The Tide is Turning

The cracks anticipated last week have been proven true - Essential price levels to watch

In the previous edition of the Weekly Compass last Sunday, I anticipated that overheated conditions were becoming more serious based on an objective VIX analysis. The approach made an essential difference against the famous adage, “overbought can continue overbought” a view often held by newbies or those who focus only on daily charts, while the real signals emerge on the weekly and monthly timeframes (posted for premium subscribers).

Also last Sunday, I mentioned how human emotions work, citing the example of the 2020 market, which continued to move up for two weeks despite the initial COVID news. As highlighted then, I do not expect a pandemic crash but a healthy pullback, based on documented studies presented to premium subscribers.

By now, you’ve likely read extensively about tariffs, Semiconductors, exports, Trump, China, and perhaps the government shutdown during the weekend. As was the case during the crash in March and April, you can expect my analysis to focus on price action and technical indicators; the news essentially serves as a trigger.

For new subscribers who joined the community last week, the previous Weekly Compass is available here. The theoretical commentary regarding the VIX is open to everyone, and the specific technical indicators used are accessible to paid subscribers.

Regarding Specific Securities:

Last Sunday, the Weekly Compass anticipated that a significant overbought level had been reached for the SPX in the weekly chart, also the imminent breakout for the VIX based on the weekly chart as well using other two indicators, the NDX also was showing a bearish divergence with an oscillator that I use mostly in the premium content, and among all the indicators I did post for everyone a signal that the Dow Jones was providing suggesting a decline, the shooting star was once again proven true. (Spoiler alert, there is now a huge weekly shooting star for NVDA)

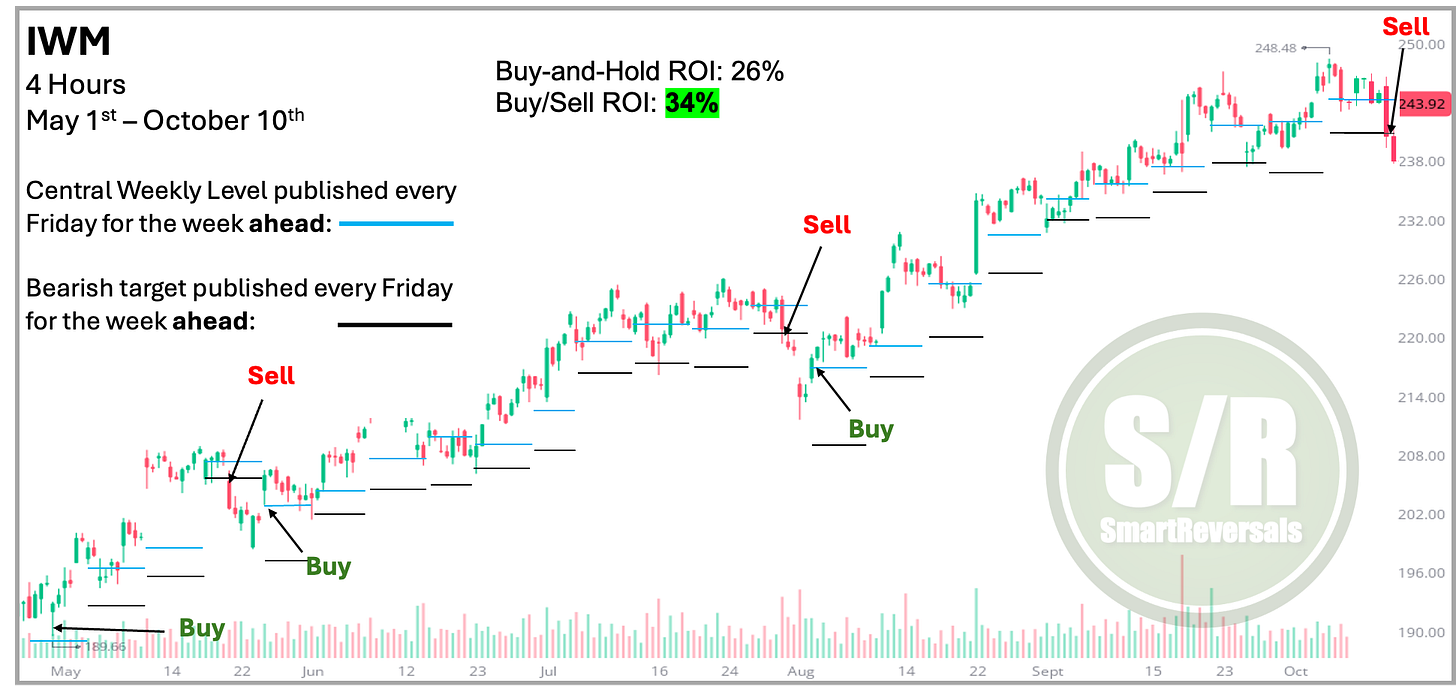

Securities like IWM and AAPL were due for a healthy pullback, I mentioned that an immediate overextension as it happened with GOOG and MSFT was unlikely since the market conditions were overbought, similar to NFLX, META and PLTR when they soared rapidly months ago.

Technicals don’t matter until they do, and as mentioned in previous notes, the longer the market continues overextended, the pullback can be more sharp. The move on Friday wiped out four weeks in few hours, proving that patience is key, and when using the support and resistance levels you have an additional edge to consider a reversal is in play. During previous weeks the central level wasn’t breached deeply for the SPX, NDX, and DJI, but on Friday it happened with significant conviction.

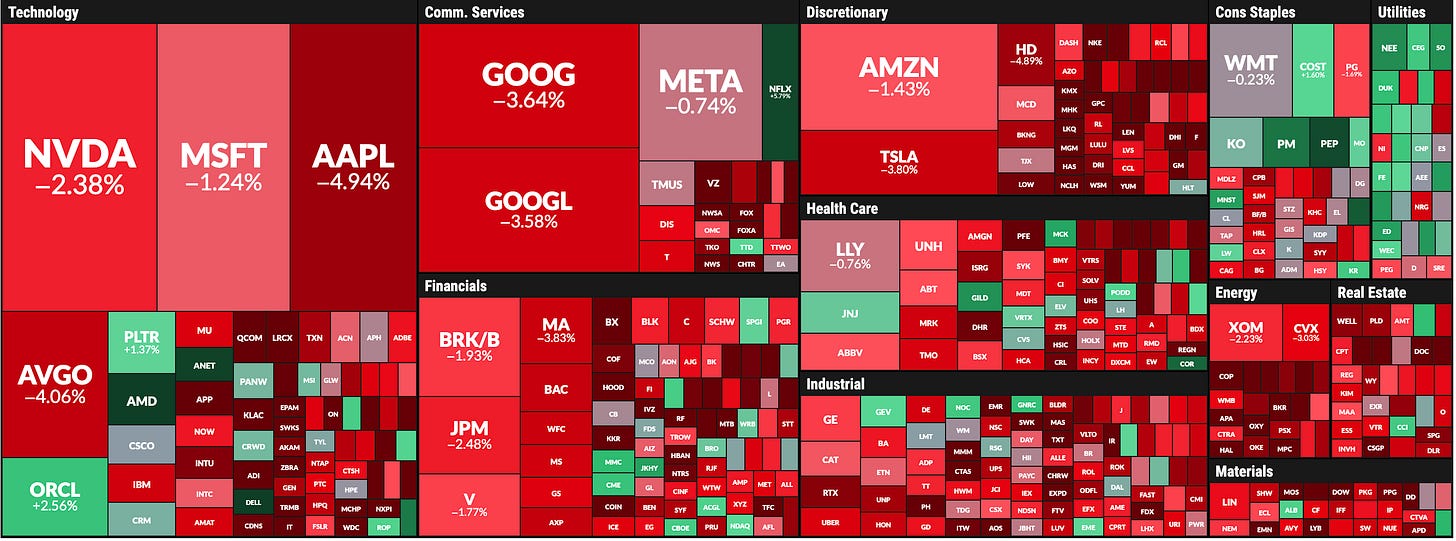

Here’s the price action overview for the week that just concluded for the SPX components:

Every security analyzed here has a central weekly level with bullish / bearish targets according to the setup:

I have charted several securities analyzed in this publication during this week, incorporating the levels to demonstrate how a buy-and-hold strategy can be enhanced by initiating buys upon the recovery of the central weekly level and executing sells when that level is lost. I provide these levels weekly to manage risk, and charts like this one can be consistently validated against my Friday publications.

The blue line represents the central weekly level forecasted each Friday, while the black line denotes the next support zone, also provided with the central level. My previous backtesting for QQQ, NVDA, SPX, and AAPL, used the blue line as the “line in the sand.” However, this backtest (like the one posted for TSLA on Wednesday) uses the next support zone (the black line) as the exit rule. The results, assuming a $10,000 investment, are as follows:

The Buy-and-Hold approach yielded an ROI of +26%, resulting in a final portfolio value of $12,615 from a $10,000 initial investment. While this strategy is simple and captures the full long-term trend, its key disadvantage is the full exposure to interim volatility and drawdowns. In contrast, the Active Buy/Sell strategy significantly outperformed with an ROI of +34%, reaching a final value of $13,048, an 8% difference. This active method’s advantage lies in its ability to buy dips and sell peaks validated by the use of levels for compounded gains, thereby reducing risk in market drawdowns.

You can access the Support and Resistance Levels for next week: Click Here

Also you can read the educational content about using the levels not only for risk management but to entries and exits: Click here

Premium Subscribers can access the premium chat where the securities you suggested to model for next week are published already.

I will continue providing educational content about using the S/R levels not only for risk management, but to time better entries. Like this post if you agree, and also like it for the next section of the eBook for everyone.

Let’s continue with the analyses including technical indicators and price levels for SPX, SPY, VIX, NDX, QQQ, DJIA, DIA, IWM, SMH, SLV, GLD, WMT, BRK.B, NFLX, PLTR, GOOG, AAPL, TSLA, NVDA, META, MSFT, AMZN, BITCOIN, and Breadth analyses for the indices. If you trade one or some of them, this publication is for you.

SPX - Bearish Engulfing Candle and Rapid Selloff - Implications for Next Week:

Today I bring a special chart to help you being open minded for a potential technical bounce given the rapid selloff, let’s begin with the technical approach for SPX and the medium term implication, followed by the one with the short term potential implication: