When Bad News Becomes Good News

Ride Wall Street's Rollercoaster with Support and Resistance Levels

It was a rollercoaster week on Wall Street, marked by an accelerated sell-off on Monday that gave way to a powerful mid-week rally. The bounce was fueled by a combination of factors.

First, tech giants came to the rescue with positive news from $GOOG and $AAPL, sparking a strong rally on Wednesday. The momentum continued on Thursday, ironically driven by bad news: a weak ADP jobs report signaled a deteriorating labor market. Traders, operating on the "bad news is good news" logic, grew confident that the Federal Reserve would be compelled to cut interest rates in ten days.

This optimism culminated on Friday with a stunning jobs report showing just 22,000 jobs added in August—a figure so far below expectations it triggered an immediate market surge. The SPX and Nasdaq soared to all-time highs as traders bet on imminent rate cuts.

However, the celebration was short-lived. A late-day reversal dragged the market back down, erasing the gains and highlighting a deeper anxiety that the economy might be cooling faster than anticipated. The day's crash was prevented only by the independent rallies of three giants: AVGO, ORCL, and TSLA, which rallied for reasons that are analyzed below.

Be prepared: after the euphoria comes the fear. The job market is deteriorating at a rapid pace, and given that recent figures have not yet been revised—a common occurrence—the potential for a deeper reduction remains.

All of the events mentioned unfolded within the support and resistance levels we modeled last week, in preparation for the new month and week:

SPX: The sell-off neared $6,344. When analyzing the body of the candles on the 4-hour chart, $6,386—a bearish layer provided last week—acted with precision as a bounce point in confluence with the monthly central level of $6,393.7. The bounce recovered $6,465, the central weekly level we use as our "bullish above / bearish below" mark, which set the price to reach its bullish target for the week, $6,502.6, on Thursday. The overextension on Friday anticipated a reversal that was posted in the paid subscribers chat, with the central weekly level ending the week as a key support.

AVGO: In Wednesday's fundamental analysis for this company, I anticipated a move toward $345 considering the strong fundamentals of this company, the mark was reached today without pulling back. This metric was based on the same model of Support and Resistance levels.

NVDA: The stock found support at $166, a level provided last week, and the daily chart showed a hammer candle.

The list continues for over 40 securities. Price moves from level to level, and news acts just as a catalyst. When you have these levels, you have an edge because you can anticipate the next destination when a level is crossed or when the price reverses from a level.

Is the Market Bullish Now?

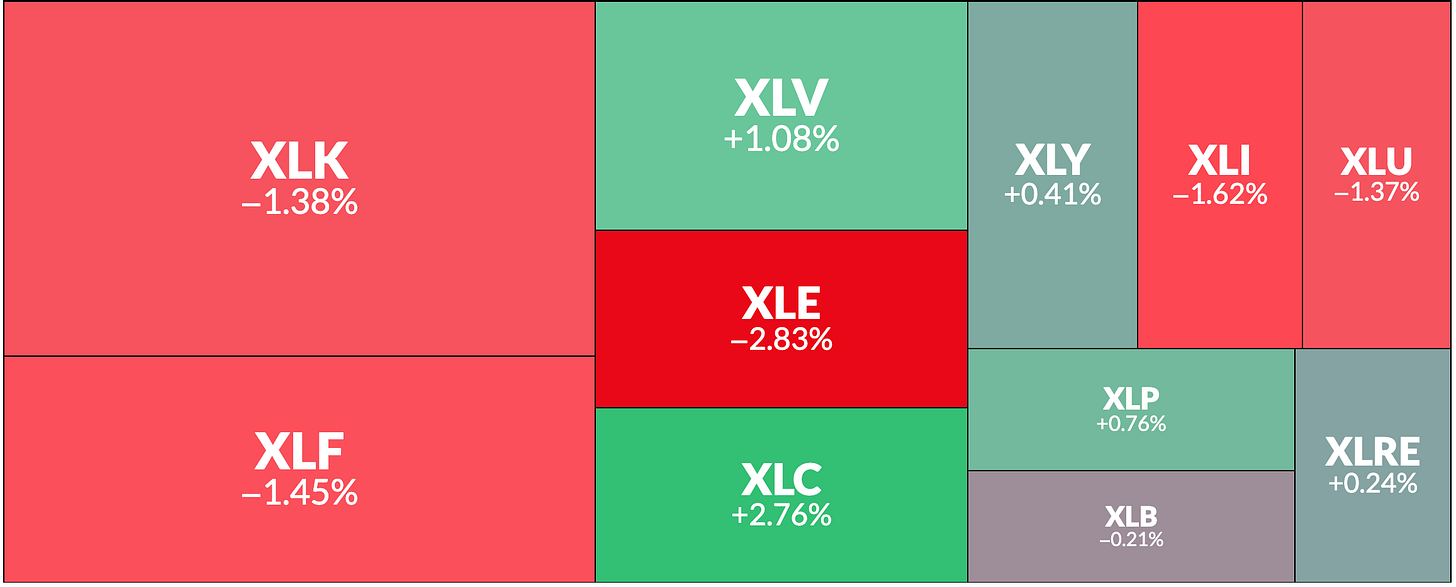

This is the summary of the last five trading days per sector, tech (XLK) is not exactly the hero and financials as a key thermometer of the economy declined, Communications closed in the green given the rally in GOOG.

Here is where the major indexes closed today:

The Dow Jones Industrial Average fell 220 points, or 0.5%, to 45,401.

The S&P 500 lost 0.3% to finish at 6,481.

The Nasdaq Composite ended the session nearly flat (-0.03%) at 21,700.

MSFT, PLTR, and NVDA declined as anticipated in the Weekly Compass, tech looks neutral as a group since its players are in different stages considering GOOG, AAPL, and AVGO.

Reflecting the rate cut expectations, the U.S. Treasury market saw significant buying, pushing yields lower. The 10-year note yield dropped nine basis points to 4.09%.

Stocks that mitigated the bearish reversal:

Broadcom (AVGO) was a standout performer, rising 9.1% after reporting strong earnings, impressive AI revenue, and a new $10 billion AI order from a customer believed to be OpenAI. We covered the company in our Wednesday Fundamental Analysis edition.

Tesla (TSLA) gained 3.6% after its board proposed a new long-term CEO compensation package potentially valued at around $100 billion.

Oracle (ORCL) climbed 4.3% following price targets raised from Cantor Fitzgerald and Guggenheim.

With this tug-of-war between bulls and bears creating such dynamic market conditions, let's begin today's analysis. Don't forget to upgrade your subscription so you don't miss these crucial insights and our compass for navigating the market.

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

See that WMT and JPM have been added to the regular analysis, replacing UNH and PFE. Now the Support and Resistance Levels cover all the Top 10 Companies of the SPX.

Subscribe now, unlock the levels for next week, the Weekly Compass with 20+ charts, and all the Market Intelligence with Educational Content gathered in this publication:

Remember to comment what are the securities that you would like to see analyzed from the S/R perfective, they will be posted on Sunday.

WEEKLY LEVELS