Markets End Volatile Week; Bitcoin Extends Selloff

S/R Levels for Next Week: Indices, Futures, Stocks, Metals, Crypto

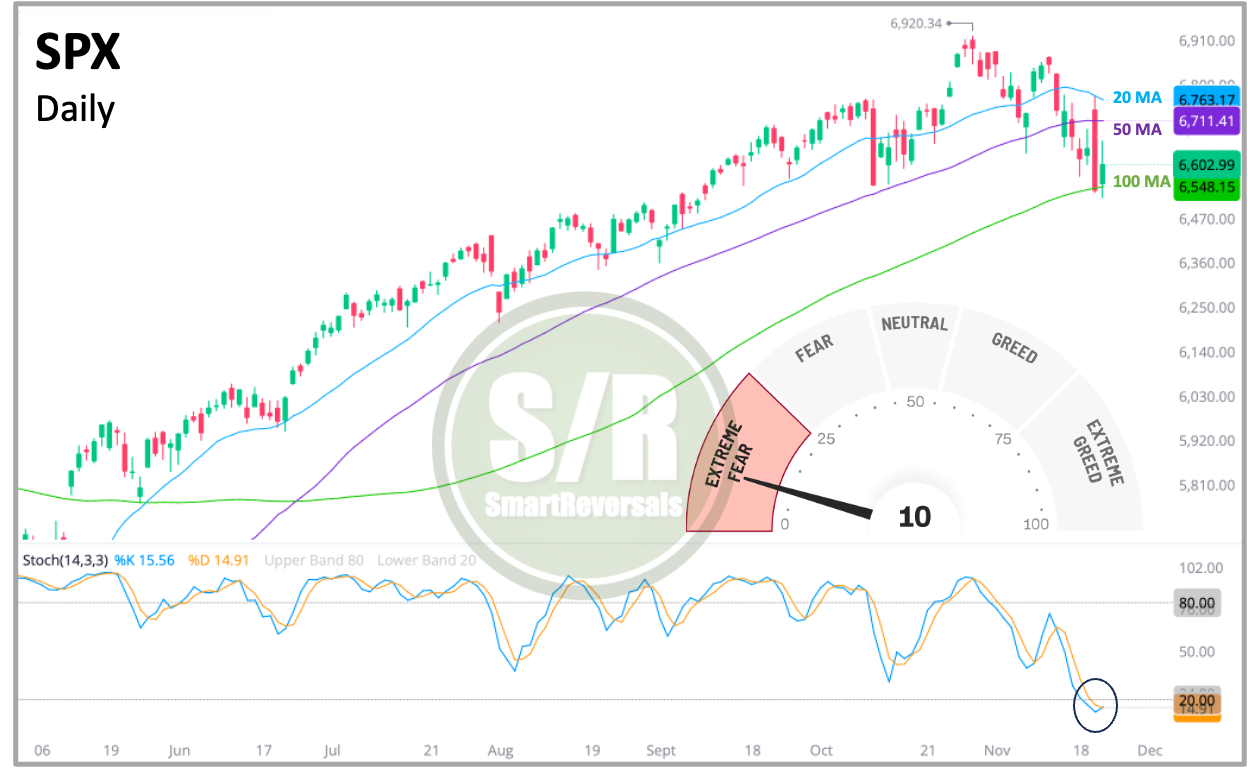

U.S. equities staged a relief bounce on Friday, attempting to salvage a bruising week marked by accelerated volatility and renewed valuation concerns. Despite Friday’s broad-based advance across all eleven S&P 500 sectors, the gains proved insufficient to erase substantial weekly losses. The technology-heavy Nasdaq shed 2.7% for the week, while both the S&P 500 and Dow registered declines exceeding 1.9%. Technical indicators underscore market fragility, with momentum gauges flashing “Extreme Fear” as the S&P 500 closes at $6,603, testing critical support near its 100 day moving average.

On Saturday, I mentioned in the Weekly Compass: “Since the FED minutes will be out on Wednesday, and the market is so looking forward for a rate cut in December, a disappointment in the market could trigger a solid visit to the 20 weekly average also considering the H.O. signal”. The publication can be read here:

The low of the week was precisely the 20 weekly average as the chart below indicates, that moving average presented confluence with $6,527, one of the support levels modeled last Friday in this edition for the week that just ended.

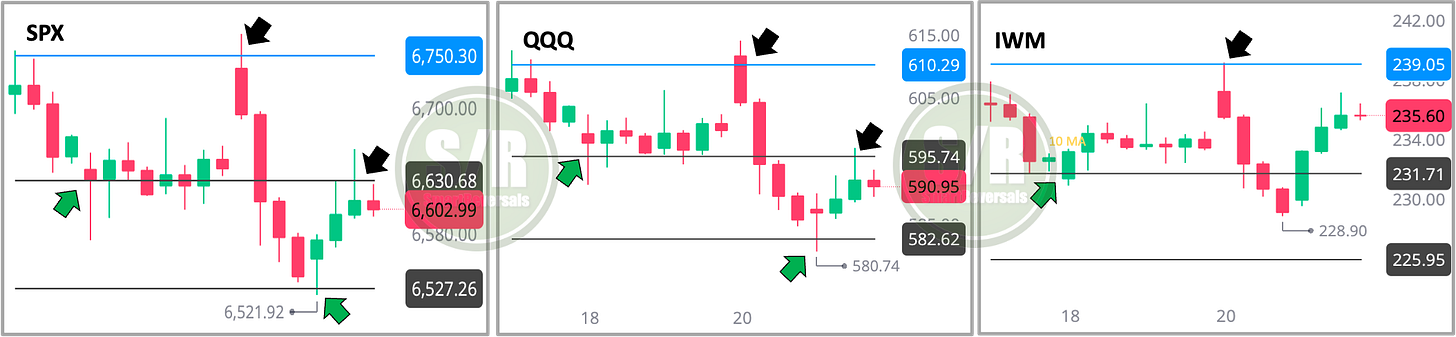

The following two hours charts present the price action during the week for SPX, QQQ, and IWM; they are three of the securities that are modeled in this publication for the week ahead. The blue line is the central level, where clearly there was rejection since Monday morning, setting bearish momentum and providing subscribers strong reasons to stay bearish, along with the Hindenburg Omen signals studied recently and the candlesticks and indicators presented in the Weekly Compass.

The gap up on Thursday was encouraging considering the consolidation that the price was showing during the week at the first support level, however, momentum faded and the central weekly level was never conquered to flip momentum in favor of the bulls.

The bounce on Friday morning occurred at the second support level for the SPX and QQQ, but again, the next support line acted as resistance and the bounce vanished on Friday afternoon.

This publication consistently models the Support and Resistance levels for the following securities to provide a broad market perspective and empower your trading decisions:

Indices & Futures: SPX, NDX, DJI, IWM, ES=F, NQ=F

ETFs: SPY, QQQ, SMH, TLT, GLD, SLV, DIA, SH, PSQ

Major Stocks: AAPL, MSFT, GOOG, AMZN, NVDA, META, TSLA, BRK.B, LLY, WMT, AVGO, COST, JPM, PLTR, NFLX

Crypto & Related: Bitcoin, ETH, IBIT, MSTR

Leveraged ETFs: TQQQ, SQQQ, UDOW, SDOW, UPRO, SPXS, URTY, SRTY

Subscribe now, and unlock the levels for next week, the Weekly Compass with 20+ charts and price targets, plus the fundamental and technical deep dives posted on Wednesdays.

Based on the bearish momentum, the latest Deep Dive for AMD, SHOP, and LLY presented ideas to short some of those securities, the ideas aged well, click here:

Is the Bottom In?

The catalyst for Friday’s turnaround emerged from dovish commentary by New York Fed President John Williams, whose remarks suggesting “near term” rate reduction prospects galvanized sentiment following Thursday’s sharp selloff. Futures markets swiftly repriced the probability of a December policy easing to 75%, jumping from roughly 40% just one day prior. However, this optimism confronts a significant challenge: Federal Reserve policymakers will navigate the December decision without critical October and November inflation and labor data, a consequence of the prolonged government shutdown. Economic anxiety is further reflected in the University of Michigan’s consumer sentiment index, which deteriorated to 51 in November as concerns over persistent elevated prices and labor market stability intensified.

Underlying the week’s turbulence was a fundamental reassessment of the artificial intelligence investment thesis, where concerns about an AI-fueled valuation bubble overshadowed even exceptional corporate performance. Nvidia, the sector’s bellwether, ended Friday slightly negative despite delivering earnings that exceeded expectations on Wednesday. This disconnect signals that robust fundamentals may no longer suffice to support elevated valuations, particularly as investors question the sustainability of current AI spending rates and monetization timelines.

Risk aversion remained evident across speculative assets despite Friday’s equity rally. While the VIX retreated 12.2% to 23.2, suggesting a temporary easing of defensive positioning, cryptocurrency markets continued their decline. Bitcoin extended its slide to trade as low as $82,000, putting the digital asset on pace for its worst monthly performance since the 2022 market collapse. This persistent weakness in speculative corners suggests underlying risk-off sentiment may prove more durable than a single day’s equity bounce would indicate.

Technical Indicators are oversold as presented below, the bounce for the SPX/SPY and NDX/QQQ happened right at the 20 weekly average in confluence with the weekly levels mentioned above, and the 100 daily moving average, there is fear in the market but the bounce vanished during the afternoon as the charts above present. A bottom must be proved next week with the consolidation of the central weekly level updated below.

Unlock the central weekly level for over 40 securities including NVDA, AMD, SMH, and AVGO. That level is the blue line in the charts above for SPX, QQQ, and IWM that accurately framed the price action for the week that just ended, along with the support and resistance lines.

When you upgrade your subscription to paid, you can suggest additional securities that you trade, and those personalized levels are posted on Sundays. Subscribe!

WEEKLY LEVELS