Bearish Weekly Engulfing Candle for SPX and NDX

Annual Levels Rejected the Rally as Expected; Now What? - S/R Levels for the New Month and Week

In every technical chart I provide the most relevant annual levels. In recent weeks, I highlighted $23,654 for NDX and $6,486 for SPX, advising caution once one of those levels were reached. Last Sunday, I also highlighted four indicators to help navigate the rally, anticipating that Amazon's earnings could trigger a much-needed pullback.

The pattern is repeating just as it did in 2022, 2023, and 2024: an overextension in July followed by a pullback starting in August. This has been compounded by recent jobs data—Non-Farm Payrolls came in at 73K versus the expected 106K—which, along with fresh news about tariffs, triggered a negative reaction in the stock market.

Let's review the weekly support and resistance levels provided last Friday for the SPX and NDX before we delve into the monthly levels for August and the weekly ones for the coming days. Premium subscribers understand the importance of the central weekly level as a reference for short-term bullish or bearish momentum. While those levels were lost this week, even more notably, the monthly central levels for August—sensitive lines used to assess momentum—were also lost today. Get access to these key lines to assess any potential bounce and avoid falling into bull traps during this well-known bearish season of the year.

SPX Summary:

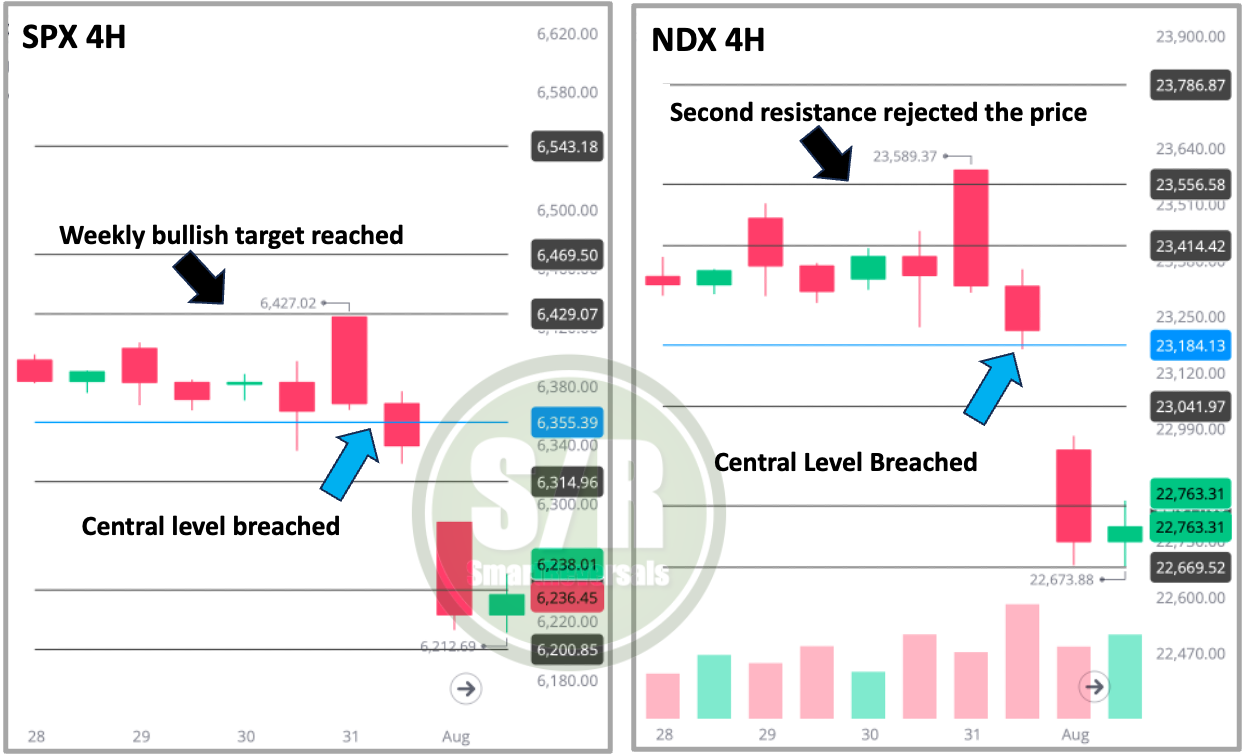

The weekly central level anticipated last Friday for the SPX was $6,355.4.

Monday, July 28: The week began with SPX trading between the also anticipated first resistance ($6,429.1) and the weekly central level. Price showed indecision, staying in a narrow range.

Tuesday, July 29: The SPX price continued to consolidate between $6,429.1 and the weekly central level. There was a brief move down that neared the weekly central level $6,355.4 but did not breach it.

Wednesday, July 30: The price printed a 4H doji in the morning continuing with the indecision during market hours, followed by a first bearish attempt breaching $6,355.4 but the price bounced closing above the central level.

Thursday, July 31: The positive earnings results for META and MSFT made the futures rally, but the anticipated resistance $6,429.02 rejected the price and the selloff started, breaking below the central level in the afternoon. This breach suggested a shift to a bearish momentum.

Friday, August 1: The price action confirmed the bearish momentum by dropping significantly from the previous day's move. It broke through the first bearish target ($6,315.0) and the second support ($6,241.3). The low of the day was at $6,212.69 which is near the third support level ($6,200.9).

The summarized price action combined with the support and resistance levels posted on July 25th for the week that just ended are the best proof of how these lines frame the price action ahead of time, so traders and investors have in anticipation essential levels where the price can reverse, and other levels that once breached they act as momentum checkpoints.

NDX Summary:

The weekly central level for NDX was $23,184.1.

Monday, July 28: NDX started the week with price action between the first resistance ($23,414.4) and the weekly central level. The price showed some consolidation around these levels like the SPX.

Tuesday, July 29: The price moved up and breached the bullish target ($23,414.4), before pulling back below the resistance anticipated.

Wednesday, July 30: The price continued retesting $23,414.4 without success, the afternoon candle was a hanging man that was temporarily invalidated when the futures soared.

Thursday, July 31: The second resistance in confluence with the annual level mentioned above rejected the rally printing a bearish engulfing candle.

Friday, August 1: The price consolidated a weekly engulfing candle, reaching the third support for the week at $22,669.5, finding preliminary consolidation during Friday afternoon.

Since some moves are done in extended market hours, I always provide the levels for the ES Futures and NQ Futures.

The levels work much better with technical indicators, for that reason the recent educational pieces about S/R levels are essential to improve accuracy, get access to the content here:

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, UNH, AVGO, COST, PFE, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Subscribe now, and unlock all the technical and educational content. As anticipated, the price action was showing exhaustion, have the right tools to navigate it.

Next week I will start updating fundamentals for the Mag 7, unlock the fundamental library as well.

Let's continue with the support and resistance levels for next week, as well as the monthly levels for August. These are the levels I use to validate bullish and bearish setups and to prepare for potential reversal zones.

WEEKLY LEVELS: