Euphoria vs. Exhaustion

Key S/R levels to watch next week since overbought conditions now loom.

For the past two weeks, I’ve been modeling the predictive support and resistance levels for the stocks most requested by our subscriber community. It’s encouraging to see that the community's interests align with my research; most of the popular suggestions, including CRWD, HOOD, PLTR, UNH, SPOT, and SHOP, are already featured in the library of fundamental analysis.

For some of the suggested stocks not yet in the library, I will be conducting a fundamental deep-dive. This ensures that every technical assessment provided is backed by a solid understanding of the company's business, financials, and competitive landscape. If you only trade the chart, you’re assuming more risk than you think. Read and educational note I posted about fundamentals:

The best point about fundamentals, is that they don’t change from one day to another, they can be valid during three months at least (between each earnings call). The fundamental library provides you fundamentals for 50+ companies already, including all the Magnificent Seven (AAPL, MSFT, GOOG, META, AMZN, TSLA, and NVDA), their competitors (AVGO, AMD, MU, SHOP, HP, SNAP, etc), and other essential companies like banks (JPM, BAC…), aerospace (LMT, BA…), streaming (NFLX, DIS, SPOT), and popular companies breaking out (CRWD, NOW, HOOD…)

The paid plan gives you access to all the content at smartreversals.com

Price action is ultimately a mechanism for discounting the market's collective judgment on a company's future prospects, it’s worth knowing the fundamental information as business model, future prospects, opportunities, competitive landscape, revenue growth, and other financial aspects of the companies.

Salesforce (CRM) and Marvel (MRVL) are included in today’s publication

And as market note, the bullish momentum makes sense with the signals studied since April, so the upcoming long holiday weekend is the perfect opportunity to dive in. Upgrade your subscription now and explore these essential studies—they are an essential read to prepare for the market's next leg up. Click in each link:

Also, at the end of this publication you will find the Support and Resistance Levels for the upcoming week.

Regarding the Support and Resistance Levels

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, UNH, AVGO, COST, PFE, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Use this long stock market weekend to sharpen your edge. Subscribe today and unlock the tools you need to prepare for the market's next move, including access to the fundamental library, all market studies, educational content, and the key support/resistance levels for next week. Plus, you'll receive the comprehensive Weekly Compass with charts and targets, published every weekend.

Summer Camp Levels: Until July 19th, in addition to the usual 40+ securities analyzed, I will model the support and resistance levels for 10 additional securities. These ten "rotating slots" will be filled by stocks chosen by you, both free and paid subscribers.

To vote, simply comment below this publication with the ticker symbols you're interested in. I will select the five most-requested stocks each week. If a stock is popular enough to get voted in every week, that's perfectly fine!

Let’s begin with the Fundamental analysis for MRVL and CRM, and then we continue with the S/R levels for next week.

Marvell Technology is a leading fabless semiconductor firm that excels in developing complex System-on-a-Chip (SoC) solutions. Harnessing a broad portfolio of intellectual property that spans computing, networking, optics, storage, and security, Marvell integrates advanced analog, mixed-signal, and digital signal processing. This expertise allows the company to deliver high-performance standard and semi-custom products that power critical infrastructure across the cloud, enterprise, automotive, telecom, and industrial markets.

Marvell Technology: Engineering AI Dominance Through Strategic Focus

Marvell Technology (MRVL) is executing a masterful transformation into a data center powerhouse, strengthening bullish conviction in the company's trajectory. Recent developments in its custom-compute division underscore an ambitious expansion of its AI capabilities, positioning Marvell as a prime beneficiary of the unprecedented surge in AI capital expenditures.

The AI Growth Engine: Catalysts Driving Outperformance

Marvell's compelling growth story centers on the data center segment, which now commands 76% of total revenue. Two powerful catalysts are propelling this momentum:

Accelerating Custom Silicon Dominance

The explosion in custom AI silicon demand is playing directly to Marvell's strengths. The company has secured two additional custom silicon clients, bringing its impressive pipeline to 18 socket wins. This commercial momentum gains further validation through an expanded five-year partnership with Amazon Web Services (AWS), delivering enhanced revenue predictability across Marvell's custom AI products, optical Digital Signal Processors (DSPs), and switching solutions.

Exponential Market Expansion

Supporting this growth trajectory, Marvell has dramatically increased its long-term data center Total Addressable Market (TAM) forecast to $94 billion by 2028—a substantial leap from the previous $75 billion projection. Most notably, the custom AI chip opportunity alone represents a $55 billion market within this expanded TAM.

Financial Excellence: Converting Growth into Shareholder Returns

This robust revenue growth is translating directly into enhanced profitability and balance sheet strength. While the initial deployment of new custom silicon programs creates temporary gross margin pressure, these strategic initiatives remain highly accretive to operating profit and earnings per share.

Marvell's financial foundation remains solid. As of April 2025, total debt stands at a manageable $4.2 billion, with healthy leverage metrics of 1.8x gross debt/EBITDA and 1.4x net debt/EBITDA. The company is aggressively returning capital to share-holders, ramping stock repurchases to $340 million in the latest quarter from $200 million previously. Inventory management remains disciplined at $1.07 billion.

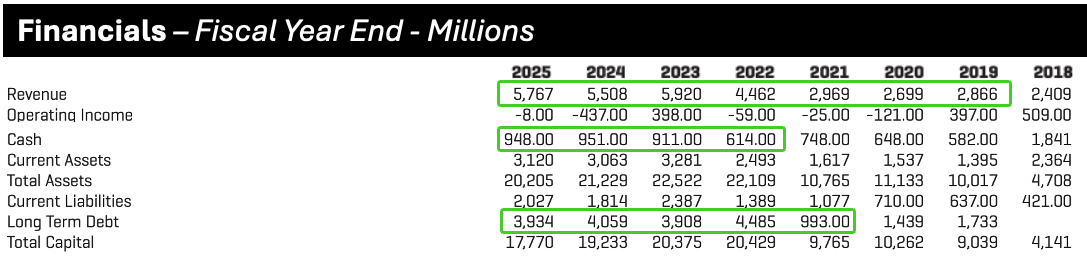

Growing revenue, increasing cash, and reducing debt is a trifecta of financial health. Here's why: