Decoding Price Action - NVDA Case Study

Essential Guide for All Traders - Make Informed Decisions

In the world of investing, making decisions based on news, opinions or beliefs, is a recipe for disaster. Today’s publication is designed to demonstrate just how crucial it is to use technical indicators to make informed, data driven decisions rather than relying on gut feelings. This guide highlights essential indicators that every investor and trader must consider to navigate the markets effectively. By moving beyond basic visuals, you can unlock a deeper understanding of market structure, validating your entries and exits with precision.

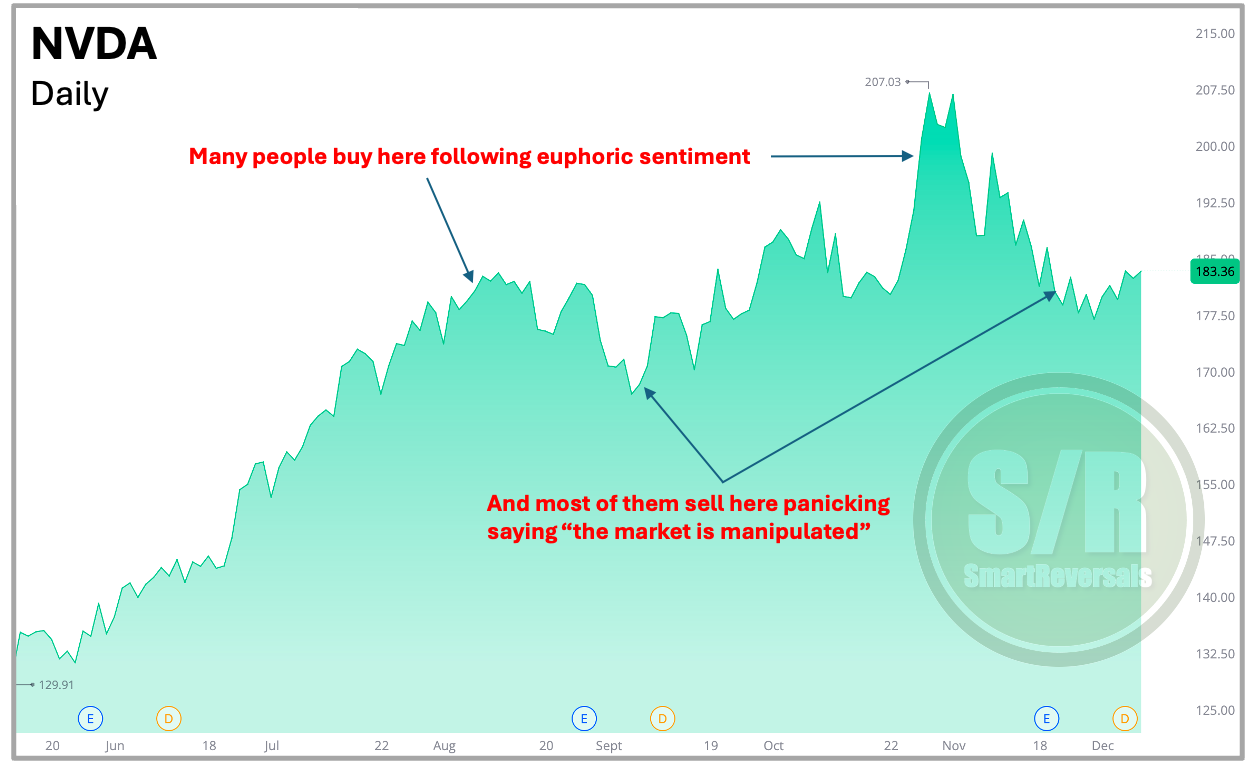

The “Naked” Chart vs. Reality The journey begins with the most basic form of data: the area or line chart. As seen in the first slide, this view offers almost no actionable information. It merely shows a trajectory without context—it fails to show overbought or oversold conditions, price action nuances, or critical support and resistance zones where the price might bounce or reverse.

Relying on this type of chart is akin to driving a car with a blacked out windshield; you can see where you’ve been, but you have no visibility on the obstacles or turns immediately ahead.

If you have a friend who makes decisions based on this type of chart, share with them this article urgently.

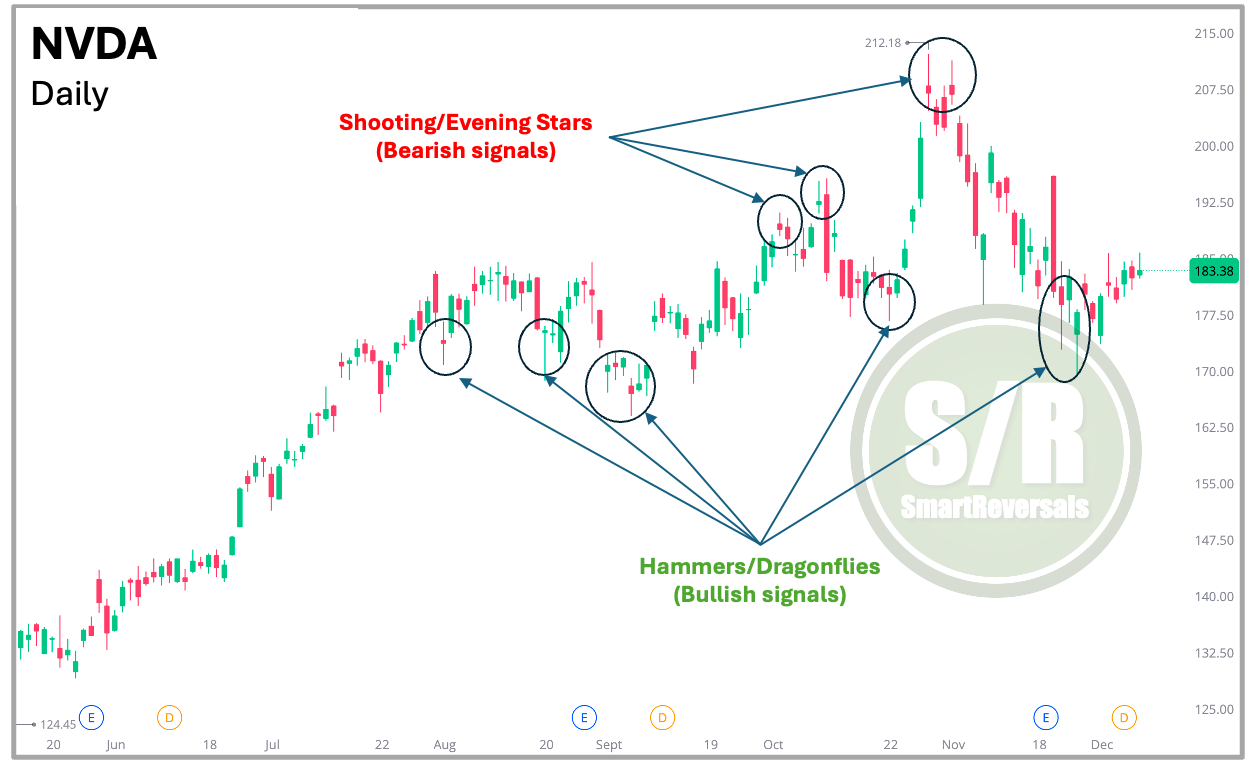

Candlesticks: Reading the Sentiment To get a better sense of market sentiment and potential reversals, traders must switch to candlestick charts. Unlike a simple line, candlesticks tell a detailed story of the battle between buyers and sellers during each time period. As shown in the chart below, specific formations like “Shooting Stars” (bearish signals) and “Hammers” (bullish signals) can anticipate intra-day reversals long before they become obvious trends. Recognizing these patterns allows you to spot exhaustion in a rally or strength in a sell-off.

Candlesticks is a basic feature that most platforms have available, you just need to change the type of graph to candlesticks from area or line.

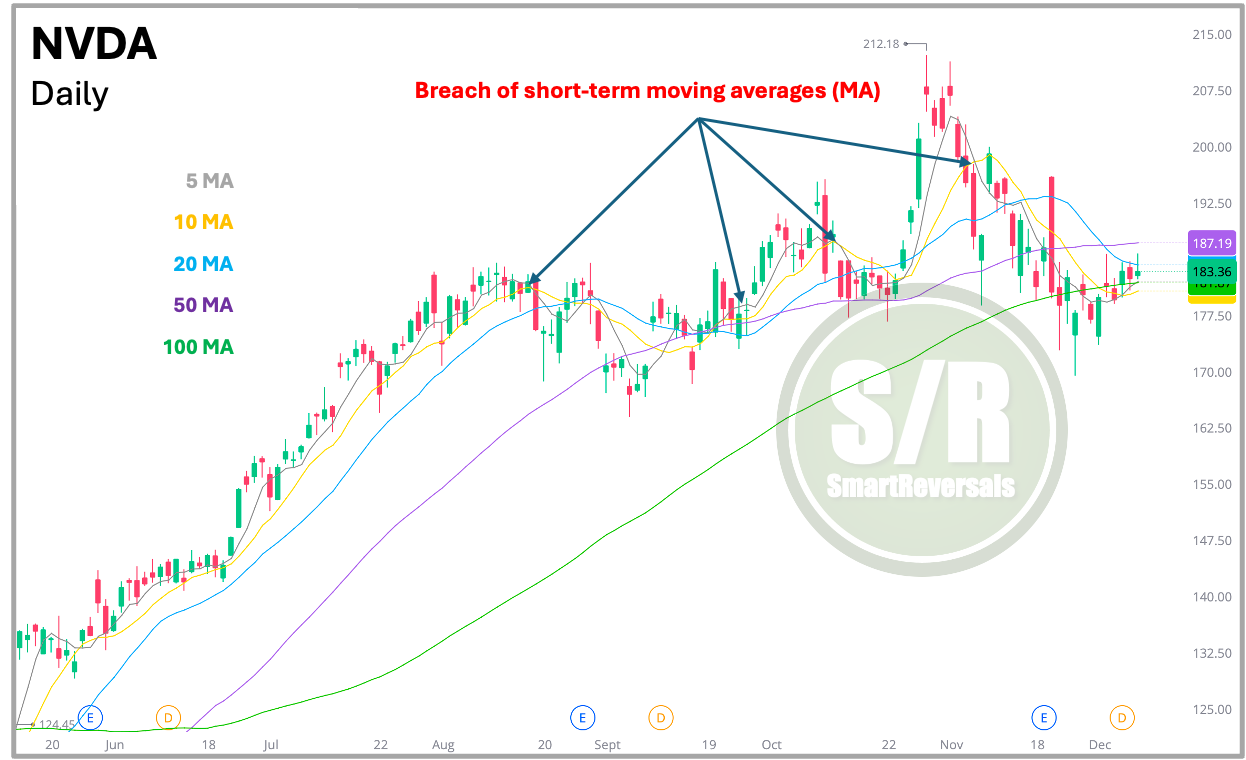

Moving Averages: Measuring Trend Health Once you can read the price action, you need to assess the trend’s health using Moving Averages (MA). The third chart illustrates how combining short-term averages (5 and 10 MA) with medium to long-term averages (20, 50, and 100 MA) creates a dynamic view of the trend. These lines act as dynamic support and resistance; a breach of a short-term MA often signals a loss of immediate momentum, while losing longer-term MAs (like the 50 or 100) are major lines that speak for the overall trend.

The chart below shows how significant is a loss of the 5 and 10 MA for NVDA. Some traders or investors may consider a loss of those levels a sell-sign, and recovering them a buy-sign. This is not a recommended rule, but an example of having a criteria when analyzing MAs.

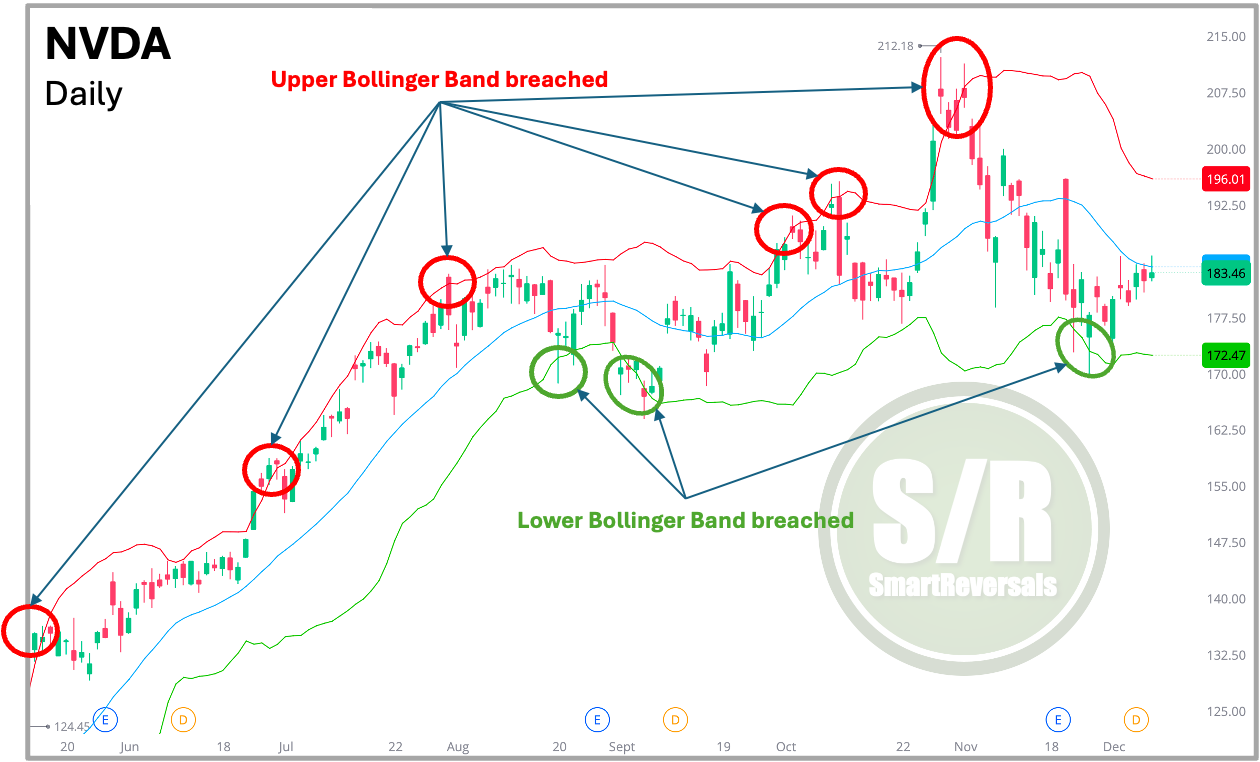

Bollinger Bands: Visualizing Volatility To further refine your view, Bollinger Bands are essential for measuring volatility and identifying extremes. As seen in the fourth chart below, price action tends to stay within these bands. When the price breaches the Upper Bollinger Band, it often signals that the asset is overextended or “expensive” relative to recent volatility. Conversely, a tag or breach of the Lower Bollinger Band can indicate the asset is “cheap” or oversold. This tool is invaluable for spotting mean reversion opportunities where the price snaps back to equilibrium.

Oscillators: Timing the Momentum Validating these moves requires Oscillators like the Stochastic, RSI, and MACD. Before diving into the chart, it is important to understand two key concepts:

Overbought refers to a condition where an asset has risen too far, too fast, suggesting buyers are exhausted and a pullback is likely.

Oversold means the price has fallen too steeply, suggesting sellers are washed out and a bounce is due. In the fifth chart, the Stochastic and RSI measure these extremes, identifying precise moments to enter or exit, while the MACD histogram is particularly useful for validating the strength of a reversal or trend continuation.

Each oscillator works different: The Stochastic changes faster, and in weak markets an overbought condition can vanish quickly, but in strong markets it continues overbought for long. Overbought is defined above 80, oversold is below 20, and when the lines cross, a reversal may be in play.

The RSI moves slower, so when it reaches 70 or more, the price is significantly overbought, and significantly oversold when the indicator is below 30.

The MACD is much slower, it provides significant signals when its lines cross as highlighted in the chart.

You started with a line or area, and now you understand different indicators, of course, there is much more to study, and you can do it subscribing to the Weekly Compass, where over 30 securities are analyzed every week, and the strongest setups are prioritized for you, including the key price levels that they need to hold to maintain momentum, or to breach to validate a trend reversal.

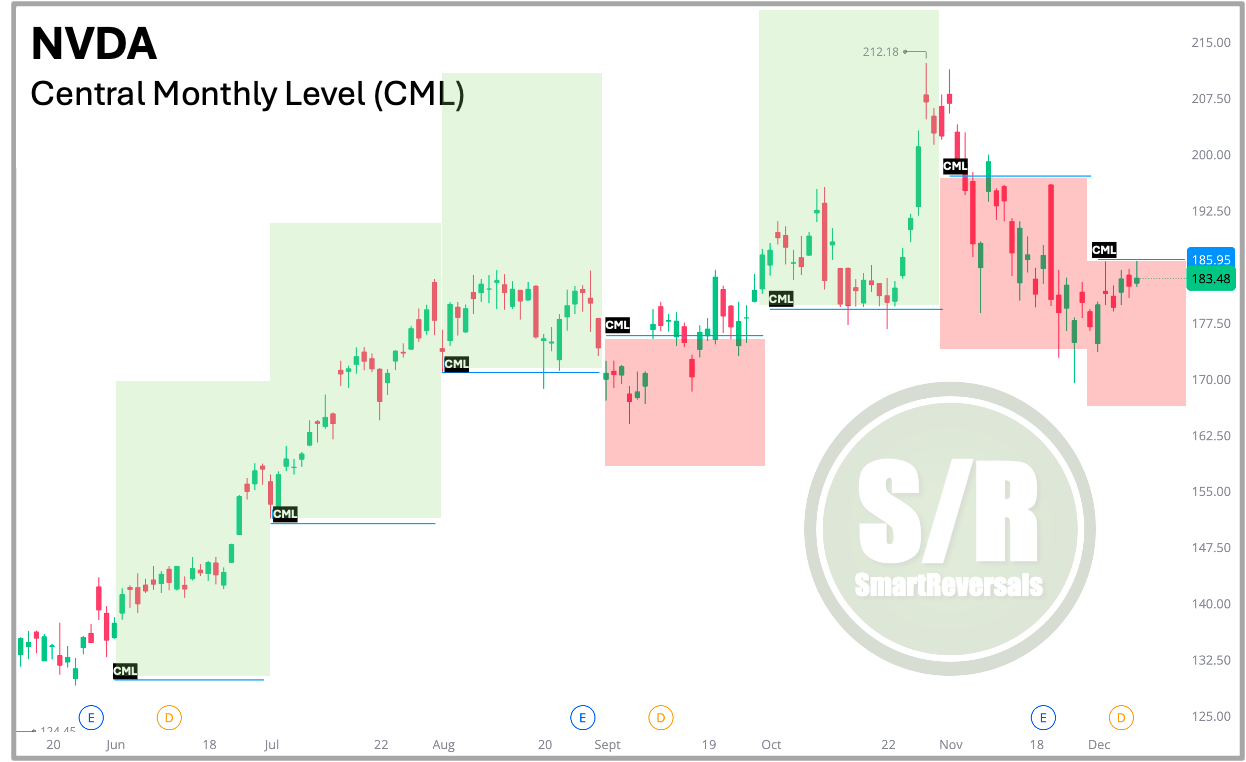

Central Level (Support and Resistance Levels): The Bullish/Bearish Line in the Sand To facilitate decision-making, I utilize specific price levels known as Central Level. As shown in the sixth chart, these horizontal levels function as a binary switch for traders: the bias is bullish if the price stays above the Central Level and bearish if it falls below. This simple yet powerful tool removes ambiguity, providing clear “make or break” levels that help you define your risk and manage expectations without guessing where the floor or ceiling might be.

Every Friday I post the Central Monthly and Central Weekly Level for the month and week ahead for U.S. indices, Megacaps, Futures, Metals, and Crypto. For almost two years premium subscribers have seen the power of those modeled lines, setting crucial levels that when you see backwards you understand how important they are to validate reversals and momentum.

Let’s continue with the NVDA case study, the Central Monthly Level (CML) that has been posted for the month ahead (for example, the CML for December was posted at the end of November), see how relevant the line is.

Losing the CML is a significant event, see how bearish was the month of November, which by the way initiated the selloff after a shooting star candle above the Bollinger band, and an overbought RSI.

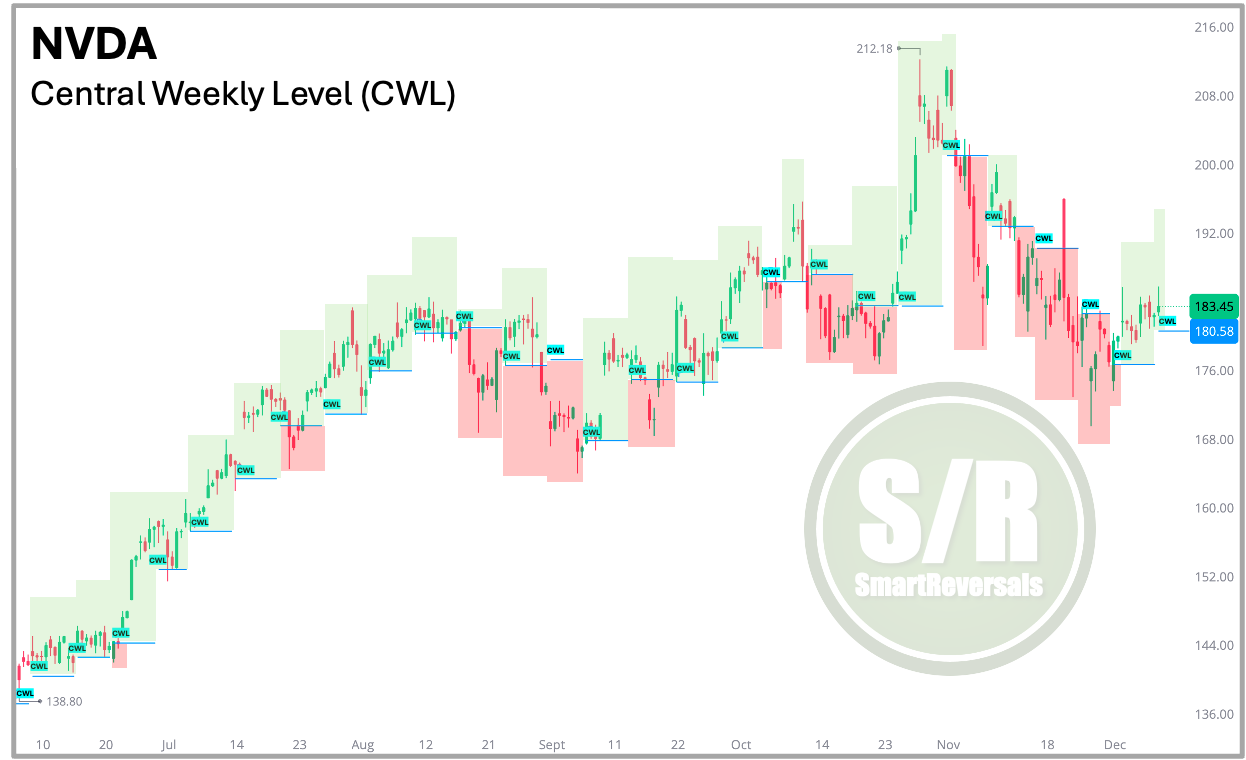

The Ultimate Filter Finally, to avoid waiting until the CML is lost, or the 10 or 20 Moving averages are breached, I use the Central Weekly Level (CWL), it is updated every Friday for the week ahead, and the subscribers can have a clear reference to validate a potential pullback (when the price is overbought and if finally falls below the CWL), or to validate a potential bounce (like the chart below for NVDA:

These concepts using the Central Monthly Level (CML) and Central Weekly Level (CWL) are critical tools for determining momentum and validating setups over longer timeframes. Technical indicators+Central Levels act as the essence for the SmartReversals methodology: if a stock is holding above its CWL/CML, the broader momentum remains positive, and dips are likely buyable. If it fails these levels, the structure is invalid, protecting you from holding onto a losing trade.

Conclusion Knowing which indicator to use and when is essential for successful investing. SmartReversals simplifies this complex analysis for you, analyzing the indicator that is more relevant for each security, and providing the critical CWL and CML levels every week along with their respective support and resistance targets. These levels have proven invaluable to our paid subscribers, helping them validate bullish or bearish momentum, manage risk effectively, and spot high-probability entries for both long and short positions.

Don’t trade alone, consider subscribing to the paid plan to get these actionable insights directly.

If you found this guide helpful, please Like and Repost for more free articles like this one!

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Premium subscribers can suggest their favorite stocks for a modeling of their Support and Resistance Levels, that customized modeling is posted on Sundays afternoon (New York Time).

My final take on NVDA? I’m bullish based on the indicators charted, that consideration remains as long as the price stays above $180.6 this week (that’s the CWL). The latest Weekly Compass and Support and Resistance Levels with the complete analysis for NVDA, and all the securities mentioned are linked here:

Buckle Up for the Fed

This Weekly Compass correctly anticipated bullish moves in individual securities last week based on the high probability setups listed, the bullish moved were significant: META jumped +3.9%, TSLA surged +5.8%, SMH rallied +3.5%, SLV gained +3.4%, COST

Market in Consolidation - Playing the Reversal Candle

Two weeks ago, this publication anticipated a strong bounce in the U.S. indices. The market delivered: the SPX rose +3.7%, the NDX gained +4.9%, and my top pick for the week, IWM, rallied +5.6%. For the week that just ended, a consolidation was expected, and the indices closed essentially flat.

And every Wednesday our Fundamental Library is updated with trade ideas, the last one includes NVDA:

Architects of the AI Factory

The market is undergoing a normal consolidation following the solid rally observed last week, a bounce considered in this publication. In today’s edition, we dive into three crucial topics:

SmartReversals gives you high-level technical and fundamental insights used by Investment Officers at a price that makes sense. Secure your access before the new year!

The content provided on SmartReveals.com is for educational and informational purposes only. All analyses, research, commentary, and other materials are intended to help users understand financial markets, investment concepts, and company fundamentals. This content does not constitute investment or any type of advice. The support and resistance levels are modeled references to manage risk and anticipate potential reversals, each investor must assess their own risk tolerance to set stops.

My only communication channel with you is via email, and the Substack chat, I DO NOT use Telegram, WhatsApp, Discord, Private Channels, or any other communication method.