Week of Battle: Bears Push, Bulls Hold the Line

Support and Resistance Levels for Sep 29th - Oct 3rd - Indices, Futures, Stocks, Crypto

The U.S. stock market ended the week with a notable rebound, bulls recovered the weekly central level as major indices, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, all closed with gains. The Dow rose 0.8%, the S&P 500 gained 0.5%, and the Nasdaq climbed 0.3%, recovering from a three-day downturn. This positive momentum was largely driven by the release of the August Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge. The report showed that core PCE rose 2.9% year-over-year, which was in line with expectations. This news, while indicating persistent inflation, solidified investor confidence that the Fed’s course toward a potential interest rate cut in October remains intact.

Company-specific news also provided key catalysts. Electronic Arts (EA) shares surged by 15% following a report that the company is nearing a deal to be taken private, potentially in a $50 billion leveraged buyout. Similarly, Boeing (BA) stock saw a significant gain of nearly 4% as the Federal Aviation Administration (FAA) eased safety oversight, a move that could accelerate aircraft production and delivery. On the other hand, new tariffs announced by the administration created a mixed performance across different sectors. We saw domestic manufacturer Paccar (PCAR) benefit from a tariff on heavy trucks, while import-reliant furniture retailers like Wayfair (W) and RH (RH) faced stock pressure. The proposed 100% tariff on imported branded drugs had a limited negative effect on major U.S. pharmaceutical stocks, as many have already announced plans for building domestic manufacturing facilities, which provides an exemption (some of them are building them already).

The week’s economic landscape was not without its complexities. The University of Michigan’s Consumer Sentiment Index for September fell to 55.1, below the forecasted 55.4, suggesting that consumers are expressing lower optimism about the economic outlook. This drop in confidence, however, did not overshadow the market’s positive reaction to the inflation data, underscoring that for now, investors are prioritizing the macroeconomic picture over consumer-level sentiment.

As we look ahead to the coming week, it is essential to remain attentive to several potential market-moving factors. The new tariffs are set to take effect on October 1, and their initial impact on supply chains and consumer pricing will be closely watched. Additionally, the ongoing risk of a U.S. government shutdown could introduce significant market uncertainty. I recommend monitoring these developments, as they will be critical in shaping the market’s direction in the immediate term.

In the meantime, remember to read three essential publications, the first one provides a picture of where the rally currently is, and what can be expected for the coming months. The following ones are deep dives in key companies with investment ideas that continue paying off:

The complete guides to Market Intelligence and Fundamental Analysis can be found here, they alone are worth the subscription:

To celebrate 18 months of SmartReversals’ Trading Compass, I’m giving away one free month to two lucky people! To enter, I’m aiming for 60 likes and 20 reposts.

Even better, upgrade to the paid plan now! Prices will be raised soon, but the rate you lock in today is the price you’ll continue to pay.

The investment ideas alone are also worth the subscription, and I’m currently fine-tuning my Smart-Screener to deliver even more. Look out for new ideas every Wednesday.

Let’s continue with the Stock Market update and Support and Resistance Levels:

The central level for the week was recovered, the SPX closed above $6,629.1, NDX above $24,422.6, the Dow Jones did the same overcoming $46,126.4, and the VIX crashed -8.6% to our level 15.3.

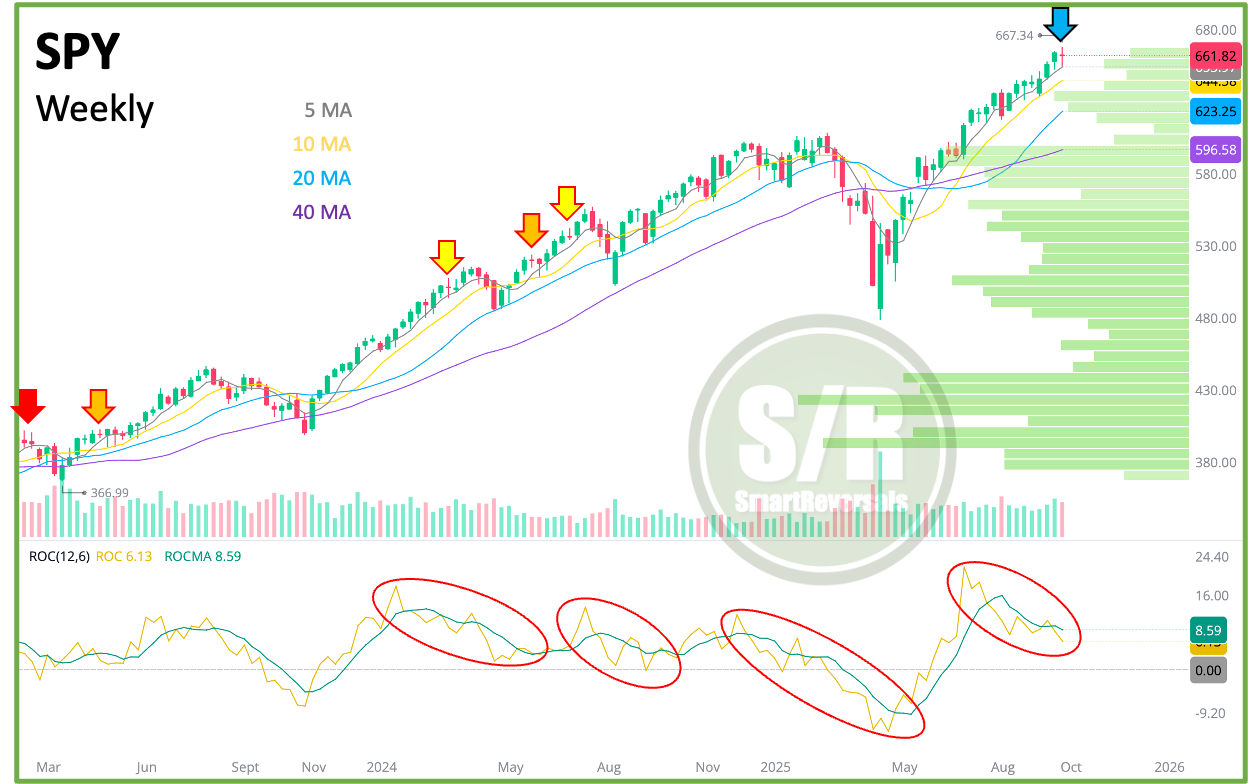

Those moves sound bullish, and they are, Monday is very likely to bring green price action, in any case let’s zoom out to analyze the weekly chart for the SPY:

The weekly candle set a cross, which as highlighted is a warning sign, during the last two years it has anticipated pullbacks or corrections to the market.

The red arrow indicates an immediate -9% correction at the beginning of 2023, the orange one that follows anticipated a -3% pullback, and the yellow one in March 2024 was an early sign of a -6% pullback. Similar cases follow for May 2024 with a mild -3% intra-week pullback (hence the orange instead of a red arrow), and the yellow one for the end of June 2024 anticipating a -6% decline.

What is the case today? An immediate correction like the red arrow indicates? an intra week pullback like the orange arrows present? or an early warning followed by two green weeks before a deeper pullback around -6%?

The weekly central level will help us to navigate the current conditions, we have studied before that choppy weeks are usually part of top formations.

When the rate of change has presented a divergence with price action, the warning signals have more relevance. The oscillator does not top with the price action like the RSI, this one provides a quiet condition that when unfolds a decline, it usually occurs quickly.

The central level for next week will help us navigating the price action, this is a simple approach based in a clear predictive model, and when the price loses the central level, the next support ones become the target from where the price have bounced lately. The bearish weekly target for the SPY was $655, and that was indeed the bounce zone, as it was for the QQQ with $588 acting with extreme precision as support.

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

If you trade one or some of those securities, the following guide will help you navigating the market next week:

WEEKLY LEVELS