Today’s publication presents how technical indicators serve as core tools for making informed, data-backed investment decisions. By relying on these indicators, investors and traders can bypass intuition, news, social media noise, and emotion to interpret what the market is truly signaling.

While some investors believe stock prices are driven solely by fundamentals, price action often tells a different story. Fundamentals are undeniably important, but they do not always correlate with immediate price trends.

PayPal (PYPL) is a prime example of this divergence. Despite boasting robust fundamentals and over $8 billion in revenue, the stock has been excessively punished. Five years after being a market favorite, it currently trades at just one-sixth of its 2021 peak. This illustrates why relying on fundamentals alone is often insufficient.

There are entirely valid fundamental reasons to buy PayPal. You could justify an investment based on its P/E ratio of 11, or the fact that Transaction Margin Dollars (gross profit) have grown +6-7% for several consecutive quarters, proving they are making more actual profit per transaction, not just processing empty volume. You could also point to the success of Fastlane, which is driving >80% guest checkout conversion versus the industry standard of 40-50%, the massive $15 billion share repurchase program that is actively boosting EPS, or the fact that Venmo is gaining traction, with debit card monthly active users up ~30%. However, this is the chart:

Are you willing to accept underperformance while the broader market leaves you behind? While PayPal has stagnated, the S&P 500 has delivered double-digit growth for three consecutive years gaining 24% in 2023, 23% in 2024, and 16% in 2025. Buying on fundamentals alone often means paying the price of opportunity cost.

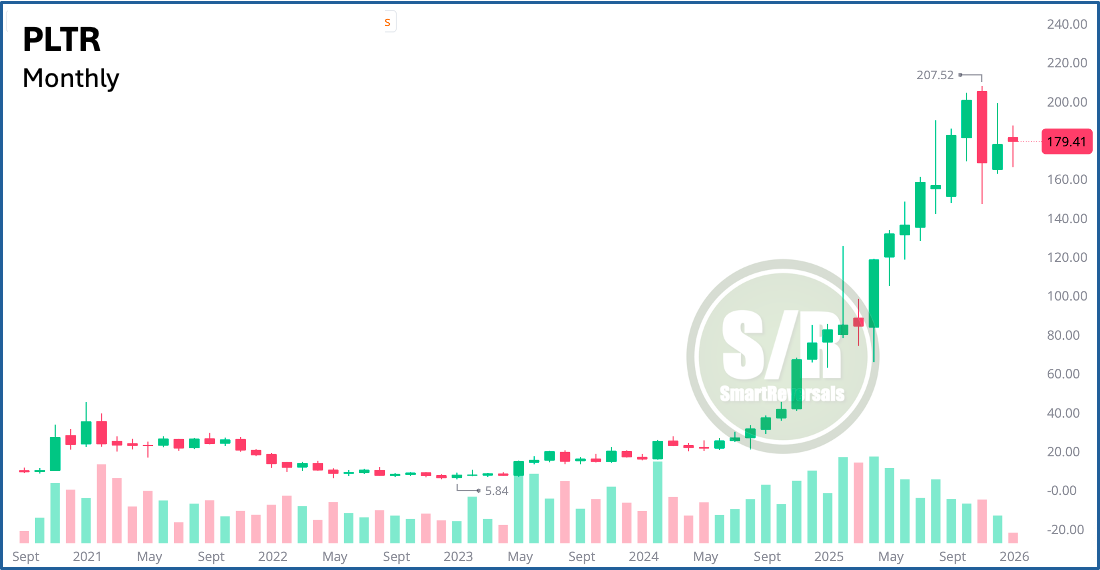

On the other hand, we have Palantir (PLTR). Publicly traded since 2021, the same year PayPal peaked, its stock price is now 17 times higher than it was in September 2021. Remarkably, its revenue is just $1.1 billion. This contrast illustrates why relying on fundamentals alone is often insufficient; price action frequently dictates the trend regardless of the revenue on paper.

Yes, fundamentals must be assessed in the context of a sector and competitive landscape. These two examples are presented to drive home the point: they can analyze why PYPL has been so punished and PLTR so rewarded by the stock market, despite the massive revenue disparity.

That said, technical indicators are essential for assessing price action and making informed decisions, whether you are a long-term investor, a swing trader, or a day trader. Price action is the purest reflection of human psychology, and the right indicators allow us to decode it.

This is an occasional free publication presenting case studies on how to analyze stocks, ETFs, commodities, and cryptocurrencies. We previously covered NVDA, SPX, and QQQ; today, we will study TSLA.

For those looking for a disciplined routine, our Premium Schedule includes:

Fridays: Support & Resistance Levels for the week ahead (44 securities).

Saturdays: The Weekly Compass featuring High Probability Setups.

Sundays: Customized S/R levels for stocks requested by subscribers.

Wednesdays: The Mid-Market Update.

On Mondays, I often post free educational content to demonstrate my technical approach and how high-probability trades are assessed. SmartReversals is here to help you navigate the stock market and crypto space.

Enough thinking. Let’s look at the charts and share with more people who want to learn technical analysis.

TSLA Case Study

When investors rely solely on fundamentals or news, they often view price history as a simple line, missing the nuance of price action. By adding candlesticks and essential technical indicators, we can uncover exactly how TSLA reverses or builds momentum. Let's examine the charts.

The “Naked” Chart vs. What the Market Is Really Communicating

This form of visualization offers very limited practical insight. While it shows general price direction, it lacks essential context, it does not identify overbought or oversold conditions, explain price behavior, or highlight critical support and resistance zones where reactions frequently occur.

Relying solely on a naked chart is comparable to driving without a clear view ahead. You may know where you have been, but without proper visibility, anticipating risks, turns, or opportunities becomes extremely difficult.

Candlesticks: Interpreting Market Sentiment

Unlike line charts, candlesticks offer a detailed visual story of the ongoing battle between buyers and sellers within each time frame. Every candle reflects not only direction, but also pressure, intent, and momentum.

As shown in the chart below, well-known formations such as Shooting Stars, signaling bearish pressure, and Hammers, indicating bullish strength, can help anticipate intraday reversals before they evolve into broader trends. Recognizing these patterns allows traders to detect exhaustion during rallies or consolidation after declines, providing a clear advantage in decision-making.

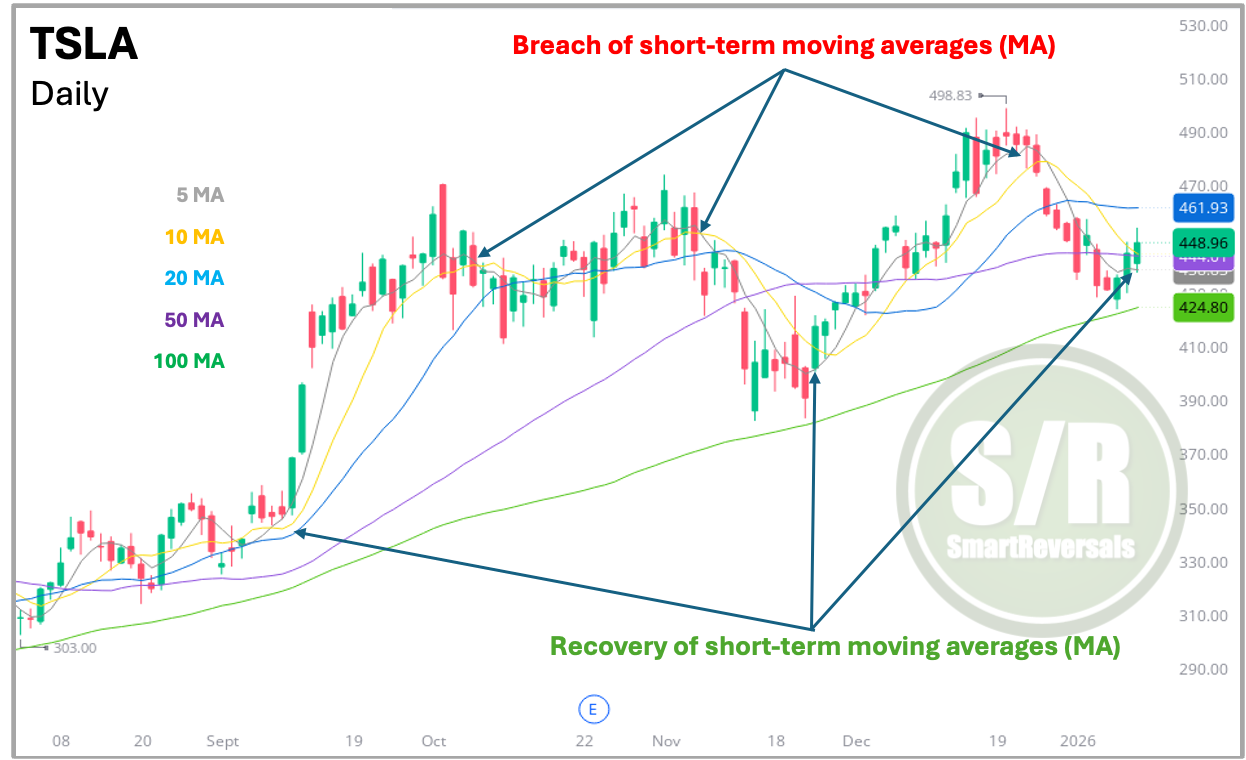

Moving Averages: Measuring Trend Strength

Once price action can be interpreted effectively, the next step is evaluating trend strength using Moving Averages (MA). As demonstrated in the chart below, combining short-term averages (5 and 10 MA) with medium and long-term averages (20, 50, and 100 MA) delivers a more comprehensive view of market behavior. The arrows highlight some of the cases when the 5 & 10 DMA were breached initiating a downtrend (and following an indecisive candle signal).

A breakdown below short-term Moving Averages often signals weakening short-term momentum, while failure to hold longer-term averages, such as the 50 or 100 MA, can indicate a more meaningful shift in overall trend structure. These longer-term levels are especially relevant, as they reflect broader market conviction.

In this TSLA example, see how important the 100DMA has been during the two recent selloffs, the market bounced from that green line with precision.

For some traders and investors, a break below the 5 and 10DMA may be viewed as a potential sell signal, while a recovery above them could suggest a buying opportunity. This example is not meant as a rigid rule since each stock presents different price behaviors, but rather as an illustration of how clearly defined criteria can enhance Moving Average analysis and promote disciplined decision-making.

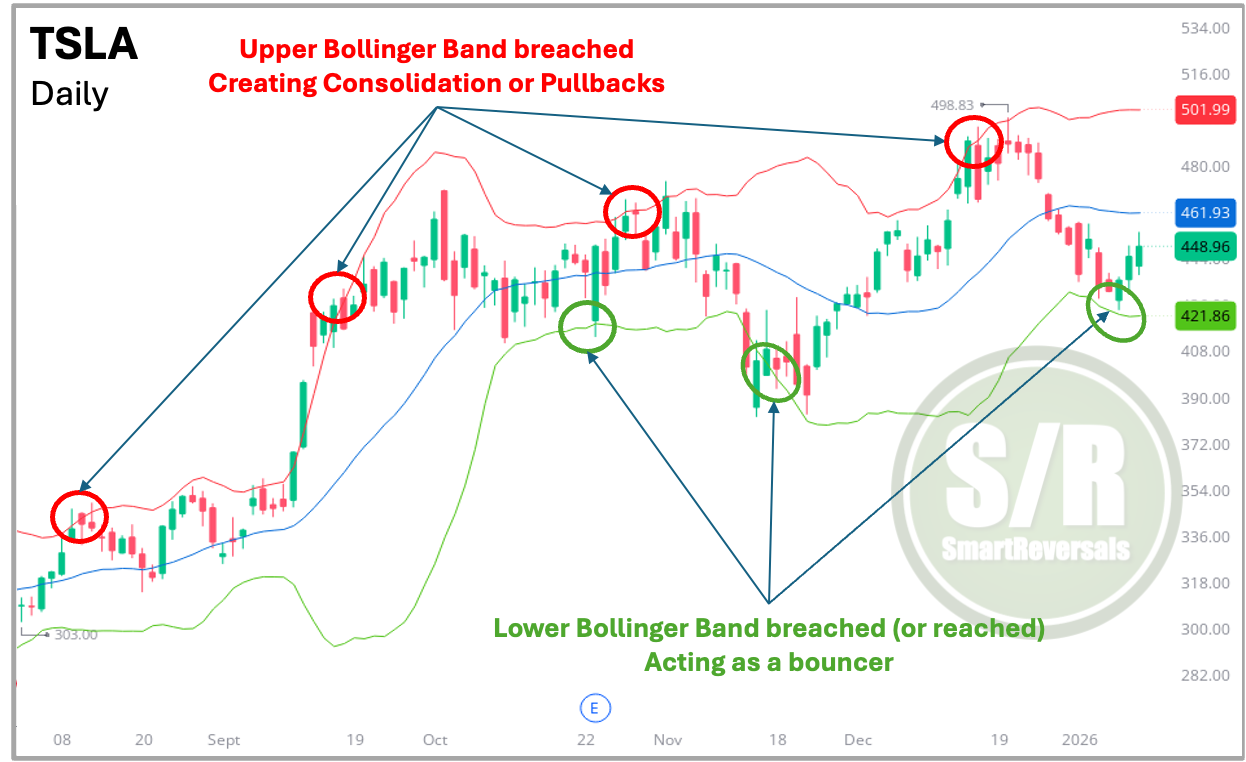

Bollinger Bands: Interpreting Volatility and Price Extremes

To gain a more refined view of market behavior, Bollinger Bands play a crucial role in assessing volatility and identifying extreme price conditions. As shown in the chart, most price action naturally fluctuates within the upper and lower bands, which define the boundaries of normal market movement.

When price extends beyond the Upper Bollinger Band, it often signals excessive bullish pressure, suggesting the asset may be trading above its typical range. Conversely, moves toward or below the Lower Bollinger Band reflect increased selling pressure, indicating a potentially oversold or undervalued condition. This indicator is particularly effective for spotting mean reversion setups, where price has a higher probability of reverting toward its average after extreme deviations.

Oscillators: Timing Momentum Effectively

To confirm price action and evaluate momentum, traders rely on oscillators such as the Stochastic, RSI, and MACD. Before examining the chart, it is important to define two core concepts that guide oscillator-based analysis.

An overbought condition arises when price advances aggressively in a short period, often signaling diminishing buying strength and an increased likelihood of a corrective move. An oversold condition occurs after sharp declines, suggesting selling pressure may be exhausted and a rebound could follow.

In the next chart, both the Stochastic and RSI are used to identify these extreme conditions, helping traders refine entry and exit timing. Meanwhile, the MACD histogram plays a key role in confirming whether a potential reversal carries sufficient momentum or if the existing trend is likely to persist.

Each oscillator functions differently and must be interpreted accordingly.

The Stochastic reacts quickly to price changes; in weaker markets, overbought signals may fade rapidly, while in strong trends, the indicator can remain overbought for extended periods. Typically, readings above 80 indicate overbought conditions, while levels below 20 suggest oversold territory. Crossovers between Stochastic lines often serve as early alerts of possible reversals.

The RSI, in contrast, moves more slowly and provides more conservative signals. When RSI reaches or exceeds 70, it indicates a clearly extended move, while readings below 30 reflect a deeply oversold market.

The MACD operates at an even slower pace, making its signals particularly meaningful when its lines cross, as shown in the chart. These crossovers tend to offer stronger confirmation of momentum shifts rather than early, reactive signals.

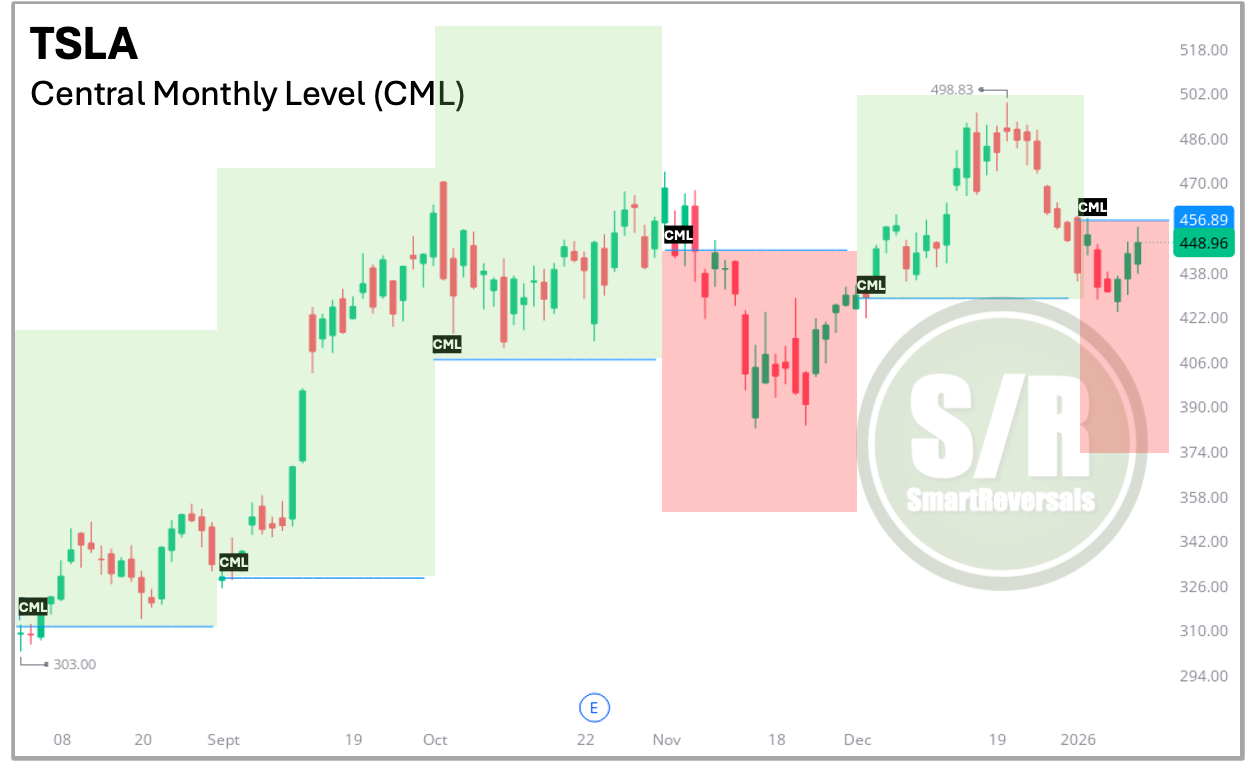

Central Monthly Level (Support and Resistance): Defining Directional Bias

To streamline decision-making, I rely on clearly defined price zones known as Central Levels. As shown in the next chart, these horizontal reference points function as a directional filter: as long as price remains above the Central Monthly Level, the market bias is bullish; when price falls below it, the bias shifts to bearish. This simple yet highly effective method removes ambiguity by establishing clear “line in the sand” levels, allowing traders to define risk and expectations without guessing potential support or resistance.

A break below the CML marks a critical change in market structure. This is clearly visible during November, which turned decisively bearish after price lost this key level. Notably, that period also coincided with the start of a broader selloff, following the appearance of a shooting star candlestick above the Bollinger Band, combined with an overbought RSI, multiple signals aligning to confirm downside momentum.

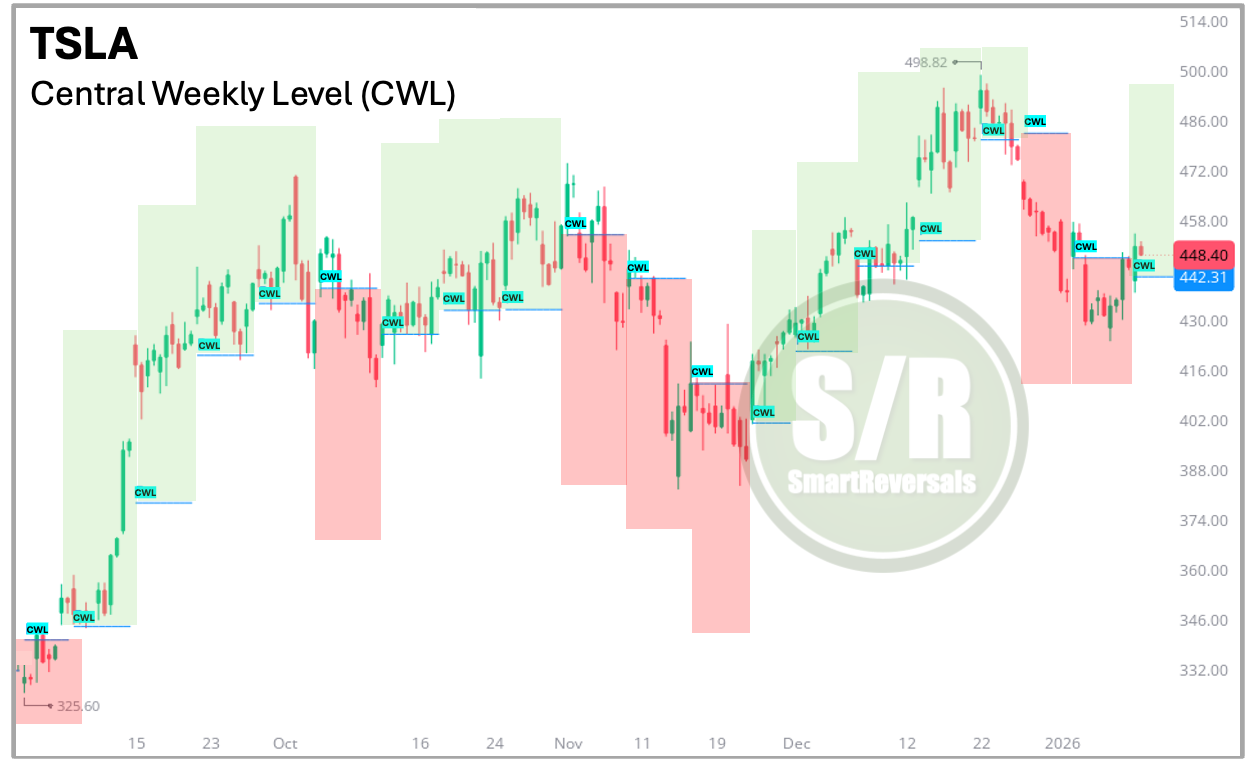

The Ultimate Filter

As a final refinement, rather than waiting for a loss of the Central Monthly Level (CML) or a breakdown of the 10 or 20 Moving Averages, I rely on the Central Weekly Level (CWL). Updated every Friday for the week ahead, this level provides a precise reference point for evaluating short-term price behavior. The CWL helps confirm whether a pullback is forming, particularly when price is overbought and then falls below this level, or whether a bounce is gaining strength, as illustrated in the TSLA example shown below.

Together, the Central Monthly Level (CML) and Central Weekly Level (CWL) serve as essential tools for assessing momentum and validating trade setups across higher timeframes. When combined with technical indicators, these Central Levels form the foundation of the SmartReversals methodology. As long as price remains above both the CWL and CML, broader momentum remains constructive and pullbacks are generally viewed as buying opportunities. When these levels fail, market structure weakens, helping traders avoid remaining stuck in losing positions.

Today, TSLA is showing signs of a bounce, validating my bullish thesis that indicated a likely bounce. I’m market neutral, premium subscribers navigated the selloff that I anticipated with disciplined study of the Shooting star printed on December 22nd, touching the upper Bollinger band, following an overbought RSI, and followed by a breach of the 5DMA on December 26th; but most importantly, with the loss of the CWL. Today TSLA is trying to recover the CML, and if the CWL is breached the bullish thesis will be postponed, but premium subscribers have a clear reference to set a stop loss and protect capital.

Every Friday, I publish both the Central Weekly and Central Monthly Levels for the upcoming week and month across U.S. indices, megacap stocks, futures, metals, and cryptocurrencies. For nearly two years, premium subscribers have benefited from the consistency of these modeled levels, which repeatedly highlight critical price zones. In hindsight, their relevance becomes unmistakably clear as they confirm momentum shifts and validate market reversals. My focus is on Megacaps with high volume so your buy and sell orders can be filled easily:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

You began by analyzing simple line and area charts, and you have now been introduced to a range of technical indicators that add depth and clarity to market analysis. While this is only an introduction and there is much more to learn, you can continue developing these skills by subscribing to the premium plan, where the securities mentioned are constantly tracked and high probability setups are posted so you have references to monetize navigating the stock market and crypto space.

For Paid Subscribers, you can download my eBook on advanced technical indicators from the latest weekly compass, where the updated charts were posted, including specific support and resistance levels for the stocks mentioned. Access here:

Consider upgrading your subscription to unlock full access, and please tap the like button if you enjoyed this educational content.

For Paid Subscribers: The premium chat features the Support & Resistance (S/R) levels for this week’s community-requested stocks. We have modeled 60 securities in total, including VXX, NKE, MU, IREN, V, AMGEN, LULU, BABA, and OKLO. This analysis includes the Central Weekly Level and specific price layers to help you set targets based on technical indicators. Get access here!

Have a good night everyone.

My only communication channel with you is via email and the Substack chat, I don’t use Telegram, WhatsApp, Discord, Private Channels, or any other communication method.

The content provided on SmartReveals.com is for educational and informational purposes only. All analyses, research, commentary, and other materials are intended to help users understand financial markets, investment concepts, and company fundamentals. This content does not constitute investment or any type of advice. The support and resistance levels are modeled references to manage risk and anticipate potential reversals, each investor must assess their own risk tolerance to set stops.

Interesting!

Vix has reached 16,9 —> indicating momentum shift? Or hedging prior to ppi?

Ndx still 500points below alltime high, while S&P made new high yesterday. Besides google mag7 are

Lagging behind the market as i see it.

Stoxhastic on ndx is curling down this morning

Cwl lost during futures. Will be interesting to see price action today at market opening