This week, the Support and Resistance levels delivered on their primary function: validating or invalidating a market setup. Last week closed with a bearish setup, a conclusion drawn from the weekly bearish engulfing candle, which I highlighted for premium subscribers last weekend.

The setup was distinctly bearish, with the McClellan oscillator on the daily timeframe indicating oversold conditions. While a bounce was anticipated for the week, its sustained nature was unexpected, a point I will discuss further.

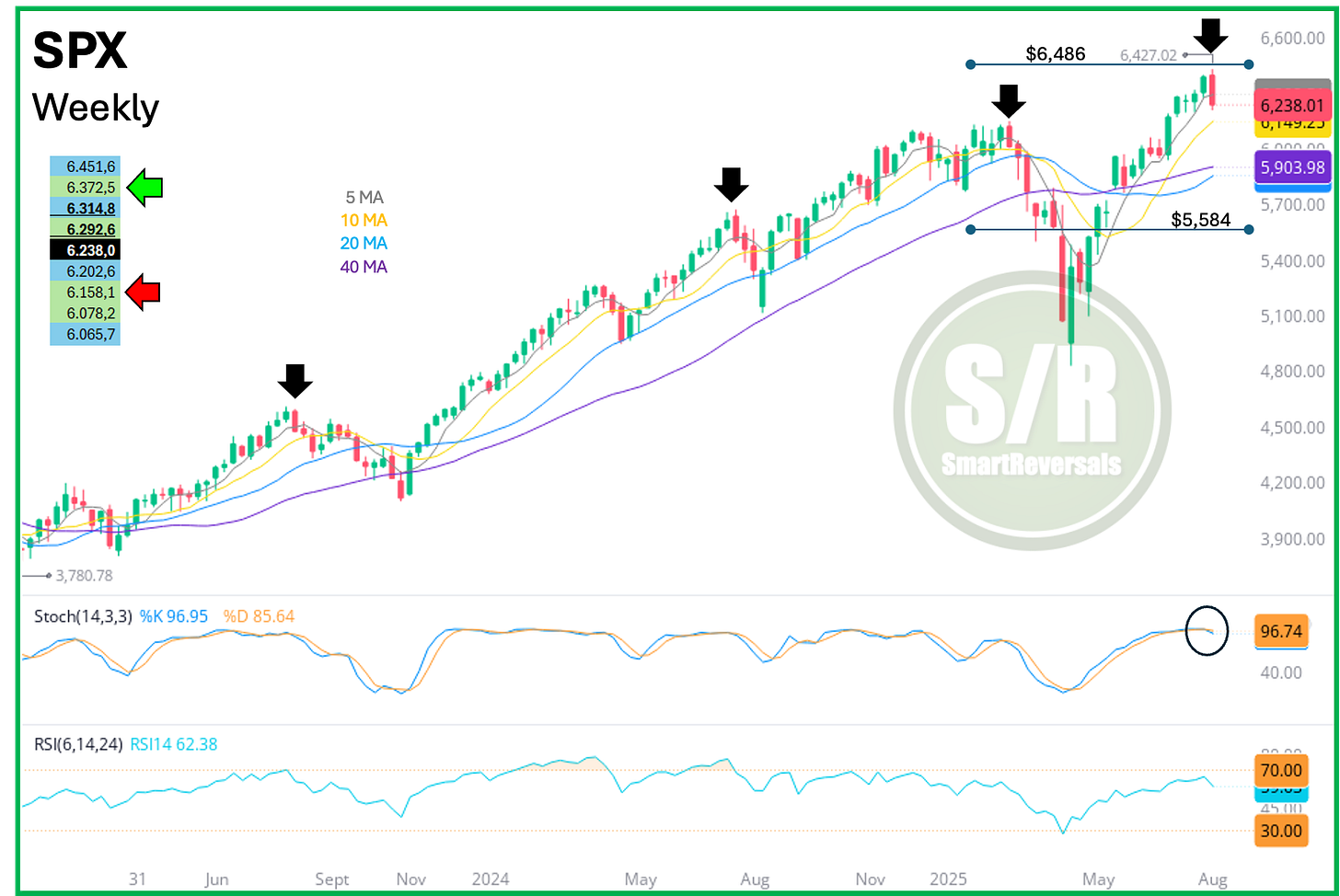

As is usual in my weekend reports, the SPX chart included the Support and Resistance levels for the five days of the week. It specifically highlighted the central weekly level of $6,292, the bearish target of $6,158.1 considering the bearish setup, and the bullish target of $6,372 if the central level was reclaimed.

SPX - One Week Ago (From the Premium Section):

The price did indeed bounce on Monday, recovering the central weekly level. This level is key for determining bullish or bearish momentum, and its recovery immediately increased bullish probabilities. In fact, the bullish target expected of $6,372 was reached and slightly surpassed, with the week closing at $6,389.

AAPL has broken out.

In last weekend's Weekly Compass, I posted the AAPL chart, noting a bullish MACD crossover that preceded the recent move. Although there was a potential for the bullish setup to be invalidated, the modeled Support and Resistance levels for Apple provided a good validation for the bounce. The central level of $206 was key; once it was reclaimed, the probability of bullish continuation increased. This is precisely what unfolded, with the stock closing the week at $229, surpassing the annual level of $225 that was first highlighted in the Weekly Compass months ago. These S/R levels mentioned are updated for over 40 securities every week including:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, UNH, AVGO, COST, PFE, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Subscribe now, and unlock the levels for next week, the Weekly Compass with the technical charts comprehensively explained, and all the content at smartreversals.com including all the educational content and fundamental & macro library, where the most recent publications include:

Regarding the 50 likes mentioned in the previous publication, the number of likes reached 48. We will try again so one free subscriber can receive a one-month access pass.

The key question today is: Will this week’s bullish move continue? You all know my bullish position for the next few months; my expectation for a pullback is within a bullish context or as a buying opportunity. In case the market declines, using the Support and Resistance levels is key. AAPL will be a must-watch next week after a 13% rally that put the stock in an overbought zone, so its central weekly level is critical, unlock it now and the other 40+ securities mentioned, and every Sunday I model 10 flexible stocks based on premium subscribers’ suggestions.

WEEKLY LEVELS: