Critical Week Ahead for Tech

VIX Signals Persistent Turbulence - Week to Make or Break for Tech

Despite the relief rally on Friday that saw the Dow Jones achieve a historic close above 50,000, the technology sector remains under intense scrutiny as it faces an uphill battle to reverse its recent underperformance. This divergence serves as a significant warning for the broader market, particularly as the “AI trade” shifts from euphoria to an era of massive capital expenditures. Amazon’s staggering forecast of at least $200 billion in infrastructure spending for 2026, a $50 billion overshoot of analyst expectations, has intensified concerns that aggressive investments by hyperscalers like Alphabet and Meta may outpace immediate returns.

While Nvidia led a single-session surge of 8%, the Nasdaq’s struggle to reclaim its 20-day moving average suggests that Tech still has considerable work to do to shift its technical structure. With labor market data cooling and industrial giants like Stellantis scaling back EV initiatives at a massive cost, the market is signaling that capital discipline is now as vital as growth. Until these tech leaders can prove that their record-breaking Capex cycles will translate into bottom-line results, the persistent drag on the NDX remains a critical risk that the high-flying Dow and S&P 500 cannot ignore forever.

Alpha Over Beta: Finding Winners While the Indices Chop

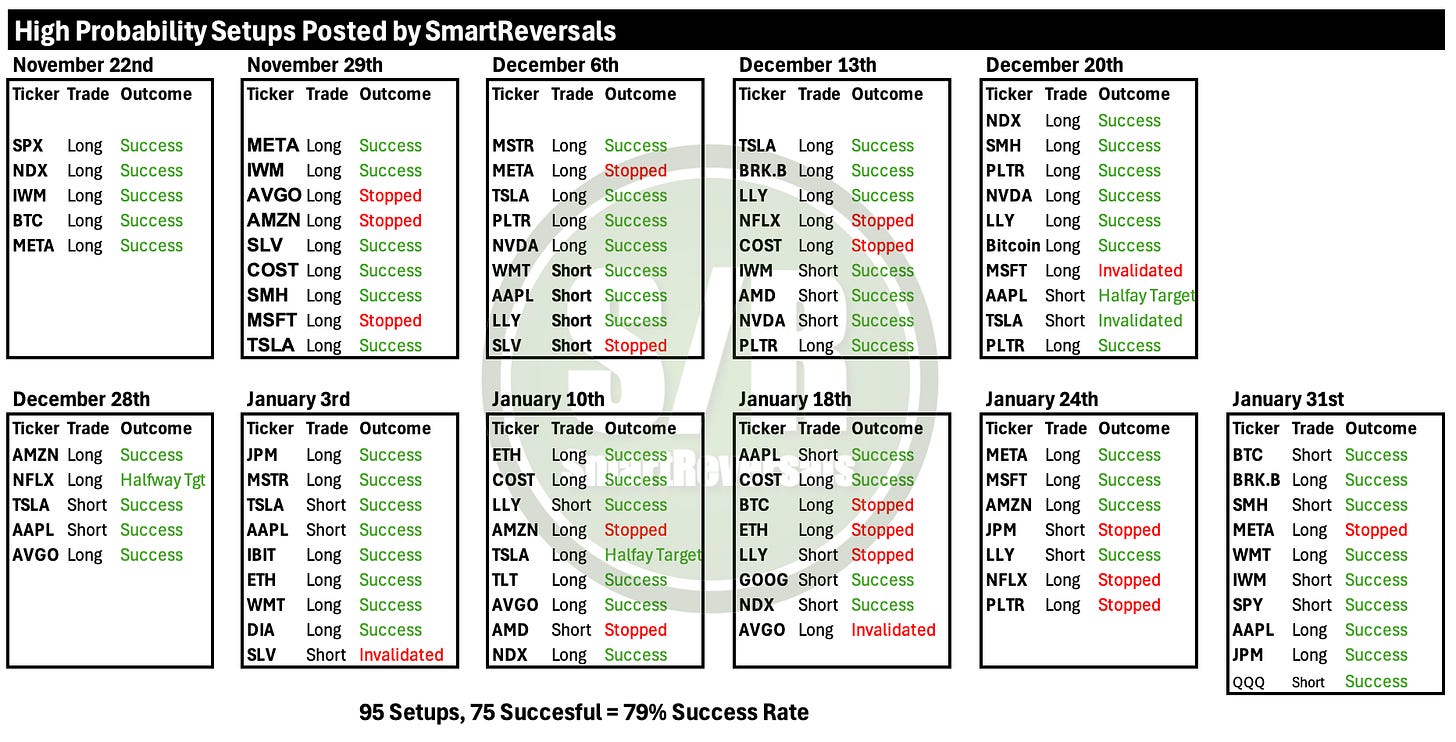

Last week, our High-Probability Setups outperformed in a very volatile week, maintaining a cumulative accuracy record of 79%. The moves in BTC, BRK.B, SMH, WMT, AAPL, QQQ, SPY, and JPM, were anticipated correctly, even for IWM in a very choppy week, securing an average gain of 5% across bullish and bearish setups. Even our only invalidation, META were cut short with a minimal -1.2% loss. This edge comes from trading a constant universe of high-volume, blue-chip securities. My focus on liquid giants ensures our orders get filled and our technical analysis remains reliable. Join the paid plan today to trade with institutional-grade precision.

Another strength of monitoring blue chip companies is to know what is behind the charts, and during this earnings season I update the fundamental library with deep research and specific financial figures for our universe. Get access to the fundamental analysis for AAPL, MSFT, TSLA, and META here in case you missed it on Wednesday:

Next Wednesday, the same deep dive will be posted for GOOG, PLTR, LLY, and AMZN.

And today, the high probability setups are below for the week ahead.

Sector Rotation: Why All-Time Highs Are Decoupling from Reality

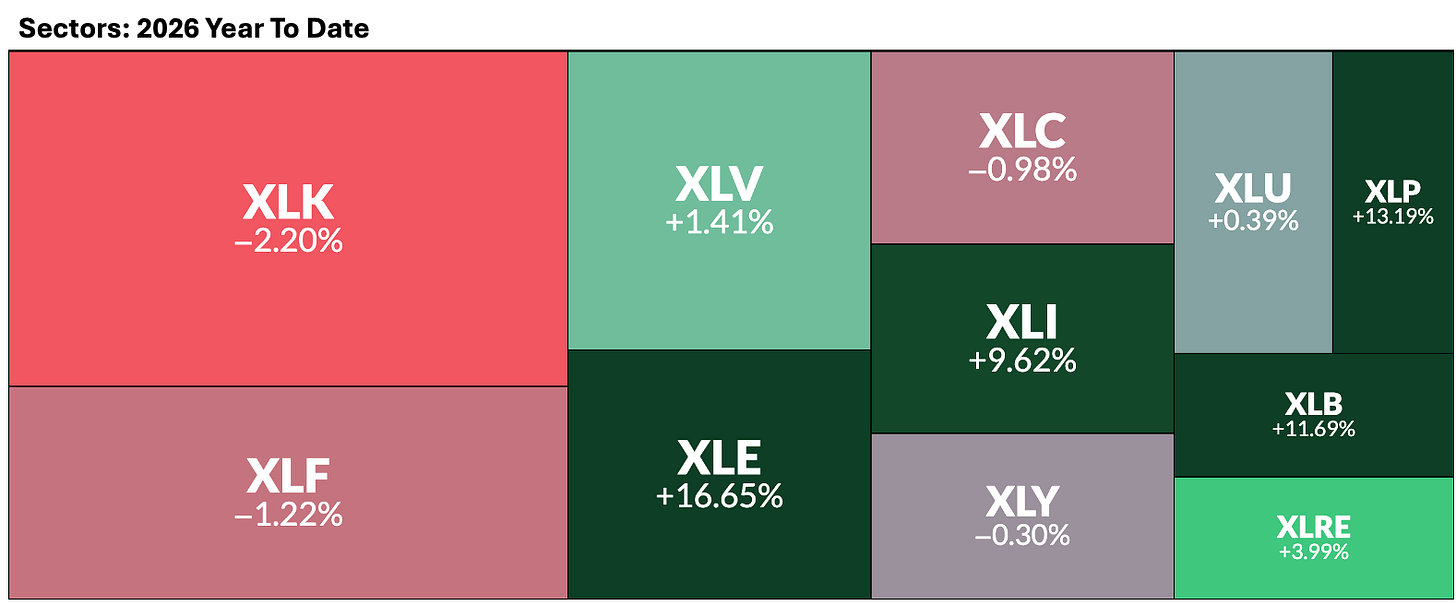

Through the first six weeks of 2026, a stark divergence has emerged in market leadership. While the S&P 500 (SPX) remains near elevated levels, traditional growth engines like Technology and Consumer Discretionary have significantly lagged the broader index. Instead, the heavy lifting is being done by defensive and cyclical sectors, with Consumer Staples, Energy, Industrials, and Materials all outperforming.

This rotation suggests a defensive posture among institutional participants and warrants extreme caution. Historically, when the “Real Economy” sectors lead while Tech falters, it signals a lack of risk appetite for the high-beta names that typically sustain a healthy bull market.

Despite the relief rally on Friday, the underlying technical structure for Technology remains fragile. The Nasdaq 100 (NDX) failed to reclaim its 20-day moving average, a key short-term trend indicator. More importantly, the Central Monthly Level currently sits above the price, acting as a formidable ceiling of resistance. Until the NDX can reclaim these overhead levels and demonstrate renewed relative strength, the broader market remains vulnerable to a deeper correction should the defensive sectors lose their momentum.

By mastering this constant universe of ‘Megacaps’ and Indices, you can identify capital rotation and time your entries with precision, rather than chasing random tickers.

Our Core Watchlist:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Price action is not out of the woods, volatility is likely to resume, make sure to have the best tools to navigate it. Subscribe now to unlock the momentum map, high probability setups, critical price levels, my two eBooks, and technical indicators you need to navigate next week’s volatility.

Today’s Agenda

The Momentum Map: Analyzing the stage of every security in a single chart.

Setups Blueprint: High-probability trades and full universe analysis (track your favorites).

Market Context: Technical charts and price levels for U.S. Indices, Volatility, and Bitcoin.

Deep Dive: Individual analysis of Metals and Mega Caps.

Let’s continue, my two eBooks on Essential, and Advanced Technical Indicators are below to download.