deep Dive: Individual analysis of Metals and Mega Caps.

Let’s continue, my eBook on Advanced Technical Indicators is also here.