Start Here: My Top-Down Trading Method

Unified Strategy for Combining Charts, Fundamentals, and Support/Resistance Levels

Over the past several months, paid subscribers have seen the value of analyzing technical indicators adding support and resistance levels. Each weekend, I publish over 40+ charts with in-depth technical analysis, carefully selecting the most relevant indicators and timeframes for each security. This publication covers a wide range of securities, allowing investors to strategically shift between overbought and oversold assets—for example, from TSLA, or NVDA to GOOG or AAPL, or from PLTR to GLD or BITCOIN.

Technical Analysis and Support and resistance levels act as a crucial safety net, providing confirmation and preventing premature moves, especially when there is a reversal setup and confirmation is required. For instance, this publication flagged serious concerns about the SPX being overbought on February 8th, preceding a 21% decline that was avoidable closing long positions on Friday, February 19th once $6,081 as weekly central level was breached. Similarly, a bearish outlook for Bitcoin on August 16th, and the cryptocurrency declined to $104K from $124K. The levels have also worked to validate bullish reversals, like the consolidation of $527 for the SPY or $447 for QQQ after the bullish analysis posted on April 16th.

All of us would love to find the exact bottom and top, and all of us have timed the precise reversal day sometimes, but setting a process improves performance and mitigates the risk of overtrading because of trying to time the exact top or bottom.

This is the Top-Down Trading Method

Given the increasing number of subscribers recognizing the effectiveness of this approach, and suggesting more securities modeled with this approach every weekend, I will be focusing this publication on what is the process beyond S/R levels, since levels alone are one indicator, and investing or trading requires confluence in different indicators.

The S/R levels work for traders, as a staff works for a musician when including four spaces on which musical notation is written. The S/R levels are seven lines per week and month on which price action moves. Every Friday the S/R levels are published now for the following securities, if you invest or trade in some of them, this publication is for you.

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Part 1: The Starting Point - Top-Down Approach

The foundation of my strategy is a “top-down” analysis. Instead of getting lost in short-term price movements, you start with the big picture and progressively zoom in. This ensures your intraday actions are aligned with the larger, more powerful market trend.

The Technical Setup & Central Level: Your Weekly Compass

Every week, the technical setups for over 20 securities are constantly analyzed and published. This provides a broad market perspective, enabling to track moves among them, including U.S. indices (SPX, NDX, DJIA, VIX), ETFs (SPY, QQQ, DIA, IWM, SMH), mega-caps (NVDA, TSLA, AAPL, GOOG, AMZN, MSFT, META, BRK.B, WMT, NFLX, PLTR), metals (GLD, SLV), and Bitcoin. All analyses consider the technical conditions for each case, assessing the bullishness or bearishness in price action, the probabilities of a reversal (bullish or bearish), or the momentum in a trend (bullish or bearish).

Since price action is dynamic and the moves are not in a straight line up or down, or the price can overextend an overbought or oversold condition, the use of support and resistance levels acs as an insurance against unexpected moves, and acts also as a validation when they are breached and a reversal was likely.

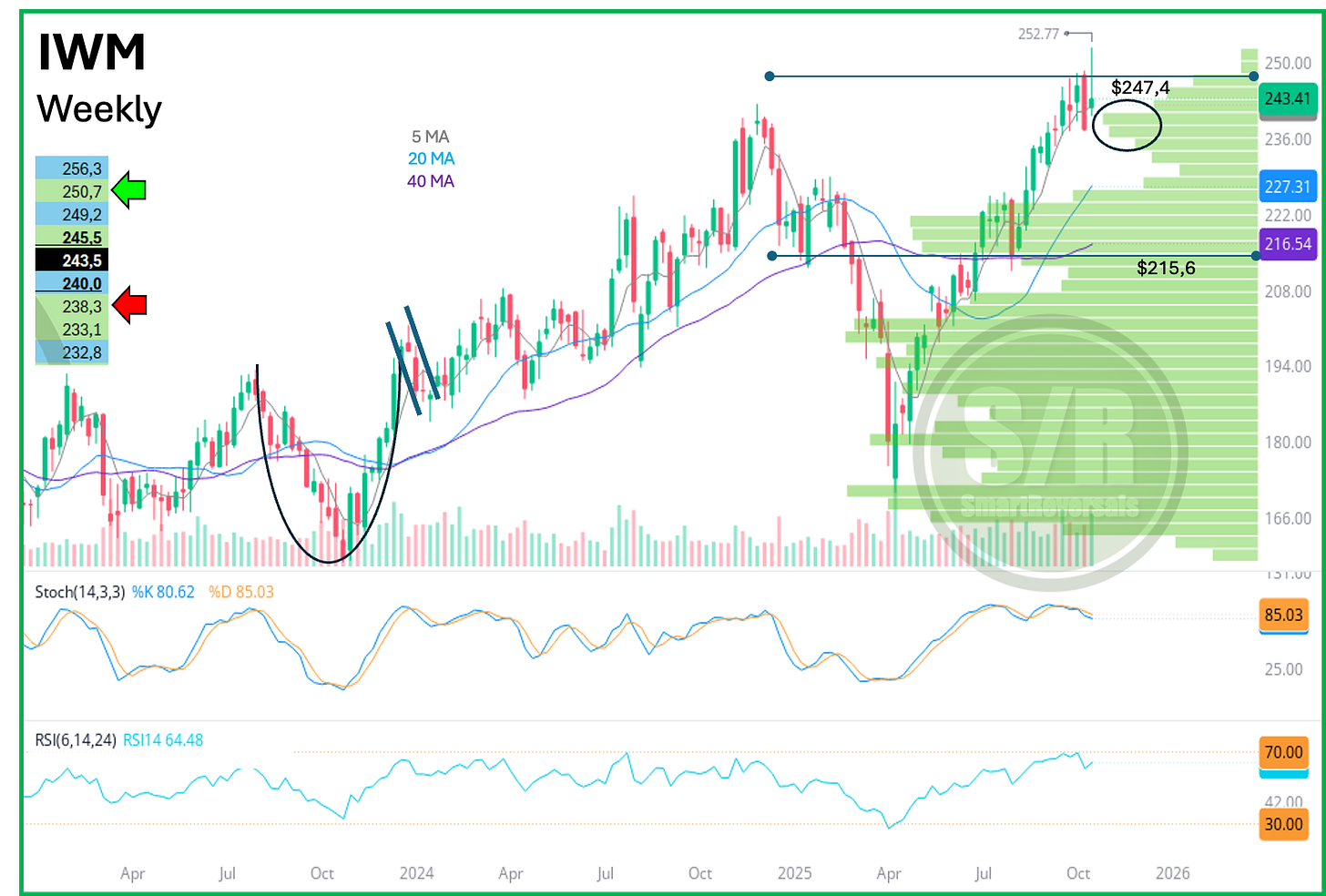

Example: The following chart was posted in the Weekly Compass starting May for IWM including the support and resistance levels. The chart was bullish based on candlesticks and a strong bounce from oversold levels relative to the Bollinger bands and the Stochastic (remember that more indicators suggesting the same oversold or overbought conditions increase the chances of a reversal, and that was the case in the second week of April as circled).

The setup in May was clearly bullish, no matter the news or apathy back then, the price action was bouncing from extreme oversold conditions and as studied, the setup suggested a visit to the 20 weekly moving average, some consolidation at that blue line, and bullish continuation.

The IWM reached new all time highs, and the $247 price mark that currently is suggesting a healthy pullback before bullish continuation as presented to premium subscribers with more technical rationale.

The price levels in the top-left corner of the chart are color-coded: weekly levels are set in a green background, and monthly levels use a blue background. The most critical figures, the weekly central level and the monthly central level, are presented as underlined and bold. The closing price from the previous Friday is highlighted with a black background. This combination of features provides superior visibility of all key levels, allowing an investor to effectively monitor the analysis written based on technical indicators and the potential bullish or bearish destinations pointed out by the red and green arrows.

To gain full access to the weekly technical setups for the 20 mentioned securities, along with the detailed Support and Resistance levels for even more assets, upgrade your subscription today.

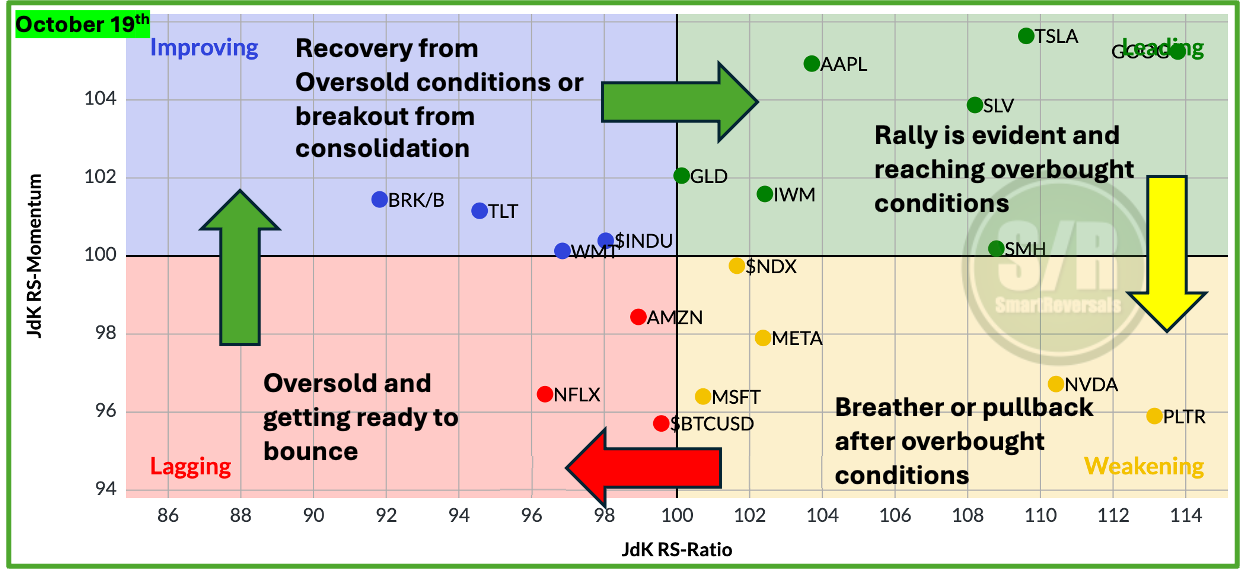

For a premium/paid subscriber, the benefit of constantly analyzing a set of premium securities is the ability to see rotation opportunities. Not all stocks are in the same phase of a trend.

The following rotation map from the Weekly Compass posted on October 19th, shows the position of each security we study relative to the SPX, with AAPL and TSLA in a strong position, NVDA in a pullback process, and NFLX in a weak position.

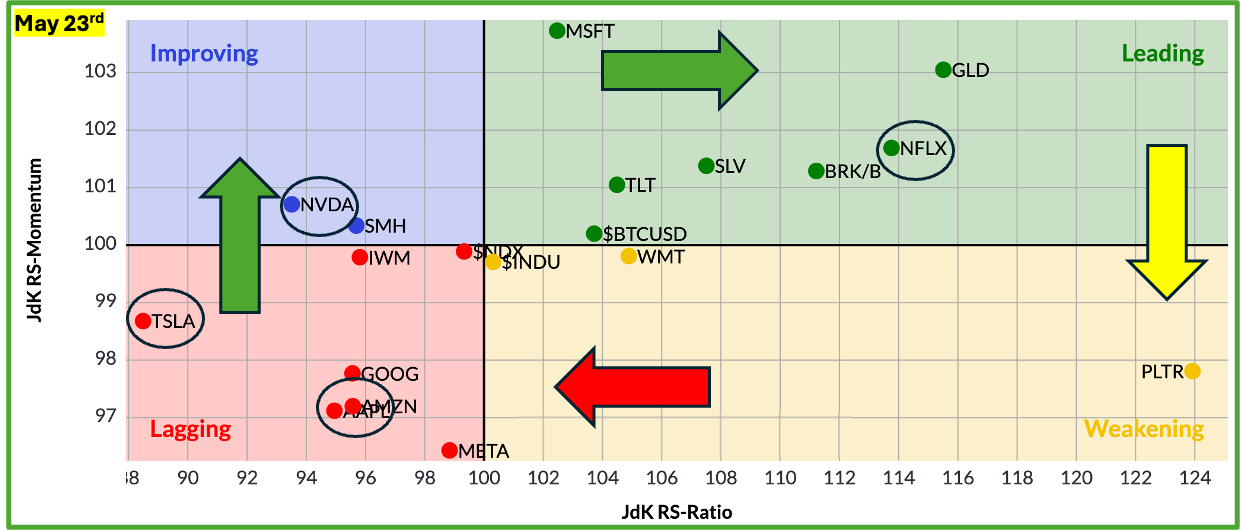

The second rotation map below, from May 2025 presents a different picture, back then NFLX was the darling, while AAPL and TSLA were laggards, and NVDA was just in the beginning of its rally. Momentum changes and that’s what we monitor in the Weekly Compass!.

See how different the positions were on May 23rd:

That said, the weekly charts help us to assess the direction of price action, and this is essential before considering any potential reversal or consolidation at a specific price level.

Fundamental Analysis - Essential at this Stage

While technical analysis tells us what is happening with price, fundamental analysis reveals why it’s happening. Understanding the story behind the chart is crucial for determining if a rally is backed by real substance or if it’s just a bubble that could vanish quickly. Some strategies start with fundamental analysis to find good companies and then use technicals to find an entry. My approach, however, focuses on big-cap and mega-cap stocks—I never analyze small caps. I prefer to screen for high-probability technical setups first, and then I dive into the fundamentals to validate the trade. This “fundamental check” includes assessing the company’s overall financial health, its competitive landscape, any durable competitive advantages, revenue growth, and its cash position—all key elements that provide a complete picture of what’s driving the company. For this reason, I constantly update the fundamental analysis for our core group of securities, especially after they post their quarterly earnings reports.

You can find this complete library of fundamental analysis at the link below.

That said, I check the fundamentals for the regular companies and some others that are part of the S&P 500 or Nasdaq 100.

Why not Starting from Fundamentals?

There are fantastic companies out there with very weak price action, my classical example is PYPL, which has not recovered from the 2022 bear market. Another example of a great company that is finally awakening is BABA, a sleepy elephant until mid 2024, but still far from its all time highs despite of great fundamentals.

That said, I start from the technical setup, focused on companies listed on the SP500, Nasdaq100, or special well known cases like TSM, BABA, JD, and others that have been worth a fundamental deep dive.

Part 2: Defining Support & Resistance

Now it’s time to talk about support and resistance levels; it follows the analysis of a technical chart, and ideally the references of the strength of a company from the fundamental perspective. We now know how sustainable can be a rally… or a selloff (remember my fundamental analysis for UNH when the stock cratered months ago, it has bounced more than 20% since then).

What a Support / Resistance Level is?

In technical analysis, support and resistance levels are specific price points where buyers or sellers may step in with enough force to halt the current price movement and potentially reverse its direction. They are technical analysis tools used by traders and investors to identify areas on a chart where the price of a security (Stock, ETF, Cryptocurrency, etc.) might be likely to pause or reverse:

Support Line: It represents a price level where buying pressure can prevent the price from falling further. When the price approaches the support line, there’s a tendency for buyers to jump in when the price is oversold, anticipating a bounce.

Resistance Line: It represents a price level where selling pressure is strong enough to prevent the price from rising further when it is overbought. As the price approaches the resistance line, sellers might become more active, anticipating a decline.

These lines are not guarantees of future price movements, but they can be helpful tools for identifying potential turning points in the market when the price is oversold or overbought.

Again: Support and Resistance levels MUST be combined with technical indicators, for example: When the Bollinger bands are widening, there is a recent bullish MACD crossover, and the Stochastic and RSI are leaving the oversold area; a resistance level can be easily flipped to support; similar case when there is a bearish MACD crossover, a shooting star candle, and the RSI and Stochastic are falling from overbought zone: a support line can be easily breached. That said, oversold or overbought conditions increase the likelihood of a reversal, a price level alone do not guarantee any bullish or bearish reversal.

How Support and Resistance Levels are Used

Support and resistance levels are crucial tools for traders and investors to confirm the validity of trading setups and to gauge the likelihood of a trend continuation. Here’s how they are used:

1. Validation of Reversal Setups:

Bullish Reversal: When a price approaches a well-established support level and exhibits signs of buying pressure (e.g., bullish candlestick patterns, positive divergence on oscillators), it can validate a potential long (buy) setup.

Bearish Reversal: Similarly, when a price reaches a significant resistance level and shows signs of selling pressure (e.g., bearish candlestick patterns, negative divergence on oscillators), it can validate a potential short (sell) setup.

2. Confirmation of Trend Continuation:

Breakout Above Resistance: When the price decisively breaks above a resistance level with strong volume and conviction candles, it can signal a continuation of the existing uptrend and the resistance flipping to support (that’s why I say that a level does not guarantee a reversal if the price is not overbought or oversold).

Breakdown Below Support: When the price breaks below a support level with strong volume, it can signal a continuation of the existing downtrend. This breakdown indicates that selling pressure has overpowered buying interest, and the price is likely to fall further. The support flipped to resistance.

3. Analyze Potential Reversals when the price is Overbought or Oversold:

When the price reaches these levels, it may reverse direction, providing potential signals for traders to enter or exit positions. Candlesticks must be analyzed and ideally an oscillator.

4. Watch for Breakouts and Breakdowns:

A breakout occurs when the price breaks above a resistance level, while a breakdown occurs when the price breaks below a support level. These can signal significant changes in the trend.

Overbought and Oversold Conditions - Examples

So far I have emphasized that a level acquires more relevance for a potential reversal when the price is overbought or oversold, here are some cases:

Overbought Condition 📈

An overbought condition suggests that a rally might be due for a pause or reversal because the price has moved up too far, too fast.

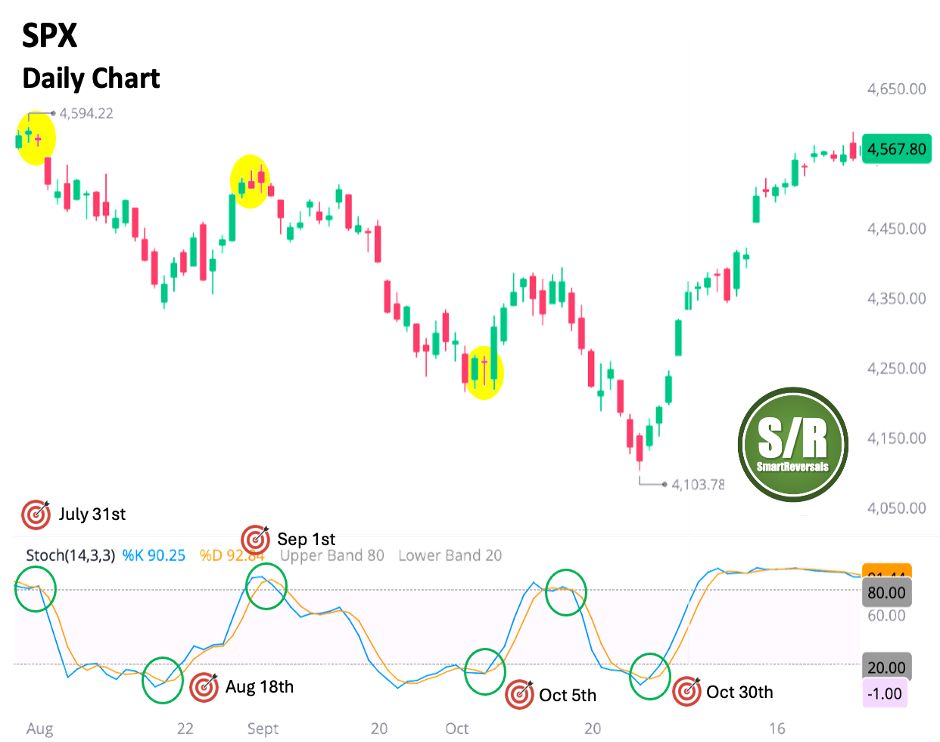

With the Stochastic Oscillator: A security is considered overbought when the oscillator reading goes above 80. On the SPX Daily Chart, the yellow circles (like on July 31st and Sep 1st) highlight where the Stochastic crossed above 80, signaling overbought conditions that preceded a price decline.

With the Relative Strength Index (RSI): A security is considered overbought when the RSI reading goes above 70. The Google Daily Chart shows a red circle where the RSI moved above 70, indicating an overextended move right before the price pulled back. See the confluence with the Stochastic also overbought.

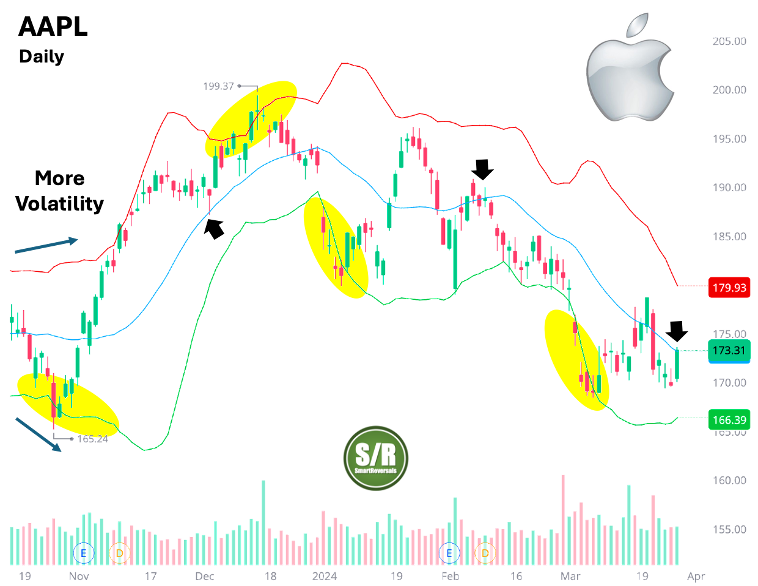

With Bollinger Bands: A price is considered relatively overbought when it touches or moves above the upper Bollinger Band. The AAPL Daily Chart shows a period in December 2023 where the price pushed above the upper band, which was followed by a price reversal back toward the middle band.

Oversold Condition 📉

An oversold condition suggests that a price decline may be losing momentum and could be due for a bounce or reversal.

With the Stochastic Oscillator: A security is considered oversold when the oscillator reading drops below 20. On the same SPX Daily Chart above, the green circles (like on Aug 18th and Oct 5th) show the Stochastic curling up below 20.

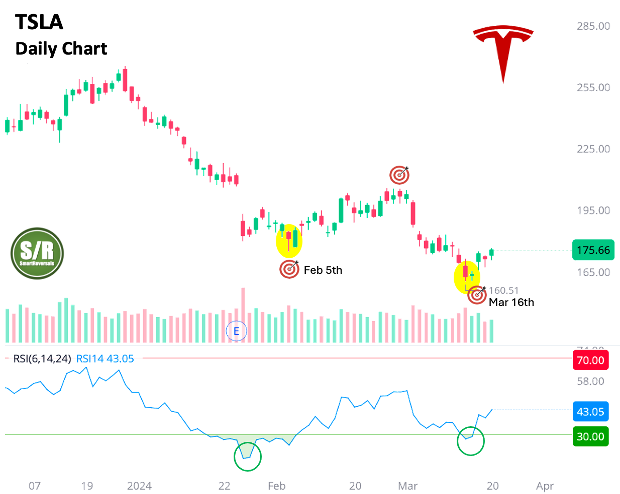

With the Relative Strength Index (RSI): A security is considered oversold when the RSI reading drops below 30. The TSLA Daily Chart shows the RSI falling into the oversold zone (below 30) on two occasions (Feb 5th and Mar 16th), both of which signaled a price bottom before a bounce.

With Bollinger Bands: A price is considered relatively oversold when it touches or moves below the lower Bollinger Band. The same AAPL Daily Chart above highlights periods in November and March where the price fell below the lower band, signaling an “oversold” state that was followed by a bounce.

When two or more indicators are aligned presented oversold or overbought conditions, the signals increase the relevance of a resistance or a support level respectively.

To gain a deeper understanding of the indicators mentioned, as well as the essential candlestick patterns needed to decipher market sentiment, visit my Market Intelligence and Educational collection here:

Key Principles of S/R Levels

In downtrends, a support level has more relevance for potential bounces when the price is getting oversold; in uptrends, a resistance level is more relevant for a potential bearish reversal when the price is getting overbought.

The more times a support or resistance line has been visited (3+) and temporarily breached, there are more chances of a breakdown or breakup. More attempts of crossing a line eventually bring the move that invalidates the line.

Support and resistance lines can be broken, validating momentum for a trend. If the price decisively breaks through a support level, it can signal a downtrend. Conversely, a break above a resistance level can indicate an uptrend.

Support and resistance levels can become each other. If a support level is broken, it can become a resistance level, and vice versa.

Proof of Concept

There are two good news for you:

You don’t have to stress out about calculating them, every Friday you can receive seven layers of Support and Resistance Levels for 44 securities, you include them in your charting platform, you can set an alarm when it is reached, or simply have it in your weekly journal for the securities you trade.

You can use diagonal trend lines, horizontal lines based on previous tops or bottoms, Fibonacci (included in my eBook), Volume profile (soon in the eBook), or predictive levels as the ones I use.

The levels provided every week are calculated ahead of time, the levels have proven to work, this example for QQQ (one of the 44 securities provided), shows weekly S/R levels provided the previous Friday before the price action actually happens.

As you see I use oscillators and candlesticks in this analysis as I do in the charts published in the Weekly Compass, other indicators like Bollinger Bands are also useful.

Part 3: Monthly and Weekly Levels - How to Use Them?

Weekly Levels: The Swing and Day Trader’s Guide

When analyzing price action relative to the weekly central level, you’re essentially looking for a medium-term directional bias and key weekly support/resistance levels.

What it Means to be Above/Below the Weekly Central Level

Above the Weekly Central Level (Bullish Bias):

Short-Term Strength: When price action consistently trades above this level, it suggests a dominant bullish sentiment for the current week . This indicates that buyers are generally in control on a week-to-week basis.

Weekly Support: The weekly central level acts as a key support level. If price pulls back on a daily or intraday chart and finds support at the weekly central level, it’s often seen as a good opportunity for bulls to re-enter or add to positions, expecting the uptrend to continue for the rest of the week. However, if the level is breached, there would be bearish confirmation and vice versa.

Targets Higher Resistance: Traders will often look for price to advance towards the weekly resistance levels (as mentioned in the weekly compass every Saturday, as the immediate bullish target if the price remains above the central level).

Confirmation of Uptrend: If you’re seeing a daily uptrend, price staying above the weekly central level provides a strong confirmation that this uptrend has momentum on a larger, weekly scale.

Below the Weekly Central Level (Bearish Bias):

Medium-Term Weakness: Conversely, if price action consistently trades below the weekly level, it signals a prevailing bearish sentiment for the current week . This indicates that sellers are generally in control.

Weekly Resistance: The weekly central level, in this scenario, acts as a key resistance level. If price attempts to rally on a daily or intraday chart but is rejected at the central level, it often suggests the bearish trend will continue for the remainder of the week.

Targets Lower Support: Traders will anticipate price declines towards the weekly support levels, beginning at the first bearish target that could provide support, otherwise the bearish momentum would accelerate towards the supports below.

Confirmation of Downtrend: If you’re observing a daily downtrend, price remaining below the weekly central level confirms that this downtrend has significant weekly momentum.

In essence, the weekly central level serves as a “line in the sand” for the current week’s directional bias. Daily fluctuations around this level will be interpreted in the context of whether the price remains above or below it.

Monthly Levels: A High-Level Compass

The monthly central level provides a high-level “compass” for the overall security direction and sentiment throughout the entire month. A daily chart might show intraday pullbacks, but if the price remains above the monthly central level, the broader bullish sentiment for the month would still be considered intact, and vice versa.

Mid-Term Bullish Bias: If the daily price action is consistently trading above the monthly central level, it generally indicates a strong underlying bullish sentiment for the entire month. This suggests that the bulls are in control on a larger scale.

Setting Targets: Traders and investors will look for price to reach higher monthly resistance levels when the price is above the central level, and vice versa for support levels when the price is below the central level.

Confirming Weakness: Trading below the monthly central level confirms the overall weakness of the asset or market for the current month.

Use Case: This makes them ideal for position traders and those with a mid-term investment outlook. They provide a broad, overarching view of the market’s sentiment for the entire current month.

Strategic Planning: Use monthly levels to establish your monthly bias. If you’re fundamentally bullish on a stock for the medium or long term , but it’s trading below its monthly central level, you might wait for it to reclaim that level before increasing your position, or use the weekly levels to manage risk in the short term if the chart is showing signs of a bullish reversal conquering weekly resistances.

Combining Monthly and Weekly Levels

This is where the real power comes in. Don’t use them in isolation.

Start with the Big Picture (Monthly Levels): First, identify the monthly central level and its S/R levels. This sets your primary bias. If the price is above the monthly central level (bold and underlined number with blue background in the tables below), your default stance might be bullish and pullbacks would be confirmed as significant bearish reversals when the central monthly level is lost.

Refine with the Medium Picture (Weekly): Then, overlay the weekly central level and its S/R levels.

Confluence is Key: Look for instances where a weekly central level aligns closely with a monthly central level or a monthly S/R level (two lines combined are relevant even if it is a weekly central level and a monthly resistance level. These areas become stronger than when the lines are separated among each other.

Trend within a Trend: Staying above both weekly and monthly central levels indicates bullish momentum, there are usually pullbacks when this condition persists for several weeks, since the price becomes overheated relative to oscillators.

Warning Signals: If a weekly downtrend breaches monthly support, it’s a stronger signal of a potential long-term reversal than just a daily breach.

Part 4: The Micro Perspective (Analyzing Price Action at the Levels)

Indecisive Price Action Makes Levels Essential. We’re navigating market environments that are far from straightforward. During these times, technical analysis isn’t just helpful—it’s indispensable. When you see a candlestick forming near a major support line amid ongoing macroeconomic headwinds, it’s more than just a price reaction; it’s a signal that market participants may be defending what they perceive as fair value, despite external pressures.

Combining Candlesticks with Price Levels for an Edge

We studied above the definition of overbought or oversold conditions, in this part you can enhance that approach with the study of candlesticks.

How exactly do you combine these elements for an edge? Here’s a useful guide:

Identify Key Levels: First, the levels provided in this publication provide precise support and resistance zones for the week ahead, considering also the monthly levels.

Monitor Candlestick Formations: With your levels clearly marked, keep an eye on candlestick behavior as price approaches these zones. For example, if you witness a bearish engulfing pattern near resistance, it signals that bulls might be losing control and a reversal could be forming . Conversely, if a bullish pattern appears at support, it might indicate that value buyers are stepping in; a sign the price could stabilize or even reverse upward.

Volume as Confirmation: Always pair these signals with volume analysis. An increase in volume during a reversal setup lends credibility to the move. In unstable markets... volume confirms whether these technical signals are supported by genuine market conviction.

Analysis Chart Examples with Candlesticks

Price action has to be considered with S/R levels, it means candlesticks, they bring signals that help to validate if a level is likely to set a reversal or if it going to be breached.

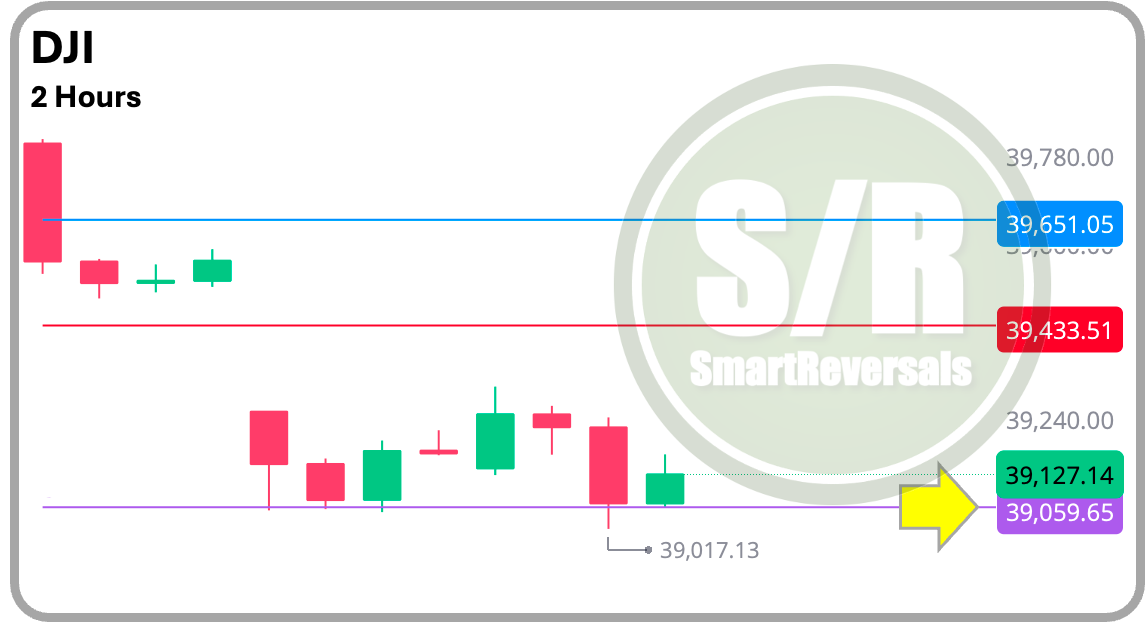

DJI (2 Hours): Breaching the Central Level This two hours timeframe for Dow Jones shows how $39,651, the central level was breached with a conviction candle (belt hold), price started a decline that ended in the second support level (there are 3 resistance and 3 support levels next to the central level provided, in this case $39,059 supported price:

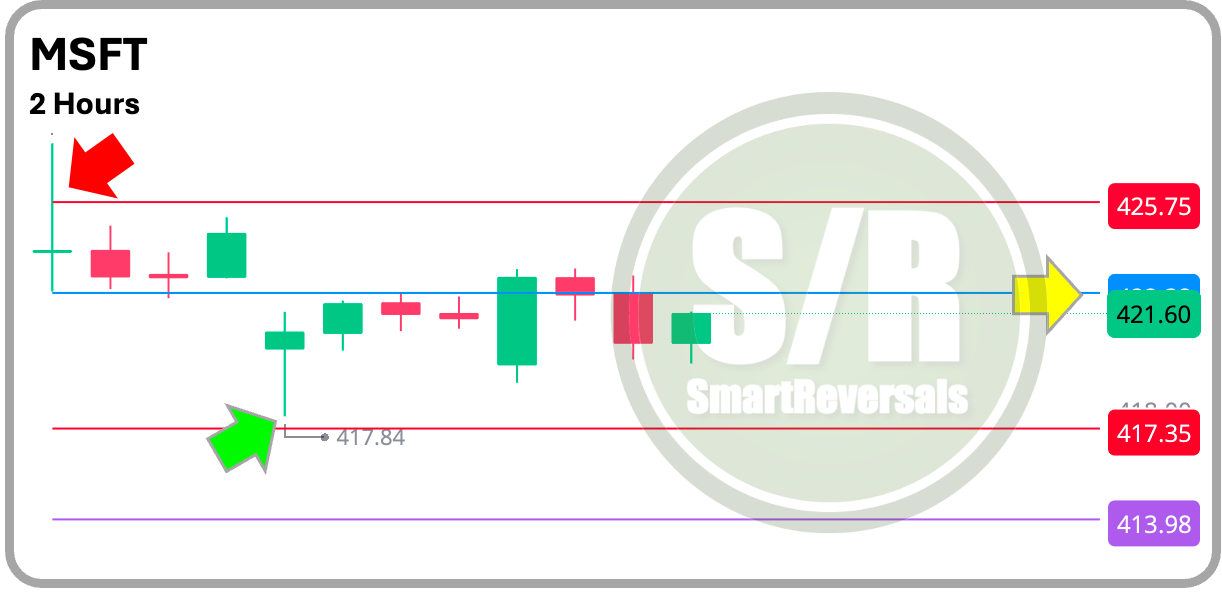

MSFT (2 Hours): Candlesticks at S/R Levels See the following example for MSFT, and the first candle that opened the month of April finding rejection at $425... The shooting star found rejection at $425.7, price moved down to the $417.4 level finding support, printing a hammer candle that suggested bullish bias, anyway the central weekly level invalidated the bullish thesis in this example at $422.

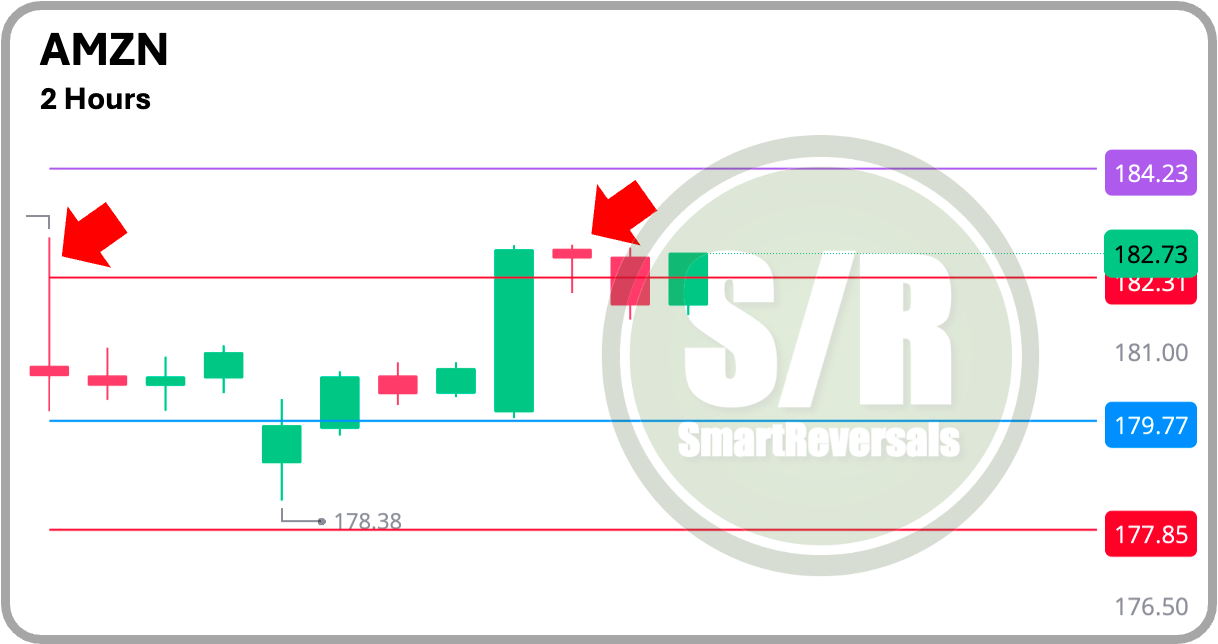

AMZN (2 Hours): Candlestick Warnings Check the green long candle... the $182 level was temporarily crossed just to retrace and drawing a shooting star candle. Two days later there is another bullish attempt but a hanging man warns about a retrace. AMZN and MSFT provide example of choppy price action but they’re useful to highlight candle formations at S/R lines.

IWM (2 Hours): Combining with Oscillators Use support and resistance levels in conjunction with other technical indicators like moving averages, RSI, or MACD for confirmation. IWM observed resistance at $206.2, four failed attempts to cross it or four candles stopping their move at that level validates its significance in the chart, on the other side the Stochastic oscillator starts to curl down indicating momentum is fading and reducing probabilities of a price jump.

SPY (Daily): Multiple Tests and Reversals The next examples for SPY shows several attempts to cross the $516 level in March; after 6 occasions price finally jumped above that level, just to find rejection close to $525 and sealing a decline with a gravestone. The following week, $517 provided support. Bear in mind that these lines are provided ahead of the week, they are not included in the chart after the price action occurred.

Now you have more references about using oscillators, Bollinger Bands, and Candlesticks to consider potential reversals or consolidations (continuations) at a support or resistance level. This publication combines all of those indicators in more chart examples:

Support and Resistance Levels are a REFERENCE to place STOPS - Why a reference?

The price can reverse at the exact S/R levels sometimes, but in other cases price crosses the line to return quickly to the other side, as a trader using weekly levels or even as a long term investor using monthly levels or weekly levels when the price is overheated. You should set stops below a level (for long positions) or above a level (for short positions) depending on your risk tolerance.

When you allow more space to move, a level is less likely to be breached multiple times, but when a stop is triggered, the pain of losing more money than with a tight stop would be higher.

When you give less space to move to a trade, a stop can be triggered quicker, but the price may return to to the expected zone and you’re out of the trade, unless you’re in front of the screen and reopen the position.

Each scenario has an upside and a downside, but no matter which one you use, as long as you are disciplined both work.

SPX - 8 Months of Validations

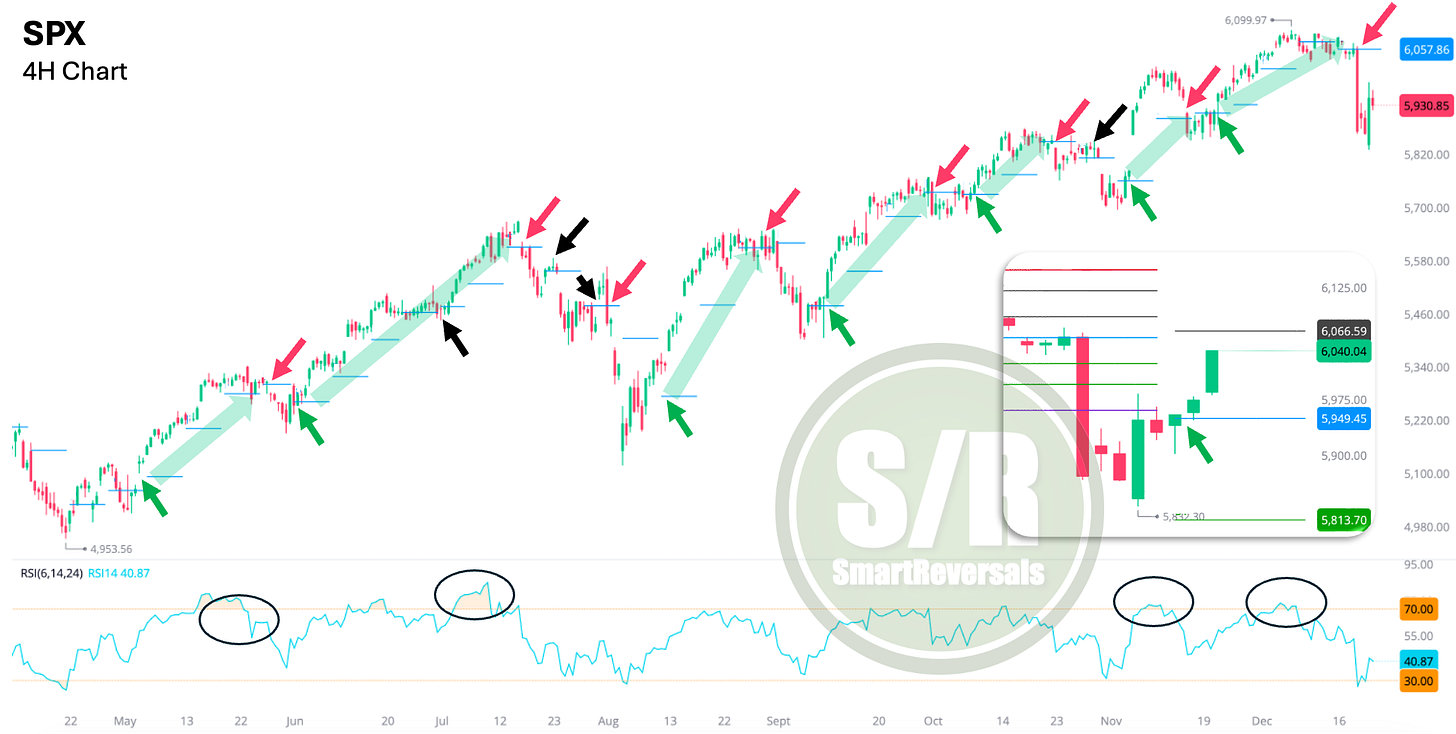

Let’s study the SPX chart describing the arrows:

Blue Horizontal Line: The central level you receive in advance every Friday for 40+ securities

Green Arrow: The buy signal triggered when price is above the central level

Red Arrow: Sell signal when price breaches the central level

Black Arrow: False breakouts of false breakdowns considering momentarily moves above or below the central level, some of them present indecision candles that correctly advice about a potential reversal.

Yes, there are choppy weeks, we all want the perfect buy and sell, but trading is about risk management and following a process as any profession, so one thing that can be done for those weeks is to consider the weekly setup, which is analyzed in the Weekly Compass along with the technical chart.

Weekly Compass + S/R Levels compliment each other.

Other Indicators: See how choppy the price becomes then the RSI is overbought, it helps to be prepared for a move, and to avoid doing premature moves.

Soft Green Arrows: Imagine riding the moves highlighted from green to read arrows, once that is managed, you don’t care about missing a portion of the peak or the bottom, because at that moment you have and edge, a solid method that keeps you focused.

You can study more backtests of the central weekly level for different securities in the following publication:

Part 5: How to Execute a Trade Using S/R Levels

This section details how to open or close a position, long or short, when using support and resistance levels.

Step 1: The Weekly Chart Sets the Stage

Before even looking at a central weekly level, you determine the market’s overall sentiment from the weekly candlestick chart. This is your strategic bias for the entire week.

SPX Example: For the week ending April 25th I posted the chart presented below, the SPX didn’t just have a random up-week. It formed a bullish reversal setup. This was suggested by:

Price Action: A strong bounce off a low point recovering the central weekly level.

Candlestick: A solid bullish candle suggesting buying pressure and momentum for the week ahead.

Context: The bounce occurred from oversold conditions (as indicated by the bullish crossover in the Stochastic oscillator), adding weight to the reversal signal.

This weekly setup is the reason to even consider a bullish trade. Without it, any buying signal on a shorter timeframe is less reliable for long positions.

Step 2: The Weekly Central Level as Your “Line in the Sand”

This line becomes your primary reference for the entire week...

Bullish Condition: If the weekly chart analysis is bullish, you want to see the price stay above the central level. This level acts as a dynamic support zone.

Bearish Condition: If the weekly setup is bearish, you would want to see the price stay below the central level, which would then act as resistance.

Step 3: Executing the Trade (Entry Strategies)

With the weekly bias established by the chart and the central level as your guide, you can now look for an entry.

Method 1: The Confident End-of-Week Entry An investor or a swing trader might open a long position around the close on Friday or the open on Monday, based on the strength of the weekly setup alone. The plan is simple: stay in the trade as long as the price remains above the central level (Back then at $535 for SPY, or $5,384 for SPX). This approach relies on the power of the weekly signal.

Method 2: The Validation Entry By Monday, or at any other day of the week, a long position can be opened as long as the price is above the central weekly level, or a short or exit can be done as long as the price is below the central weekly level. Watching the candlesticks and indicators presented above is key.

Method 3: Waiting for Confirmation Wait for the price to bounce off a support or resistance level before entering a trade. Confirmation can help reduce false signals. The risk with this approach is that the price can rally without a retest.

There is no bullet proof approach, and as mentioned above, the process and consistency is more important than perfection.

Step 4: Managing the Trade (Defense and Offense)

Once you are in a trade, your focus shifts to risk management and profit-taking.

1. Setting Your Stop-Loss (The Defensive Play)

Support and resistance levels provide logical references to set stop-loss orders. Place stop-loss orders below support or above resistance levels to manage risk.

Crucially: Do NOT set a stop loss exactly at a support level. Here’s why:

False Breakouts: Prices can often temporarily break through a support level before reversing direction. If your stop loss is set exactly at the support level, you could be prematurely stopped out. (Check again the QQQ chart, price reverses exactly or before the level, and other times the level or line is briefly breached).

Market Volatility: Markets can be volatile, and sudden price movements can cause your stop loss to be triggered even if the overall trend remains intact.

Instead, consider placing your stop loss slightly below the support level, giving yourself some room for price fluctuations.

The “Buffer Zone”: Instead of placing your stop at the central level, you place it a certain percentage below it. This creates a buffer to absorb volatility.

Low Volatility: A 0.5% buffer below the level might be sufficient.

High Volatility (wide level ranges): A 1% buffer gives the trade more room to breathe and respects the current market conditions.

Risk Tolerance: Set your stop loss based on your risk tolerance and the size of your position. Each person has to define how lower, it depends of risk tolerance and personal choice.

This document does not suggest a stop loss, it provides the references and each trader who wants to set a stop loss should use the S/R levels and calibrate the level of tolerance above them (for shorts) or below them (for longs).

2. Setting Price Targets (The Offensive Play)

Traders can use these levels as potential targets for their trades. For example, if a price breaks above a resistance, the next significant resistance level above it can be considered a potential profit target. The same logic applies to bearish targets below broken support.

Reading Momentum at the Next Level: When the price breaks through a resistance level... you must assess the quality of the break.

Strong Break (Momentum): A long, solid-bodied candle (like a Belt Hold) breaking through resistance suggests strong buying pressure and the likelihood of continuation.

Weak Break (Indecision/Reversal Warning): If the price breaks the resistance... but the candle that follows is a Doji (indecision) or a Shooting Star (reversal signal), it’s a yellow flag. This is the market telling you that momentum is fading.

Always Confirm with Indicators: No matter the timeframe, check your tools. Did the break of the first resistance occur with the RSI entering overbought territory? Is the price hitting the upper Bollinger Band? These add context to the candle signals.

3. Trailing Your Stop-Loss to Lock in Profits

This is the final, crucial step... Once the price has successfully broken through a resistance level (e.g., the immediate bullish target for the week) and you’ve assessed that momentum is strong, you can adjust your exit criteria to protect your gains.

The Adjustment: You can “move up” your stop-loss from its original position (e.g., -1% below the central weekly level) to a new, higher level. A logical new spot would be breakeven or slightly above the central weekly level.

The Logic: By doing this, you have transformed a trade that had risk into one that has zero risk of principal loss. You are now playing with the market’s money. Your new goal is to capture further upside toward the next resistance level, while ensuring you give back minimal profit if the trend suddenly reverses.

The S/R levels are not exact recommendations for stop losses or stop buys, every person is different and has to set as little or as much as they want the distance to the S/R levels. Some people can use a -0.15% price variation below the level to set stops for longs, and some other people can set the first support level or the same -0.15% below the first support level to provide space to price action.

This publication provided a guide about the top - down approach using the S/R levels as validation of technical signs, not as a sole indicator, please let me know any questions.

Send me a DM, any question is valid.

The content provided on SmartReveals.com is for educational and informational purposes only. All analyses, research, commentary, and other materials are intended to help users understand financial markets, investment concepts, and company fundamentals. This content does not constitute investment or any type of advice.

Absolutely unreservedly positively the clearest deepest stock investing tutorial ever! I got it - investing is hard work - but if a person is willing to wade through your training - a bit each day (bite size pieces because it’s so substantial) there will be more peaceful nights and more in the bank to serve others! Wow! Peace and blessings! 🙏🤗

This can be one of the most complete guides I have ever read, thanks for the clear flow, it’s always good to remember that levels work in the context of a technical setup, and technical setups need to be backed up by fundamentals. Thanks for the eBook!