Is the Pullback Over?

Levels for August 25th - 29th - Indices - ETFs - Crypto - Stocks

The setups analyzed in last Saturday's Weekly Compass anticipated the recent decline. Price action was indicating indecision amid overextended conditions, and the market leaders that fueled the rally were signaling a pullback (and many still are), as detailed in the individual security analyses. Importantly, that edition also provided a worst-case scenario for an S&P 500 selloff, using the same approach I used in December 2024 to anticipate a visit to the $4,830 level. The bear market bottomed in April 2025 at $4,835.

Make no mistake: this is not a market top that is expected to lead to a bear market (-20% decline). The pullback observed until yesterday, given the overextension from July, was due. Its purpose is to reset overbought indicators, and today, the strongest support levels are now a greater distance from the current price of the SPX and NDX.

The Obvious Question Today: Is the Pullback Over?

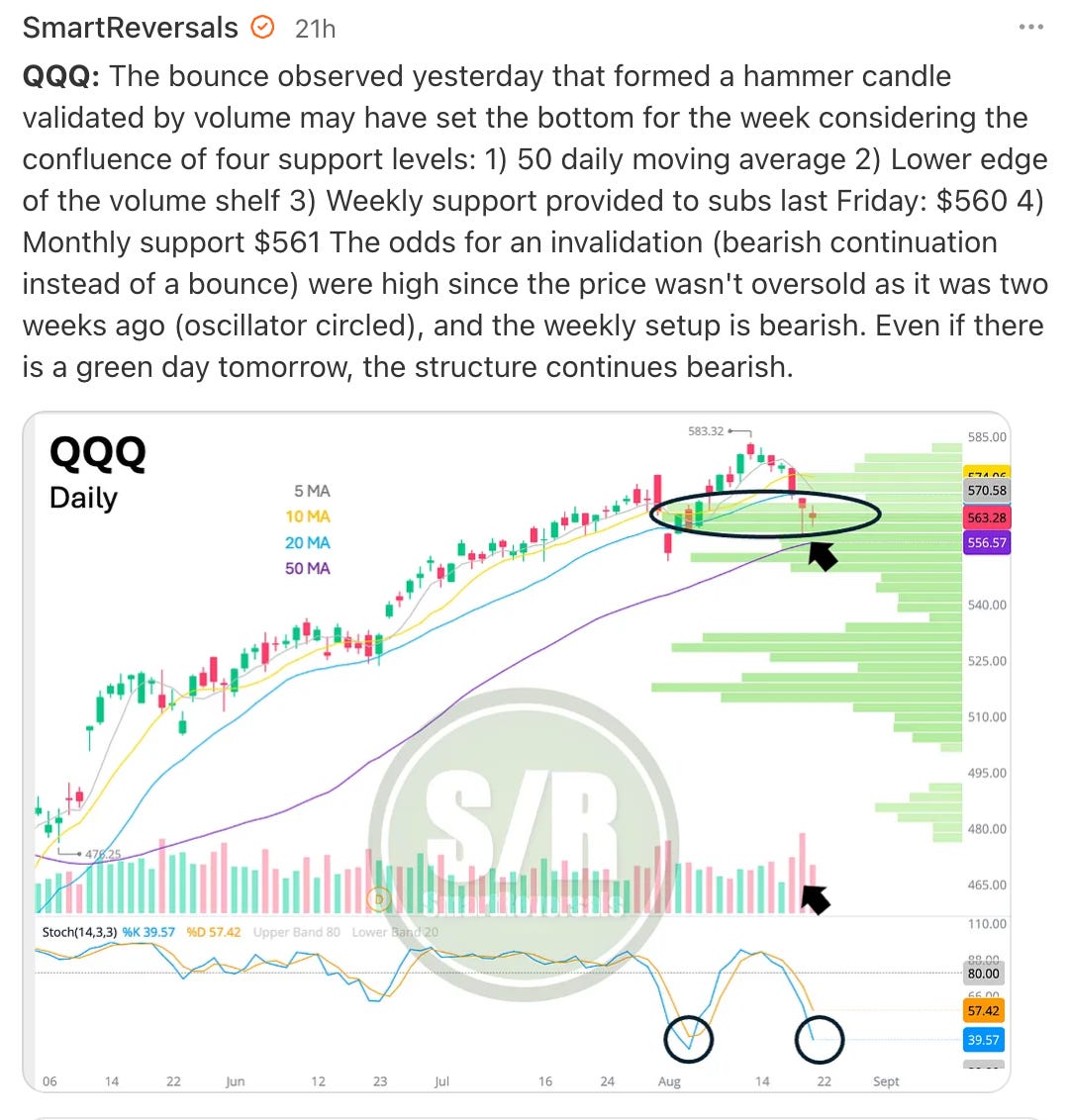

The price found support on Wednesday at a confluence of specific support levels, for example, in the case of QQQ, weekly and monthly support levels matched the 50DMA creating a significant confluence that as I anticipated via notes (click here) in Substack yesterday, the low of the week was very likely to be in, and the chances for a green day today were high, of course, the magnitude of the rally was above expectations.

I will elaborate in the weekly compass about the last sentence in that note using the combination of indicators that premium subscribers know.

Technical analysis provides a reliable compass to navigate the stock market and crypto space. The bearish setups presented last week included Bitcoin, and once again, the reversal occurred right after the signal was presented here. This is not to mention that the $124K price level was anticipated as a target months ago and has been on my charts every single week of this year. This is further proof that reversals can be anticipated. With the right support and resistance levels, the triggers can be identified before it's too late and emotions like regret or FOMO take over. Bitcoin also jumped today after reaching $111K, very close to the $112K which was the bearish target mentioned last week before a technical bounce.

This publication analyzes indices, stocks, ETFs, and crypto, with a focus on Bitcoin and Ethereum. Last Wednesday, I presented a deep dive into Bitcoin that is essential reading—whether you invest in crypto or not. Understanding the fundamentals and macro context for an asset that has seen significant inflows from governments and companies is as critical as being informed about Gold, Oil, or the Volatility Index.

Two recent publications have been mentioned so far: last week's Weekly Compass and the Bitcoin special edition. If you are a new subscriber or missed them, you can access them here:

Remember, you can visit all premium content on the website www.smartreversals.com or download the Substack app to receive notifications.

This publication consistently analyzes the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, UNH, AVGO, COST, PFE, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Finally, the bullish run that began in April was analyzed at its very start. You can access these studies in our educational section, which is organized by topic in the following guide that covers everything from technical, macro and fundamental indicators to options, trading psychology, and macro analysis. It also features dedicated sections on advanced topics like Fibonacci, Elliott Wave theory, and market breadth. The section on my special market studies—is the one mentioned with the studies that support the bull market thesis at this point even if there is a pullback.

Let’s begin with the support and resistance levels, and a preview of the study that will be posted tomorrow:

WEEKLY S/R LEVELS: